Which Camp?

The stock market had a strong finish in its final trading week of the first half of the year, with gains of 2.4%, 2.3%, and 3.7% for the S&P 500, Nasdaq Composite, and Russell 2000 respectively. While the Tech sector remained strong, with Apple Inc (AAPL) reaching a $3 trillion market capitalization, the rally broadened with strong performances by small caps and S&P 500 Equal Weight Index (RSP) of 3.4%. As value-oriented investors at North Star we favor small caps within three dedicated North Star small cap value strategies and believe the RSP is relatively attractive with a reasonable weighted average P/E under 15x versus nearly 22x for the more commonly used market cap weighted S&P 500 (SPY). There are seven terrific companies that comprise approximately 28% of the SPY (Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta), but can companies with trillion-dollar market caps grow at rates that justify 30+ P/E multiples? Inquiring minds want to know, and only the future can provide the answer.

The economic data continued to show a resilient economy combined with easing inflationary pressures. The consumer confidence index rose to a 17-month high, while the Federal Reserve’s favorite inflation gauge – the core personal consumption expenditures index – registered its slowest pace in more than two years. Can you say, “soft landing”?

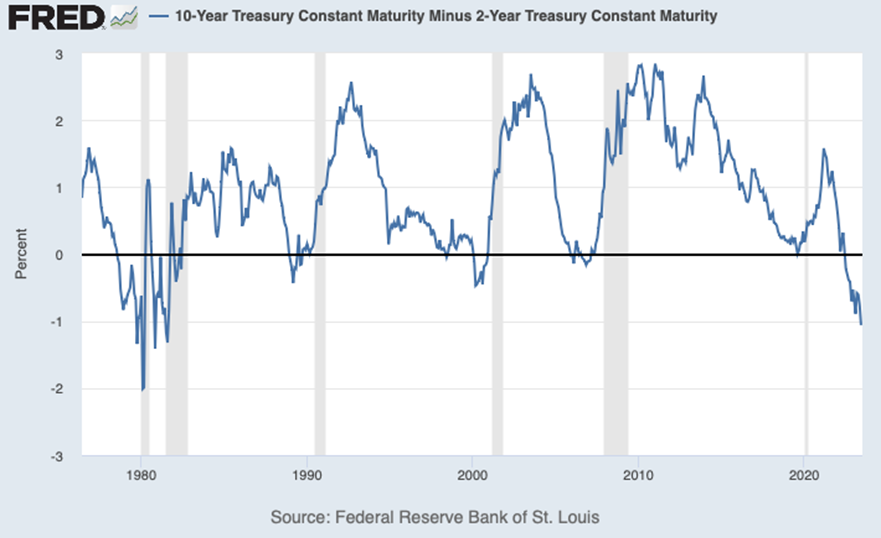

The recent positive performance of equity indices seems to reflect the “no recession” camp while the widening 10-year yield minus 2-year yield indicator stubbornly, and even increasingly, seems to reflect the “yes recession” camp (see chart below). This indicator suggests that there is some consensus in the bond market that it is better to lock in lower yield for 10 years than to invest in higher yields for 2 years, which implies that beyond the next two years, less attractive long-term risk-free fixed income returns will be available, probably due to weaker economic conditions.

The Energy sector was the top performer as Crude Oil bounced back over $70 per barrel. All the other equity sectors performed well, except for modest declines in Health Care and Utilities. The Dollar and Gold were both unchanged, while the yield on the 10-year Treasury moved up 8 basis points to 3.82%.

There is no good news to report on the Chicago Sports scene.

