Last Week

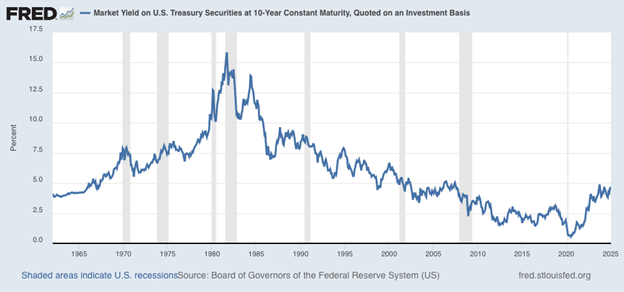

Stocks sank during the holiday-shortened week as solid economic data reignited concerns that the Federal Reserve will keep monetary policy tight in early 2025. In fact, several central bank policymakers hinted that the rate easing cycle might be on hold, with a January cut off the table. Most of the damage in the markets came on Friday following the December employment report which showed the economy added 256,000 new jobs and that the unemployment rate edged down to 4.1%. The yield on the 10-year Treasury spiked 18-basis points to 4.78%, its highest level since it briefly touched 5% in late 2023. The S&P 500 sank 1.9%, the Nasdaq Composite slid 2.3%, and small caps suffered a 3.5% shellacking. Declining issues more than tripled advancing issues, with only the Oil & Gas sector finishing more than 1% in the green.

The stock and bond selloffs seemed excessive, particularly when considering that the moderate wage growth during the month could dampen inflation going forward and temper the Fed’s hawkishness. Additionally, a strong domestic economy should bolster earnings growth and be a tailwind for small cap companies although the unusually high short-term interest rates are certainly a headwind.

As concerns swirl over the outlook for the stock market with 5% longer-term interest rates, we think it is important to note that 5% was the floor rather than the ceiling for rates for the 4 decade period prior to the financial crisis. The inverse of the 10-year rate at 5% would suggest that the current multiple of 20 on the S&P 500 would be around fair value, with other sectors of the market offering bargain prices.

The devastating fires in Los Angeles added to the somber mood on Wall Street. Our thoughts are with all those affected.

This Week

Activity on Wall Street could be brisk following three consecutive weeks of shortened trading.

On the economic calendar, Inflation will be in focus, with the December 2024 producer and consumer price reports scheduled for Tuesday and Wednesday, respectively. The economic calendar will also see the Fed Beige Book on regional U.S. economic activity, and the retail sales update for December 2024.

Earnings season will kick into gear, with the Financial sector heavy hitters JPMorgan (JPM), Goldman Sachs (GS), Citigroup (C), and Wells Fargo (WFC) all reporting results on Wednesday, followed by UnitedHealth (UNH) on Thursday, and oilfield services and equipment provider SLB on Friday.

The ICR retail conference provides investors with the opportunity to hear updates from major players such as Walmart and hundreds of other presenters. North Star’s President Peter Gottlieb will be there soaking in the information.

On the Chicago Sports Scene: some optimism over the recent play from Lonzo Ball for the Bulls. Meanwhile, the University of Chicago Maroons basketball team is on a 9-game winning streak and will be playing conference games this weekend at the Ratner Center versus Carnegie Mellon on Friday and Case Western on Sunday.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.