Last Week:

The focus was clearly on trade issues, with bad news bookends from China and Mexico. Early in the week China indicated that it would retaliate to recent U.S. actions by using its 80% dominance of rare-earth metals used in high tech gear. Technology shares suffered further losses, with the sector declining 8.43% in the month of May, while the Telecommunications sector lost 6.73% during the week. Expectations of a quick “win” in the “trade war” with China have evaporated, with the best case now seeming to be an agreement to delay the imposition of additional tariffs at the G20 later in the month. On Thursday night President Trump tweeted “The United States will impose a 5% Tariff on all goods coming into our country from Mexico, until such time as illegal migrants coming through Mexico, and into our Country, STOP.” The Automotive sector got hit particularly hard on Friday, with General Motors falling 4.3% and Ford Motor shedding 2.3%. Every sector in the market suffered losses, with the S&P 500 declining 2.62%.

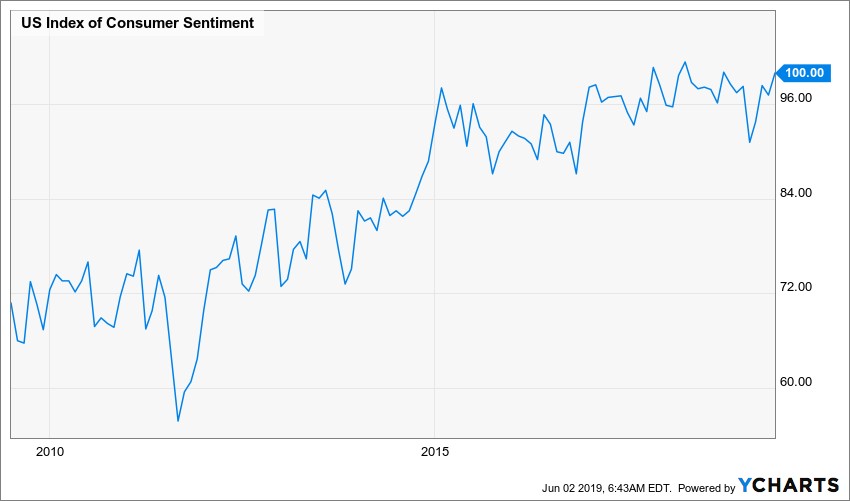

May was not a very merry month on Wall Street. Main Street, on the other hand, continued to show optimism, with a nice rebound in consumer sentiment to match the highest level in the last decade.

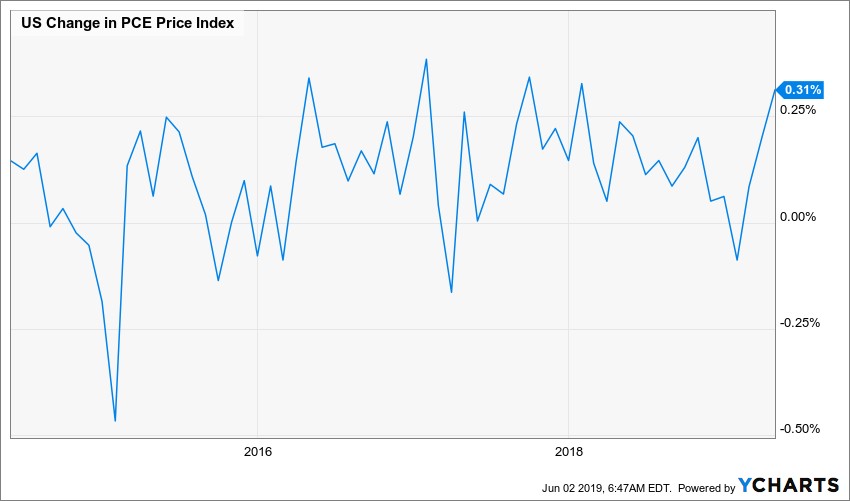

Inflation remains under control, although there was a slight uptick in the PCE Price Index, back up towards the upper band for the last 5 years which is still slightly below the Fed’s target range.

