Last Week

Stock market bulls breathed a sigh of relief as the market digested slightly hotter-than-expected CPI and PPI numbers on Tuesday and Thursday. On Friday, however, Quadruple Witching futures and options-related trading pushed prices lower to close the week. The S&P 500 slipped 0.1%, and the Nasdaq Composite fell 0.7%, but the broader damage was worse with Mid-Caps -1% and Small-Caps -2.1%. Declining issues outnumbered advancing issues by a factor of 3-2, and only the Oil and Gas and Basic Materials sectors finished in the green.

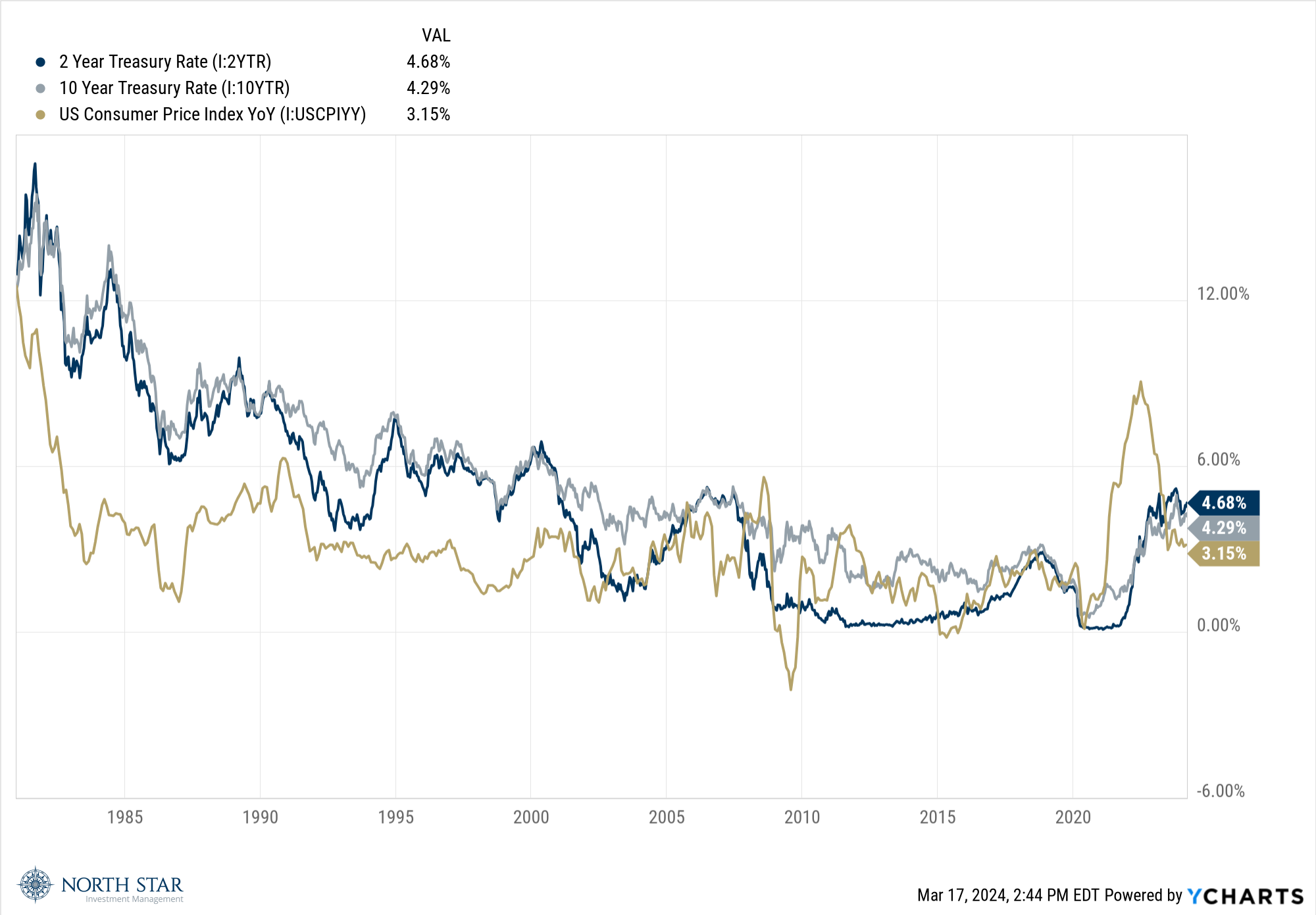

The impact of the inflation readings was more apparent in the bond market, where the benchmark 10-year Treasury jumped 21 points higher to 4.29%. We believe an examination of the CPI and interest rates over the past 40 years suggests that we are finally back to a relatively normal environment. The extraordinary monetary measures taken in response to both the 2008-2009 financial crisis and the 2020-2021 pandemic resulted in artificially low rates for such an extended time left investors with a skewed sense of the scale of normal interest rates.

What is unusual is that short-term rates exceed longer-term rates, and Fed Funds rates are even higher. We still believe those dynamics will reverse in 2024, although the recent stickiness of inflation makes it likely that the onset of that reversion will be delayed until the summer.

This Week

The Federal Reserve meeting on Wednesday will be in focus, although the FOMC will almost certainly leave rates unchanged at the multi-decade of 5.25-5.50%. The Summary of Economic Projections, also known as the dot plot, will be closely analyzed for any deviation from the market’s forecast of 3 cuts during 2024, with the first quarter-point rate cut in June.

The other domestic economic data will be housing-related releases, with the NAHB Housing Market Index for March, the February starts and permits figures, and February existing home sales on the calendar. We don’t believe they will be market moving.

On the Chicago Sports Scene, we bid adieu to Justin Fields and look forward to the Caleb Williams era in Soldier Field. In basketball, the Illini look very talented, so we will once again likely overrate them going into the March Madness. We are open to any insights into teams from readers who follow conferences other than the Big 10.

In men’s college basketball, March Madness seems to have started BEFORE the NCAA tournament even starts, with numerous conference tournament upsets that likely foreshadow a wild upcoming post-season. Additionally, the women’s NCAA tournament has more anticipatory excitement than ever before, with superstars such as Caitlin Clark capturing a wider audience of fans. Good luck to all your favorite teams.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.