Last Week

As the lyrics go in the Grateful Dead’s classic tune U.S. Blues, “Summertime done, come and gone, my, oh, my.”

Stock market investors waved the rally flag wide and high as the market continued its long trip to higher ground. The most recent gains overcame the headwind from a “disappointing” outlook from the American Beauty Nvidia, whose shares declined 7%. While Nvidia and its fellow mega-cap growth stocks garnered most of the attention, it was a great summer for most market sectors as small caps and value stocks kept pace. Berkshire Hathaway, the poster child for value stocks, reached the $1 trillion-mark last week, as Nvidia slipped below $3 trillion in market cap.

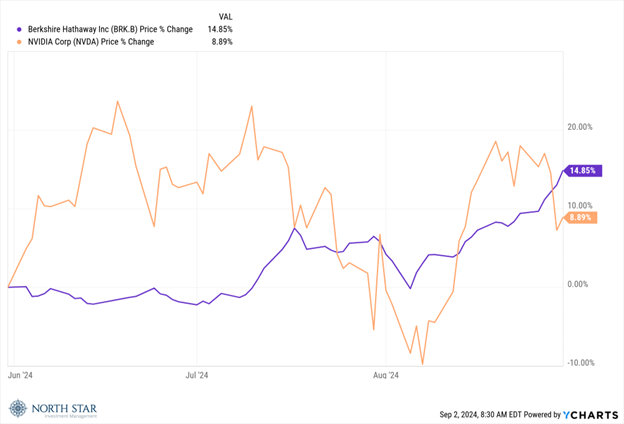

As value investors, we would highlight the slow and steady Berkshire which outdistanced Nvidia over the last month while the latter dominated the headlines. The other headline grabber remained the Federal Reserve, as the PCE report showed year-over-year inflation at 2.5%, slightly softer than forecast, solidifying the case for impending interest rate cuts.

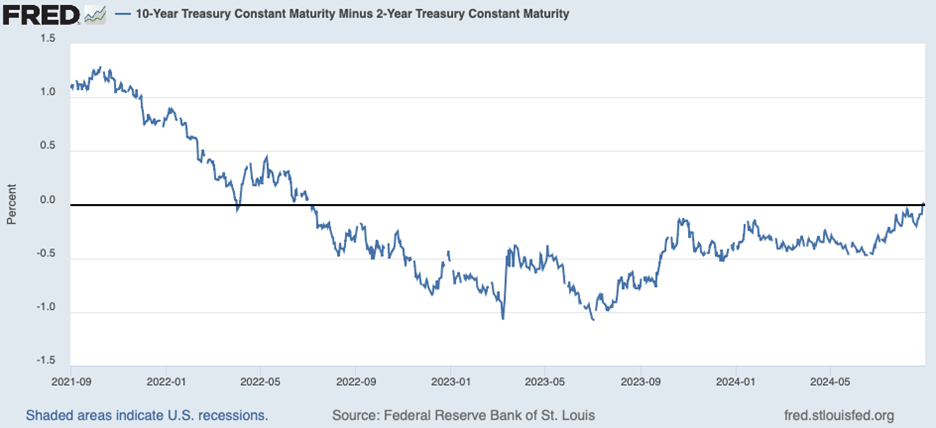

For the week, the S&P 500 climbed 0.2%, the Nasdaq Composite slipped 0.9%, while small and mid-caps treaded water. Advancing issues outnumbered declining issues by a factor of 4-3, while all the industry sectors other than technology finished in the green, with financials leading the pack. In the bond market, the 10-year Treasury yield moved 10-basis points higher, while short-term rates drifted lower, leading to the 10-2 spread finally moving out of its post-Covid inversion that started in mid-2022 and peaked at more than 100 basis points in early-to-mid 2023 (see graph below). In other words, the bond market confirmed the “soft landing” or no recession scenario after over 2-years of flashing a warning sign.

On the Chicago Sports Scene, the “W” flags have been flying on the North Side, to signify “Cubs Win!” The Cubs are the hottest team in baseball and have a reasonable chance of making the playoffs. Meanwhile, on the South Side, the White Sox have set a record for most losses in a season – definitely a tale of two cities.

This Week

Wall Street will see a holiday-shortened week, with the markets closed on Monday in observance of Labor Day. The economic data will spotlight the labor market, with the latest Job Openings and Labor Turnover Survey (JOLTS) scheduled for Wednesday, followed by ADP’s monthly report on private employment on Thursday and the August nonfarm payrolls report on Friday. The July payrolls report showed unexpected weakness, leading to a brief spike in market recessionary anxiety. Subsequently, the weekly new claims for unemployment insurance have helped quiet those concerns. The accuracy of the BLS jobs data has come under fire due to the massive revisions; nevertheless, the report is still likely to motivate traders to do what they do: trade.

August Small-Cap Stocks on the Move

On Wednesday, August 28th, ARC Document Solutions (ARC) announced it had entered into an agreement to go private at $3.40/share, a 28.8% premium to the closing price. The company’s management team is financing the transaction.

+50.0% Hamilton Beach Brands Holding Co (HBB) soared during the month of August after a strong earnings release at the end of July, in which operating profit improved to $10M for the quarter vs $0.7M in the prior year. We expect this positive momentum, driven by strategic initiatives and improved channel inventories, to continue, all of which is beefing up HBB’s cash flow profile.

+23.1% Build-A-Bear Workshop Inc (BBW) shares rose after solid second-quarter results defined by strong unit growth and a 10% increase in EBITDA. During the quarter, the company also returned capital to shareholders in the form of share repurchases and regular dividends.

+18.5% Accuray Inc (ARAY) saw shares climb last month after posting solid fiscal fourth quarter and full-year 2024 results. These results were consistent with guidance and included several milestones reached in international markets. North Star senior analyst Jim Lane expects services revenues to grow and subsequent margins to stabilize.

+14.6% Champion Homes Inc (SKY) began its FY25 period with a strong first quarter marked by a 35% increase in units sold, a 28% increase in backlog, and a 170 bps expansion in gross margin.

-12.8% Otter Tail Corp (OTTR) shares steadily decline during the month despite record second-quarter earnings and approval of its most recent IRP from the Minnesota Public Utilities Commission. However, shares slid more dramatically after OTTR was named in a lawsuit accusing major PVC pipe manufacturers of collusion/price fixing. OTTR denies these claims.

-17.2% ProPetro Holding Corp (PUMP) shares slipped with the overall energy market. The North Star Research Team sat in during the company’s presentation at the Midwest IDEAS Conference and feels confident in the company’s investment in asset upgrades and long-term return potential.

-19.5% Vishay Precision Group Inc (VPG) saw shares decline after a disappointing earnings report that missed both top- and bottom-line estimates. The company is focused on cost-reduction initiatives while it experiences a period of end-market choppiness.

-20.4% CarParts.com Inc (PRTS) shares sank during the month of August after another noisy earnings report at the end of July.

-22.5% of 1-800-Flowers.com Inc (FLWS) sold off after a lackluster earnings release. Additionally, Bill O’Shea, the company’s CFO, is set to retire at the end of the month.

-26.6% Superior Group of Cos. Inc. (SGC) reported solid results at the beginning of August, including solid revenue and cash flow improvements. In addition, the company maintained its full-year outlook and announced a $10M stock repurchase plan.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.