Last Week:

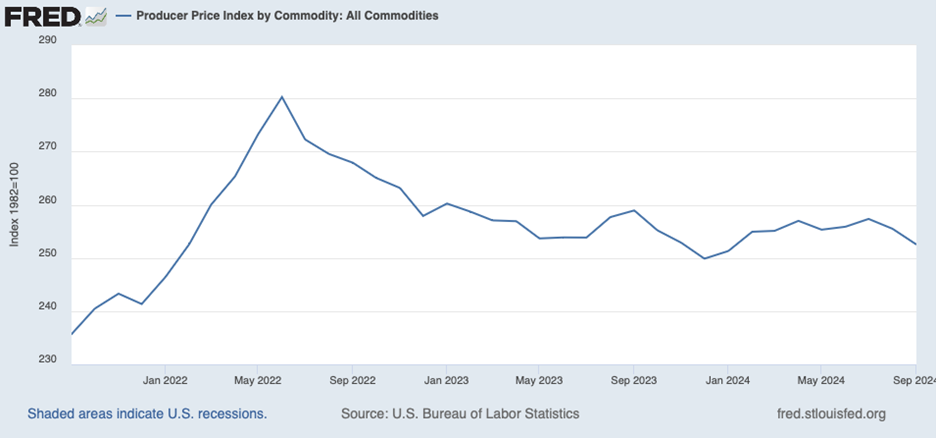

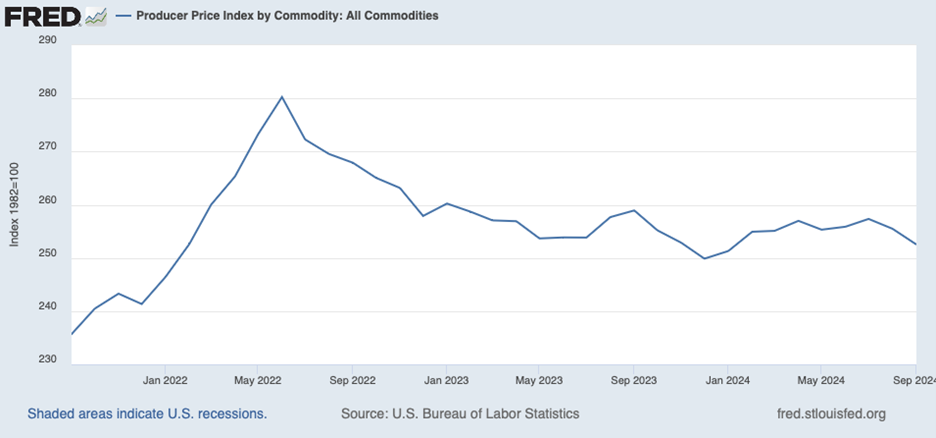

The market was able to extend its winning streak to five weeks despite escalating tension in the Middle East, a slightly hotter-than-anticipated consumer inflation report, a spike in jobless claims, a decline in consumer sentiment, and a 9-basis points increase in the yield on the 10-year Treasury. Offsetting those concerns were strong quarterly reports from major banks to kick off earnings season and a cooler than expected producer price index reading (see graph below), which is often a precursor to a decline in consumer prices. The flattening of the Producer Price Index graph sharply contrasts with the rapid steepening we saw in early 2022 and suggests businesses have less rationale for raising prices to end user consumers going forward. Additionally, the Fed’s minutes from its September monetary policy committee meeting on Wednesday showed that a “substantial majority” of policymakers backed the 50-basis point cut. The PPI graph below validates that majority and suggests further rate cuts are likely.

All the major indexes gained approximately 1%, with advancing issues modestly outpacing decline issues. Tech sector stocks rose 1.9% to top the leaderboard while Utilities were at the bottom with a 2.5% decline. The weakness in Utility stocks can be primarily attributed to the recent increase in the 10-year and to a lesser extent the damages caused by the back-to-back hurricanes. Crude Oil futures rose 1.5%, although Oil & Gas stocks were flat. The dollar and gold both inched higher.

Rising corporate profits combined with declining short-term interest rates provides a solid foundation for the stock market, with selective sectors still trading at bargain prices. Dividend-paying companies have recently outperformed, but in general still offer terrific relative value, particularly in the small cap universe. Gold and Oil & Gas sector equities also trade at reasonable prices and could act as good hedges to the unsteady geopolitical environment. Feel free to contact us if you are interested in our holdings in those sectors.

On the Chicago Sports Scene, how about those Bears! Tottenham stadium was rocking with Bears fans, including Brooke Kuby, cheering on the Monsters of the Midway as they crushed the Jacksonville Jaguars across the pond.

This Week:

Third quarter earnings season will kick into gear, with 43 S&P 500 companies reporting results. The consensus forecast calls for a 4.1% increase in overall profits, marking the fifth consecutive quarter of growth. Current expectations are for a substantial increase in that growth rate in the following two quarters.

The economic calendar is fairly light, with retail and food services sales for September offering a look at how the consumer is behaving.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.