Positive Light

Stocks and bonds fell for the week as a combination of strong U.S. economic data and challenges in China unnerved the financial markets. The healthy domestic economic data drove interest rates higher, though bond prices stabilized on Friday. The 10-year Treasury yield reached its highest level since November 2007 on Thursday before retreating on Friday to finish the week at 4.25%, up eight basis points. The 10-year rate has increased for five weeks, totaling 50 basis points. With the 10-year yield still 125 basis points below the level of short-term rates set by the Fed, it seems likely the longer-term rates will continue rising, as the Fed has no plans to reduce short-term rates.

We view the strength of the U.S. economy in a positive light. Most recently, the July retail sales data was much stronger than expected. The economy and the stock market thrived for decades before the pandemic and financial crisis, with interest rates comfortably higher than 4.25%. Inflation has been tamed, supply chains are on the mend, jobs are plentiful, and consumer confidence is rebounding.

Obviously, unlike the team at North Star, some other investors were in a more bearish mindset last week, as the S&P 500 posted a 2.1% decline to its lowest level in nearly eight weeks, the Nasdaq Composite slid 2.6% to a 10-week low, and the Russell 2000 dropped 3.4%. Every industry sector finished in the red, and declining issues outnumbered advancing issues by more than 4-1.

Chinese Matters Matter

For over a decade, ill-timed spikes in paranoia and hyperbole regarding the demise of the world’s second-largest economy, China, have reminded us of Mark Twain’s 1897 letter stating, “The report of my death was an exaggeration.” This time there may be more truth than exaggeration to China’s economic woes, as there is strong evidence of intensifying financial stress in China.

