A Shift Back to Dovish

Against the backdrop of the Fed raising rates and a shrinking GDP, the stock market finished July with a flourish as the S&P 500 rallied 4.5%, the Nasdaq gained 4.7%, and the Russell 2000 advanced 4.3%. The Oil and Gas sector was the strongest performer, jumping 10.6% with energy prices reversing the recent downtrend after Russia’s Gazprom said on Monday that it would halve natural gas exports through the Nord Stream pipeline to Germany. Longer term bond yields continued to fall, with the yield on the 10-Year Treasury finishing down 14 basis points to 2.64%, its lowest level since early April.

As was widely expected, the Fed raised rates by 75 basis points on Wednesday to a target range of 2.25%-2.50%. What was not expected was the slightly dovish shift in tone for Chairman Powell, suggesting that future hikes might be less aggressive. Early in the year, with short term rates at near zero percent and with inflationary pressures mounting, the Fed adopted a decidedly hawkish posture. Going forward, we would anticipate a shift back to more data dependent monetary policies.

Media outlets pounced on the headline that the U.S. was in a recession following the report on Thursday that the economy shrank by 0.9% in the in the last three months, marking the second consecutive quarter where the economy has contracted. In the first quarter, GDP, or Gross Domestic Product, decreased at an annual rate of 1.6%. While two consecutive quarters of negative growth is the most frequently used definition of a recession, the National Bureau of Economic Research makes the determination, and many factors go into that calculation. Two of those factors, namely full employment and a record level of household wealth, clearly argue against declaring a recession. Furthermore, the decline in GDP in the first half of this year was driven by net exports (the value of exports minus the value imports) and inventories. In the latest quarter, real personal consumption increased at a 1.0% annual rate, with services spending up 4.1% while goods spending fell 4.4%. The pandemic has been the root cause of many of the unusual swings in the GDP inputs. In 2021 supply shortages motivated consumers to aggressively purchase goods. In response to that rampant consumer demand, producers built up inventories. As the economy reopened, consumers shifted their demand to services, while lowering demand for goods. In the latest quarter, producers slowed the rate of inventory growth, which in turn reduced GDP.

Earnings season continued to prove less bad than feared. To date, 56% of the companies in the S&P 500 have reported results for the second quarter. Of these companies, 73% have reported actual EPS which are in aggregate 3.1% above estimates. As a result, the index has a higher earnings growth rate for the second quarter today relative to the end of last week and relative to the end of the quarter. The blended earnings growth rate for the second quarter is 6.0% today, compared to an earnings growth rate of 4.7% last week. Positive earnings surprises reported by companies in the Energy and Health Care sectors were substantial contributors to the increase in the earnings growth rate over the past week. Future expectations have also remained relatively stable, with earnings growth of 6.7% forecasted for the third quarter.

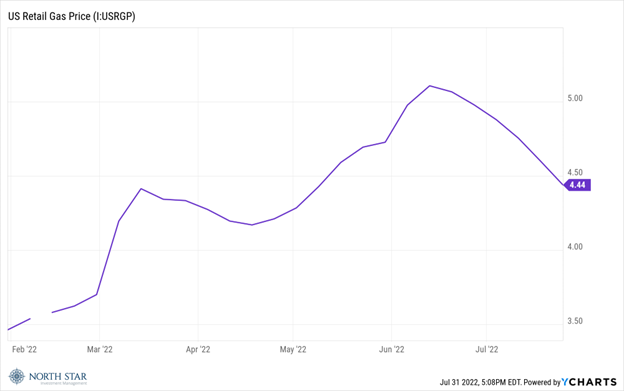

Gas prices fell for another week. As we discussed in our commentary a month ago, gas prices at the pump have a significant impact on consumer confidence, which in turn influences stock prices. As such, the next consumer sentiment reading might follow stock prices and show a nice uptick.

Not much new to report on the Chicago sports scene, although the White Sox have crept to within 2½ games of the division leading Minnesota Twins in the AL Central.

Second Quarter Results Pour In

During the upcoming week, 152 S&P 500 companies are scheduled to report results for the second quarter.

On Friday, the Bureau of Labor Statistics will release the jobs report for July. Economists estimate that the economy added 250,000 jobs during the month, and that the unemployment rate remained unchanged at the “full employment” level of 3.6%. The BLS will also release the Jobs Openings and Labor Turnover Survey (JOLTS) on Tuesday, which is expected to show a substantial decline from the previous month. A decline in the JOLTS number could be viewed as a forward-looking indicator of a softening labor market.

Stocks on the Move

-10.1% Acme United Corporation (ACU) supplies cutting, measuring, and safety products for the school, home, office, and industrial markets. The Company produces shears, scissors, rulers, first aid kits, utility knives, manicure products, medical cutting instruments, guillotine paper trimmers, and pencil sharpeners. Acme United reported second quarter earnings of $0.71 per share and revenue of $56.77M, up 26.6% Y/Y. While the Company is still experiencing some supply chain and operating challenges, they have also seen some improvement in the environment.

+10.2% Amazon.com Inc (AMZN) is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous others. Amazon is also the dominant cloud services provider (through Amazon Web Services, or AWS), an influential entertainment company through its video streaming operations, a force to be reckoned with in grocery with its ownership of Whole Foods, and a leader in digital personal assistant devices (Alexa and Echo). AMZN popped last week after reporting strong top-line growth and Amazon Web Services results. The Company also reported a one-time charge related to its investment in Rivian Automotive (RIVN). Despite naming energy inflation as one of its biggest cost pressures, the Company intends to move ahead with warehouse buildouts to support future growth.

-14.6% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories. Boot Barn plunged last week after announcing mixed results with earnings of $1.26 beating estimates by $0.11 and revenue of $365.9M up 19.5% y/y but missing estimates by $0.86M. The Company also modestly cut their guidance after raising it earlier this year. During the period, SSS were up 10% and the Company opened 11 new stores.

+10.5% The Mosaic Company (MOS) is one of the world’s leading producers and marketers of concentrated phosphate and potash crop nutrients. Mosaic is a single source provider of phosphate and potash fertilizers and feed ingredients for the global agriculture industry. Fertilizer stocks performed well last week after a Russian missile strike on Ukraine in Odessa signaled the two countries are likely not reaching an export pact in the near term.

+16.5% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. VALU reported FY2022 earnings last week of $2.50 per share and net income of $23.82M. Liquid assets increased 27.5% Y/Y to $57.83M at the end of the period.

-10.4% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. Last week, EML declared an $0.11 per share quarterly dividend, in line with historical distributions.

+13.8% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. There was no significant company news last week.

+10.8% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.