Last Week

As the number of 2Q24 earnings reports picked up last week, the financial markets seemed keenly aware that “Twisters,” the sequel to the 1996 cult-classic tornado-chasers “Twister,” debuted last week, as the recent rotation out of technology stocks continued with the Nasdaq Composite and S&P 500 posting 3.6% and 1.9% declines respectively. North Star’s Chief Investment Officer, Eric Kuby, was quoted in Reuters last week discussing the change in narrative. Despite a sell-off later in the week, the broader market was able to finish positively, with small caps topping the leaderboard as the Russell 2000 climbed 1.5%. There were slightly more advancing issues than declining issues and mixed sector performance, highlighted by gains in Energy and Financial stocks.

Solid corporate earnings, soft economic data, politics, and an alarming IT outage were winds blowing in different directions, generating swirling activity in the equity markets. Earnings season got off to a good start with the estimated growth rate for S&P second quarter profits increasing to 9.7% from 9.1% the week earlier. That growth rate would be the highest since the fourth quarter of 2021, when the economy was recovering from the pandemic. The softer economic data came in the form of a jump in initial claims for unemployment, following the decline in consumer prices and the June nonfarm payrolls report earlier this month that showed slowing jobs growth and an uptick in unemployment.

We will refrain from comments on politics, but much of the sector activity and the cover story in this week’s Barron’s magazine centered on the investment implications of a change in administration. Historically, election-related sector rotations have been short-lived, characterized by short-term price volatility that does not last unless there is substantial earnings growth follow-through. Industries dependent on taxpayer funding, such as health care, infrastructure, energy and utilities, and defense, have had short-lived speculation-induced volatility around election outcomes without sustained valuation changes of any meaningful magnitude.

A corrupted data file from a software update by CrowdStrike (CRWD) on Microsoft (MSFT) platforms dominated the news and markets on Friday, as the systems were down for many companies, including some leading financial institutions. This unprecedented disruption may have lingering effects early in the coming week. In the early part of the week, we certainly expect financial markets prognosticators to soothsay what has changed in their crystal balls as a result of the significant news surrounding the November presidential election.

The yield on the 10-year Treasury and the dollar inched marginally higher, while gold and crude oil suffered declines of approximately 3%.

There is nothing new to report on the Chicago Sports Scene, although the Cubs did manage to move out of last place in the NL Central Division. As for the White Sox, there were almost as many “twisters” that hit the Chicago area last week as games the team has won all season.

This Week

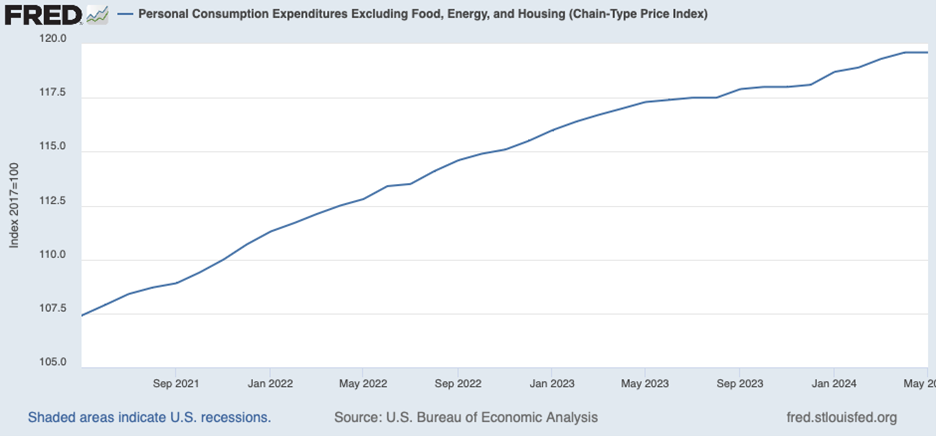

Trading could be quite interesting, with 138 of the S&P 500 companies reporting results and the PCE (the Fed’s favorite inflation gauge) for June on the calendar for Friday. The headline reported PCE statistic will matter to short-term traders, but for Fed policy, the most important PCE data series will likely be the year-over-year(Y-O-Y) change in the sub-component called “PCE excluding Food, Energy, and Housing.” That Y-O-Y change came in at 2.0% for May, the lowest level of year-over-year change reported in two years. The graph below shows how this data series curve has bent favorably recently through the data reported for May 2024, which at 119.6 was flat with the reported level for April 2025.

Many high-profile companies, including Google’s parent company, Alphabet (GOOGL) and Tesla (TSLA), will release second-quarter earnings, and their numbers will represent a big test for the “Magnificent 7” following the recent rotation out of that club since the last consumer inflation report.

To rotate or not to rotate, will be the question on investors’ minds following those earnings and related data.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.