Modestly Dovish

The Fed is still talking (seemingly every day) about when it should cut rates, as the evidence shows that the economy is still holding steady. The suddenly not-so-magnificent Tesla had a bad day on Monday, and Nvidia finally had a bad day on Friday. Nevertheless, it was a pretty, pretty, good week in the financial markets.

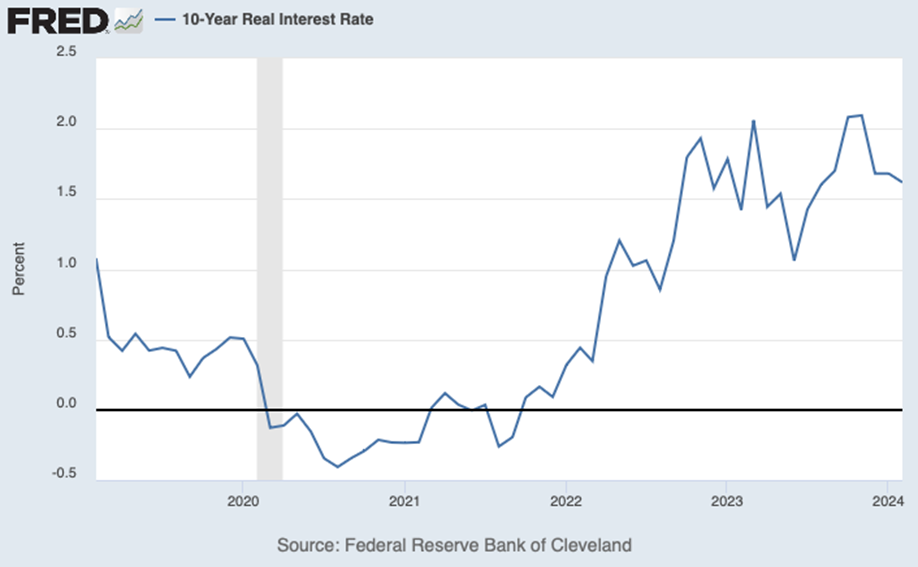

On Thursday, Fed Chair Jerome Powell said the central bank is “not far” from cutting interest rates. We agree with this sentiment and hope it translates to action in the near term. Recent economic data reports do not show any overheating. Yet the 10-year real interest rate is at a contractionary level of more than 1.5%, and Fed Funds are at a level more than 2% above inflation.

In response to Chair Powell’s modestly dovish comments, the stock market pushed to a new record high. On Friday, Nvidia shares took a tumble, bringing the Nasdaq down in sympathy. Additionally, on Friday, the February jobs report provided a mixed picture, with the U.S. economy adding 275K jobs, yet with the unemployment rate moving up to 3.9%. On balance, we believe the report showed signs of a softening job market, with slower wage growth and a significant downward revision in the previously reported January number. For the week, the Nasdaq lost 1.2%, and the S&P 500 drifted 0.3% lower. The Russell 2000 gained 0.3%, and mid-caps led the leaderboard, moving 1.4% higher. Advancing issues outnumbered declining issues by a factor of 3-2. Gold and Bitcoin continued to set record highs, while the dollar slid 1%.

We believe the trend of the equity rally broadening remains on track, with opportunities knocking outside of Nvidia and the rest of the “Magnificent 7”. Many shares are trading at relatively modest valuations, the U.S. economy shows great resilience, and the Fed rate cuts as 2024 progresses should provide a nice lift.

The yield on the 10-year Treasury slipped another nine basis points to 4.09%. The bond market seems to suggest that the Fed’s 2 percent target inflation is in the cards. “Cut, Jerome, Cut!”

On the Chicago Sports Scene: DeMar DeRozan and Coby White are great, but the Bulls remain a below-average NBA team. Justin Fields is still a Bear. We continue to stand with Justin and will have a party on opening day next season if #1 is under center.

Healthy Dose

Investors will have a healthy dose of economic data to parse.

The consumer price index report for February on Tuesday will be the most closely watched release. Economists expect CPI to rise 0.4% month-over-month and 3.1% year-over-year. The producer price index report will follow the next day, with retail sales on Thursday and the latest reading from the University of Michigan on consumer sentiment on Friday.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.