Deep in Oversold Territory

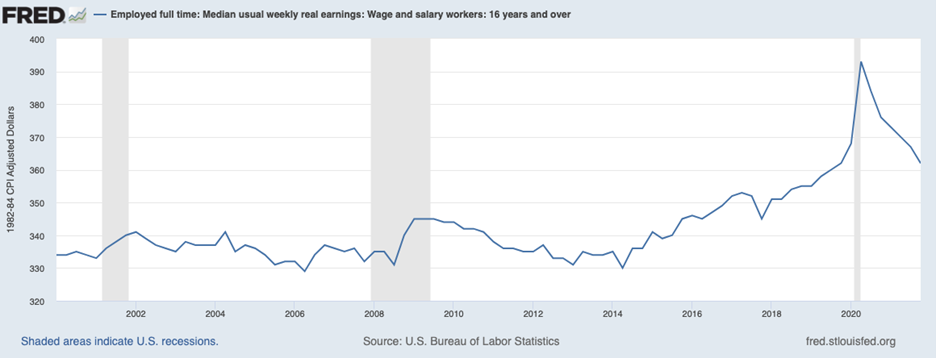

There is probably no better analogy for recent financial markets activity than the summertime-classic game of tug-of-war. The main players in this summer picnic classic are: (1) inflation reports and employment reports suggesting robust demand for goods and services that the Fed needs to subdue with rapid rate increases; versus (2) slowing corporate earnings growth, falling real wages (see chart below), and clear signs of corporations slowing hiring plans. We would characterize last week in the tug-of-war as a whole lot of no progress. Despite notable daily multi-percentage swings, equity markets finished largely unchanged for the week.

The major events that drove equity markets last week were economic reports. On Wednesday, the Consumer Price Index (CPI) for June 2022 came in at 9.1%, increasing speculation that the Fed may raise interest rates by a full 100 basis points in July, rather than the anticipated 75 basis points. The higher-than-expected 9.1% reading was above the 8.6% in May and seemed to contradict some recent speculation that inflation was peaking. Equity markets fell sharply Wednesday following the CPI report. On Thursday, the Producer Price Index (PPI) confirmed that inflation remained elevated, and the PPI report had no indications that inflation might be peaking or slowing.

However, equity markets rallied substantially on Friday, July 15th, following the release of slightly better than expected retail sales. While the headline sales growth statistic of 1.0% was a bit better than expected, the reported sales include price changes that are running in the high single digits as reported earlier in the week; based on the Friday consumer spending report, the price-level-adjusted volume of goods and services purchased was certainly negative. The likely main culprits are energy costs and food costs, both of which are impacted significantly by the ongoing war in Ukraine and cause low-income and some middle-income households to cut back on discretionary spending. On a positive note, consumers expectations for future inflation did moderate for the first time in several months. That those data points triggered a substantial rally suggests the oversold level of the stock market.

So far, the start of second quarter earnings season for the S&P 500 has been uninspiring, as the number and magnitude of positive earnings and revenue surprises have been smaller than average. A report came out of JP Morgan last week that potentially had most influence on sentiment. Besides being an earnings disappointment driven by non-cash reserve building as required under new banking regulations, during the company’s earnings conference call, the company’s outspoken CEO, Jamie Dimon, stated that the economy was in good shape, and business credit has never been better. So, the earnings report was weaker-than-expected, while the company leadership made positive comments about the economy – yet another tug-of-war.

On the Road Again

Sometimes when the data we pay close attention to on our computer screens is giving mixed messages, it is good idea to do some traditional, on-the-road research. This past week was a great example. On Wednesday, July 13th, the North Star research team visited with executive management of one of our newer holdings, Accuray Inc (ARAY). We were pleased to hear that the management has been able to source alternate materials to improve manufacturing speed, and that supply chain challenges are starting to ease. Good management teams learn and improve from challenges such as inflation and global supply chain challenges; several c-suite executives we speak to regularly are seeing slight improvements relative to the worst of global shortages and logistical problems since late 2021. We are optimistic that such improvements will possibly translate into substantially higher earnings in 2023 relative to 2021 for many of our portfolio companies. Accuray’s management seems to be winning their own tug-of-war against supply-chain challenges and freight challenges.

A Break from “Fedspeak”

Earnings reports will dominate the week with results from big names like Bank of America (BAC), Netflix (NFLX), and Tesla (TSLA). In total, 73 S&P 500 companies are scheduled to report results for the second quarter. Company specific updates on consumer demand, labor shortages, and supply chain issues will be in focus. The economic calendar includes updates on housing starts, existing home sales, and the Philadelphia Fed Manufacturing Index. We get a break from “Fedspeak” as the speakers will be in a blackout period ahead of the FOMC meeting on July 26th-27th, so the tug-of-war between the more hawkish Fed governors and the more dovish governors is on hold until the end of the month.

We will continue to watch for retail gas prices trends. Falling prices, albeit still elevated significantly, would likely improve consumer demand for other goods and services. According to AAA, the national average for a gallon of regular was $4.577 at the end of last week, down from a peak of $5.016 in mid-June. Perhaps we have seen the peak in retail gas prices, but with fall and winter approaching, European energy supplies will be more and more in focus as reliance on Russian oil and natural gas remains significant. President Biden’s visit to Saudi Arabia last week may assist with supply improvements, but until there is visibility on adequate supply of energy to Europe in the winter months, energy prices will likely remain above historical averages.

Stocks on the Move

-29.2% Industrial Logistics Properties Trust (ILPT) is a real estate investment trust whose portfolio is comprised of 412 consolidated properties containing approximately 59.7 million rentable square feet located in 39 states. The portfolio includes 226 buildings, leasable land parcels and easements containing approximately 16.7 million rentable square feet located on the island of Oahu, HI, and 186 properties containing approximately 43 million rentable square feet located in 38 other mainland states. Last week, ILPT cut its quarterly dividend from $0.33/share to $0.01 per share to enhance its liquidity as it finances its recent acquisition of Monmouth REIT (formerly MNR). The company intends to return the dividend to its historical level sometime in 2023.

-11.5% Horace Mann Educators Corporation (HMN) is a holding company for insurance subsidiaries that market and underwrite personal lines of property and casualty insurance products, life insurance products, retirement products, and employer-sponsored benefit products primarily to K-12 teachers, administrators, and other employees of public schools and their families. Last week, HMN released a shareholder update indicating that Q2 catastrophe losses were historically high and as such FY2022 guidance was revised down to $2.10-$2.30 with a second quarter loss of 10-20 cents. The earnings release is scheduled for August 4th.

-16.2% Innovative Industrial Properties Inc (IIPR) owns and leases industrial real estate assets. The Company focuses on the acquisition, disposition, construction, development, and management of industrial facilities leased to tenants in the regulated medical-use cannabis industry. Last week, IIPR announced that its 5th largest tenant had defaulted on its long-term and reimbursement payments.

-13.1% Delta Apparel Inc (DLA) designs, markets, and manufactures branded and private label active and headwear apparel. The Company’s products are sold to boutiques, department stores, outdoor and sporting goods retailers, college bookstores, screen printers, and the US military. Last week, Delta Apparel announced preliminary fiscal third quarter results with net sales up 6% year-over-year led by Salt Life Group segment net sales of over 25%. The company anticipates this momentum to continue into upcoming quarters. The earnings release is scheduled for August 4th.

+10.2% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. There was no significant company news last week.

-13.3% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

The stocks mentioned above could be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.