The yield on the Ten-Year Treasury matched its lowest level since September 2017 at 2.14% after declining 18 basis points during the week, suggesting more concern of a recession than of a pick-up in inflation.

This Week:

The U.S. Manufacturing ISM on Monday will be important, given the growing concerns of a softening economy. On Friday the Department of Labor will release the jobs report for May, with the consensus calling for 183,000 new jobs and the unemployment rate to remain steady at a 50-year low of 3.6%. Any surprises in the jobs report could impact the Fed’s interest rate path.

In the absence of any other significant news, the tweets and responses will likely remain in focus.

Stocks on the Move:

Allied Motion Technologies, Inc. (AMOT) -10.28%: Allied Motion Technologies designs, manufactures and sells precision and specialty motion control components and systems. There has been no news since the Company reported solid quarterly results on May 10. During the earnings call Richard Warzala, CEO and President highlighted “We kick off the year on a healthy note as revenue grew 13% organically and 23% overall to a new record level despite FX headwinds that reduced our reported revenue by 3%. Additionally, incoming orders hit a new record at $94 million. Adjusted EBITDA was up 20%, and earnings per share were up 7% year-over-year. Earnings in the quarter were somewhat muted in relation to the revenue increase as we continued to make the necessary investments in internal resources and CapEx to support our strategical growth objectives for the future.” AMOT is a 1% holding in the North Star Micro Cap Fund.

Lee Enterprises, Inc. (LEE) -13.20%: Lee Enterprises is a local news publication company in the United States. Its products include daily and Sunday newspapers, weekly newspapers and classified and few other specialty publications. There has been no news since the Company’s quarterly results on May 19. On their earnings call CEO Kevin Mowbray indicated “Overall, we’re pleased with the second quarter operating results. Our total revenue trend was the best quarterly performance in nearly 4 years due to substantial revenue growth at TownNews, incremental revenue on our management agreement with BH Media Group and solid digital performance from our legacy businesses.” LEE is a 0.9% holding in the North Star Opportunity Fund and LEE corporate bonds are a 2.9% holding in the North Star Bond Fund.

Movado Group, Inc. (MOV) -22.08%: Movado Group designs develop, sources, markets, and distributes fine watches in the United States and internationally. The Company released quarterly results that fell short of expectations. CEO Efraim Grinberg commented “We are pleased with our first quarter results which confirm that our teams are executing against our strategic vision that we have developed for our business. This performance was delivered despite operating in a global retail environment undergoing transformation and even as we ramped up our investments to support our future growth. For the quarter, our sales were up 15.3%, or 18.9% on a constant dollar basis, even excluding the addition of Movement, our sales were up 5.2%, or 8.9% in constant dollars. Our adjusted operating profit was $7.2 million, a $1.7 million decline from last year, due to our planned investments behind our brands, the ongoing integration of Movement and our digital initiatives.” MOV is a 2.8% holding in the North Star Micro Cap Fund and a 1.0% holding in the North Star Opportunity Fund.

BG Staffing, Inc. (BGSF) -15.02%: BG Staffing is engaged in providing temporary staffing services. The business activities are carried out through Real Estate, Professional, and Light Industrial segments. There has been no news since the Company reported quarterly results on May 9 that fell slightly short of estimates. Beth Garvey, President and CEO commented “Our first-quarter operating results, particularly revenue and gross profit growth, coupled with the promising runway before us support my confidence about the remainder of 2019. The staffing industry outlook for 2019, subject to normal seasonal pattern, is optimistic; and the present economy and labor market remains positive for staffing overall. Strong customer demand continues to fuel our success and is led by solid operational performance by our management teams in the field. We are proud to have supported 26.8% consolidated quarterly gross profit, our eighth consecutive quarter with consolidated gross profit percentages in excess of 25%.”

Investors might be concerned about the Company’s capital expenditure plan over the next two years to address 23 distinct projects to improve operations. BGSF is a 2.7% holding in the North Star Dividend Fund.

Portfolio holdings are subject to change and should not be considered investment advice.

North Star Investment Management Corp. is the Advisor for the North Star Family Mutual Funds.