Convinced and Concerned

For both the Winter Olympics and the market there were many exciting spins and twists during the week, but the stock market took a nasty spill on the slippery ice of the quad combo of geopolitics, economic reports, corporate earnings, and Fedspeak.

Developments in the Russia/Ukraine conflict dominated the news flow and the direction of the market. Volatility was high on Monday on concerns of an imminent invasion, with a relief rally on Tuesday and Wednesday on the belief that Russia was pulling back troops from the Ukrainian border. President Biden dispelled that notion in an address Tuesday afternoon, leading to another downturn in the market that continued for most of the rest of the week, despite a few moments of optimism over the possibility of a negotiated solution to the conflict.

News on the economy did not provide any comfort, as the Bureau of Labor Statistics producer price index report on Tuesday showed a 1% rise in January and a 9.7% year-over-year increase. The January increase was almost twice the consensus forecast for the month. Wage pressures, energy prices, and supply chain disruptions all have contributed to the upward spiral in producer prices. We believe that the latter two can abate over the next few months, which would be extremely well received by the financial markets. In particular, the recent very sharp decline in COVID-19 cases and hospitalizations should allow workers to return to their jobs and help ease the supply chain issues.

One bright sign for the economy came from the Commerce Department report on Wednesday that retail sales grew 3.8% in January, a faster-than-expected rebound from a sharp decline in December. Whereas some of the increase comes from their methodology in which the retail sales data is not adjusted to account for inflation, it is still encouraging that overall consumer spending held up last month.

Corporate earnings for the week were as expected, with growth of approximately 30% year-over-year still on track. Estimates for the rest of the year have been modestly reduced to a 5-8% range, mainly because of the inflationary pressures eating into profits.

Those inflationary pressures were the focus of Fedspeak during the week, with Chicago Federal Reserve Bank President Charles Evans, New York Federal Reserve Bank President John Williams, St. Louis Federal Reserve Bank President James Bullard, and Cleveland Federal Reserve Bank President Loretta Mester all giving speeches. It is with almost 100% certainty that the Fed raises short-term rates at the March meeting; the debate, however, is whether it will be a 25 or 50 basis point bump. We anticipate those rates steadily moving up from near-zero to 2%, but also believe the Fed will stop raising rates if the economic data starts to hint at a recession. We do not see evidence of widespread economic growth deceleration, but economic data statistics in some industries we track such as commercial construction and industrial production have slowed. In contrast, despite recent lows in Consumer Sentiment readings, restaurant sales trends and other consumer spending indicators have been resilient.

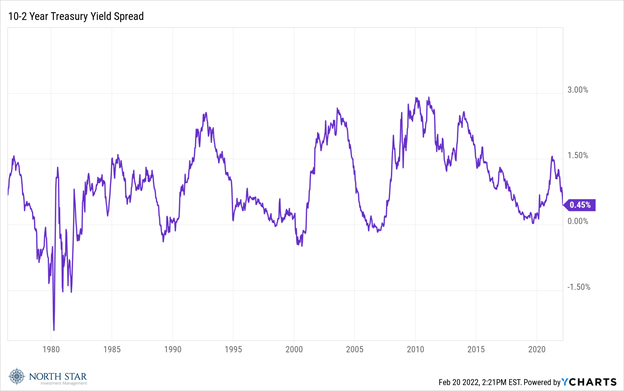

The S&P 500 declined 1.58%, the Nasdaq dropped 1.76%, while small-caps fared slightly better declining just 1.03%. The darling of 2022, otherwise known as the oil and gas sector, was the worst performer as crude prices pulled back over 2%. The dollar was stable, while gold continued its recent rally pushing up to $1,900/ounce. The yield on the 10-Year Treasury reached 2.05% on Tuesday, its highest level since the summer of 2019, before finishing the week down 2 basis points at 1.93%. The 2-Year Treasury followed a similar path, leaving the 10/2 spread at +46 basis points. That spread is worth monitoring, as an inverted yield curve is viewed as a warning sign for a recession.

Since the 2-Year Treasury rate is much more sensitive to Fed Fund rate increases, the flatness of the curve could motivate the Fed to tread carefully with its rate hikes to avoid creating an inverted yield curve.

NBA All-Star Weekend Comments

- Stephen Curry’s three-point shots are nothing short of magical.

- I’m softening on LeBron James after all these years, and actually happy to see him hit the game winning shot.

- Apparently, the prize money is too skimpy to motivate NBA stars to enter the Slam Dunk contest. Maybe they should open it up to the public? I would like to enter the under 5’10” and over 60 age category, but my family and colleagues would likely lobby against any such category given my recent injuries and lengthening recovery times.

Geopolitical Waves

The markets were closed on Monday in observance of the Presidents’ Day holiday.

The economic calendar is light, with the Purchasing Managers and Consumer Confidence Indexes for February released on Tuesday both expected to show little change from January.

Earnings season continues to wind down. Companies that have reported negative surprises have seen their share prices punished more harshly than the average over the last five years. In general, those share price declines have been confined to the individual company, rather than affecting the broader market.

Russia’s military operations will heavily influence the financial markets. We continue to hope for a peaceful solution but are concerned that a new era of geopolitical instability and aggression is upon us. On Monday President Vladimir Putin gave a lengthy address during which he recognized two territories in eastern Ukraine as independent and indicated that Russia would be sending troops into that territory. Despite condemnation of these actions and economic sanctions, President Putin remained defiant and undeterred.

Stocks on the Move

+21.2% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. Electric vehicle stocks in general had strong performance last week.

BLBD is a 2.2% position in the North Star Micro Cap Fund and a 2.0% position in the North Star Opportunity Fund.

+11.1% ACCO Brands Corporation (ACCO) manufactures office products. The Company produces staplers, daily scheduling diaries, shredders, laminating equipment, and presentation boards. Last week, the company reported Q4 2021 earnings of $0.54/share which beat by $0.06 and revenue of $570.3M which beat by $9.37M and represents a 24.0% year-over-year increase. ACCO also announced the retirement of EVP and CFO Neal Fenwick who has been with the company for 37 years. The Company posted record sales for the full year and fourth quarter with CEO Boris Elisman attributing earnings growth and margin enhancements to portfolio shifts into faster growing consumer and technology categories.

ACCO is a 2.6% position in the North Star Micro Cap Fund and a 3.3% position in the North Star Dividend Fund.

-13.3% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

PRTS is a 2.3% position in the North Star Micro Cap Fund and a 1.7% position in the North Star Opportunity Fund.

-21.2% Paramount Global (PARA) formerly ViacomCBS Inc (VIAC) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Paramount Global plunged after its Investor Day on Wednesday. Shareholders were left dissatisfied with the company as its legacy business will face more headwinds and its streaming business expansion will eat into cash flow and operating income with $6 billion being spent on direct-to-consumer content in 2024 versus $2.2 billion in 2021.

PARA is a 1.3% position in the North Star Opportunity Fund.

The stocks mentioned above may be holdings in our mutual funds. For more information, visit nsinvestfunds.com.