Note to Powell

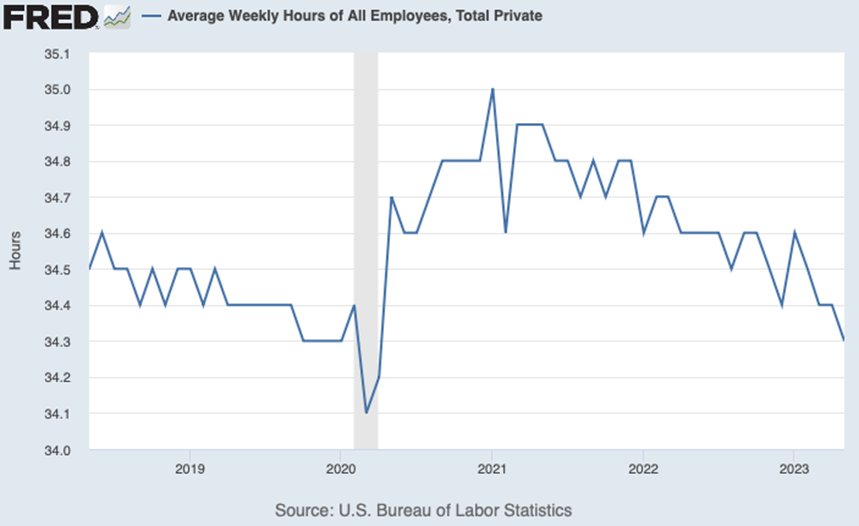

The economic calendar is quite busy despite another holiday shortened trading week. On Monday the Census Bureau reports on construction spending, and the Institute for Supply Management will release its Manufacturing Purchasing Managers’ Index. Construction spending is forecasted to show reasonable growth, while the ISM report is expected to remain in contraction territory for the eighth straight month, with a consensus estimate of 47. Wednesday has the release of the FOMC’s mid-June monetary policy meeting at which rates were left unchanged but also were accompanied by with the usual hawkish jawboning. Thursday has a triple dose of jobs data with the Job Openings Labor Turnover Survey (JOLTS), initial jobless claims, and the ADP National Employment Report. Additionally on Thursday the ISM releases its Services, which has been in expansion territory for the last 5 months, but the most recent reading of 50.3 was barely above the 50-dividing line of expansion and contraction. The BLS jobs report on Friday will likely be the most significant of all the releases, with Economists forecasting that 213k jobs were added during the month, with the unemployment dipping to 3.6% from 3.7%, and average hourly earnings increasing 0.3% month-over-month and 4.2% year-over-year. There has been much emphasis lately among financial markets pundits on hours worked, which have been inching down (see chart below), possibly an indicator of a turning point in labor market strength. Any surprises in those numbers could influence the monetary policy decisions at the July FOMC meeting. Memo to Chairman Powell: The pause is good, maybe even a pivot, raising rates won’t undo the damage from policy mistakes two years ago.

Stocks on the Move

The month of June’s movers with significant news…

+55.3% Oil-Dri Corp of America (ODC) reported fiscal third quarter results on June 8th with earnings of $1.25 per share, revenue of $105.42M up 22.9% y/y, with gross profit margin expanding to 26% from 18% the year prior period. The Company also raised its quarterly dividend by a penny to $0.29 per share. Additionally, ODC put out a press release on June 29th announcing it would implement price increases ranging from 10%-15% for its industrial and automotive clay absorbents effective September 1st.

+31.4% Lakeland Industries Inc (LAKE) reported fiscal first quarter results on June 7th with earnings of $0.18 per share beating estimates by $0.04. Gross margin increased to 43.4% from 40.5% the prior year period. Management commented that “China will remain weak” and “North America is currently running at pace,” as well as reiterated guidance for the full 2023 year.

+28.6% Apogee Enterprises Inc (APOG) reported fiscal first quarter results on June 23rd with earnings of $1.05 per share beating estimates by $0.15. The company also increased its full-year EPS outlook to a range of $4.15 to $4.45 reflecting the strong first quarter results and an improved outlook for the second quarter.

+27.0% Patterson Companies Inc (PDCO) reported fiscal fourth quarter results on June 21st with earnings of $0.84 per share beating estimates by $0.14 per share. The Dental segment stood out with strong topline growth of almost 8% year-over-year due to strong demand for both equipment and services.

+23.2% Commercial Metals Inc (CMC) reported fiscal third quarter results on June 22nd with earnings of $2.02 per share and revenue of $2.34B beating estimates by $0.20 and $100M, respectively. The Company says it is experiencing a “boost” from North American construction and anticipates this demand to continue.

+20.1% V2X Inc (VVX) announced on June 7th that it had secured a position on the Training Systems Acquisition IV, or the TSA IV, program with the U.S. Air Force. The contract vehicle is valued up to $32.5B over ten years. Chuck Prow, V2X President and CEO commented, “This partnership enables us to develop, install, and provide long-term support for cutting-edge technologies that shape the future of warfighter training.”

+16.3% Duluth Holdings Inc (DLTH) reported first quarter results on June 1st with a $(0.12) loss per share and revenue of $123.7M beating estimates by $0.02 and $5.0M, respectively. The brand saw strength in women’s apparel, AKHG sub-brand sales, and direct-to-consumer sales. The Company reaffirmed its 2023 full year outlook.

+13.7% ARC Document Solutions Inc (ARC) announced on June 26th that it had entered into an amended credit agreement with more favorable terms. The Company also disclosed it had purchased over 500,000 shares, or 1.2%, of its own stock from April to the first three weeks of June. There is currently $10M available for continued buybacks.

+10.9% The Eastern Company (EML) announced on June 29th that it had acquired certain assets of Sureflex to be incorporated as part of its Velvac unit. Sureflex is a manufacturer of tractor-trailer cable assemblies. No financial terms were disclosed.

+10.9% Nathan’s Famous Inc (NATH) reported fiscal fourth quarter results on June 8th with earnings per share of $0.80. Revenue of $27.42M for the quarter increased over 10% year-over-year. The strong results were attributed to increased sales from the two company-owned restaurants, higher selling prices that benefited the license royalties segment, and higher attendance at branded product program customers, including sports arenas, amusement parks, malls, and movie theaters.

-11.4% Blue Bird Corp (BLBD) fell after it announced an underwritten secondary public offering of 4.5 million shares at the price of $20.00/share. The selling stockholders will receive all the proceeds and Blue Bird will not receive any proceeds from the offering.

-17.4% American Software Inc (AMSWA) reported fiscal fourth quarter results on June 8th with earnings of $0.12 per share beating estimates by a penny. The stock price reacted to the soft guidance given for fiscal 2024 which indicates little growth. Management commented, “…booking remains volatile in the near-term, given our ongoing economic uncertainty.”

-22.1% Methode Electronics Inc (MEI) reported fiscal fourth quarter results on June 22nd with earnings of $0.21 per share missing estimates by $0.17 per share. The missed quarter was attributed to acquisition cost, material cost inflation, and unfavorable foreign currency translation. The Company also indicated it expects lower organic sales in FY24 due to program roll-offs and expected weakness in key markets. However, management still expects the business to grow 11% organically from FY24 to FY25 as they replace the sunsetting programs.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.

Have a safe Independence Day!