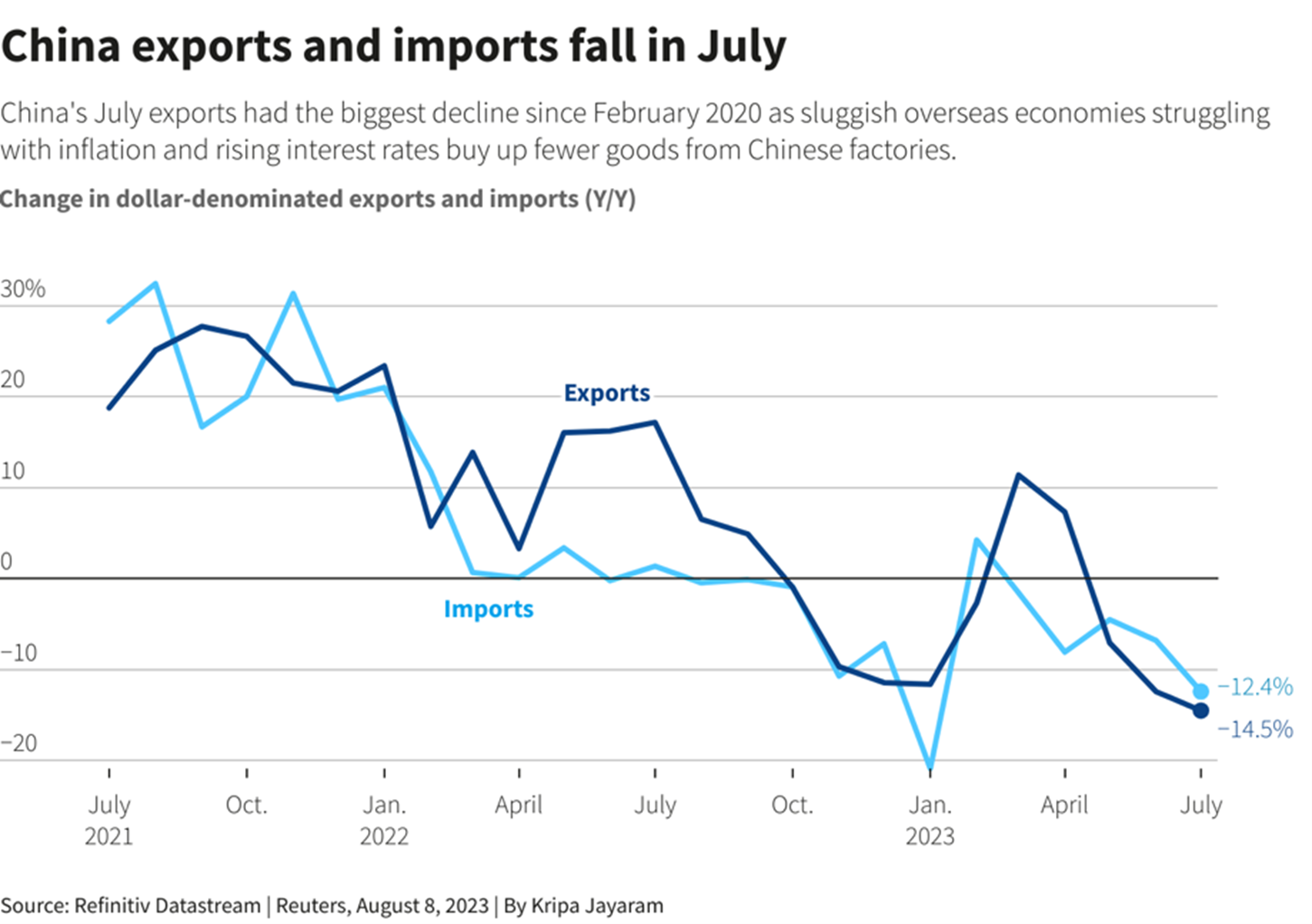

The last two weeks have provided several negative data points. Chinese real estate development behemoth Evergrande filed for bankruptcy protection in the Manhattan bankruptcy court. In addition, from a macroeconomic perspective, employment trends seem very weak in China recently, likely spurring last week’s China National Bureau of Statistics cessation of publishing unappealing unemployment data, at least temporarily on young adults aged 16 to 24, which recently had reached 21.3% in June. Finally, recent reports indicate that China’s imports fell 12.4% year over year in July, suggesting weak demand. This is a significant drop, even considering that lower oil prices than a year ago certainly impacted this comparison (see chart below).

What does the grim news about the second-largest world economy mean for U.S. investors? We have a few ideas, most of which support our mainly positive outlook on prospects for U.S. businesses. First, continued weakness in the Chinese economy would probably drive some incremental U.S. dollar strength, as some investors may see incremental value in owning U.S.-denominated assets relative to Chinese assets. While dollar strength can hurt near-term earnings, it can also help the affordability of foreign goods and services for the U.S. consumer. Second, we could see incremental strength in the prices of U.S. Treasuries due to a flight-to-safety effect, and such incremental demand may be positive for demand in upcoming auctions of US Treasuries to fund U.S. deficit spending. Third, even though the gold price historically has been inversely related to the strength of the U.S. Dollar, gold has been more sought after in China households during periods of economic weakness. And finally, the U.S. Federal Reserve has been sensitive to the stability of large foreign economies, suggesting the possibility of less restrictive monetary policy in response to China’s economic troubles.

Hopefully, our patriotic inclinations are not biasing us to see the silver lining in China’s economic clouds. Still, our analysis suggests more positives for the U.S. economy than negatives if China does not resort to aggressive military action in response as a solution to its challenges.

Keep it Simple

Quarterly earnings reports from several retailers on Tuesday will provide further insight into recent consumer behavior, following encouraging retail sales data and results from Target and Walmart last week. The big earnings story for the week will come on Wednesday when chip maker Nvidia announces its fiscal second quarter results. If the company posts strong enough results, perhaps the tech sector can pull out of its recent downdraft.

Monetary policy will be back in focus on Thursday when the Jackson Hole Economic Symposium kicks off, with Fed Chair Jay Powell’s speech Friday morning serving as the event’s main highlight. Our policy and speech advice to the Chairman, “less is more,” is in the spirit of Ludwig Mies Van Der Rohe, one of the founders of modern architecture and a proponent of the simplicity of style.

Less is more does not always work in sports, and the Bears came up with fewer points than the Colts in their second preseason game. The Cubs are hanging in the pennant race but have four fewer wins than the Milwaukee Brewers, with less than 40 games left in the season.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.