Last Week:

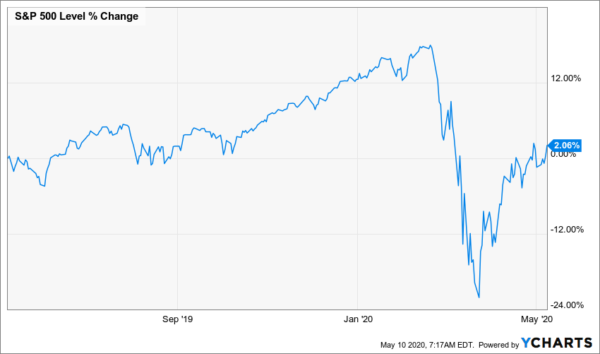

Reopening fervor overwhelmed COVID-19 fever as the S&P 500 surged 3.5% and the Russell 2000 jumped 5.5%! Following that rally the S&P 500 is now higher than it was a year ago:

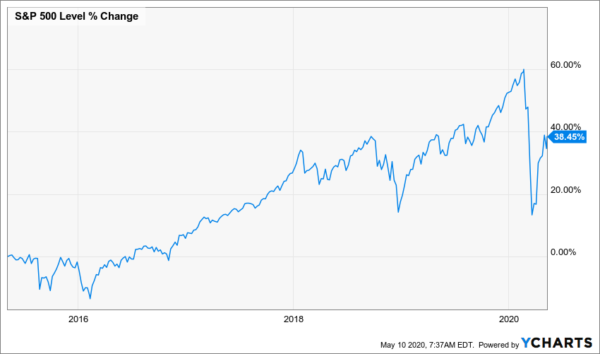

It is also almost 40% higher than it was five years ago, which seems like a very reasonable annual rate of return:

It is worth noting the market was at an all-time record high at the starting point of the graph. The news itself remained far less rosy (intentional understatement), as the unemployment rate hit 14.7% in April, COVID-19 cases and deaths continued to mount, and corporate earnings sputtered.

Here is the silver lining playbook:

1) A very high percentage of the unemployed anticipate returning to work within 6 months.

2) The curve has clearly flattened, and therapeutics and vaccines are being fast tracked while the supply of PPE, ICU beds, and ventilators has been ramped up. Sunday marked the lowest number of new COVID-19 cases and deaths since the end of March.

3) The market is looking past 2020 earnings and forecasting a significant recovery in 2021.

The potential hole in the silver lining is that stocks are currently statistically expensive with a forward P/E of 20.2, the highest in 18 years. Additionally, the “E” is really a guesstimate rather than an estimate as many companies have withdrawn guidance. Value investors in particular should take note that Warren Buffet was uncharacteristically cautious at this year’s annual meeting, as Berkshire Hathaway was unable to identify bargains and instead piled up cash. Unfortunately, the risk-free options provide a paltry return, as the yield on the Ten-Year Treasury continued to hover around 0.65%. In other words, TINA (There Is No Alternative) is still the primary underpinning of the case for stocks. In short, proceed with caution and make sure that your allocation of your financial assets is consistent with your risk appetite.

This Week:

Earnings season will wind down with only 21 S&P 500 companies reporting results for the first quarter. The economic calendar includes the release on Tuesday of the consumer price index for April, which is likely to soften, reflecting crashing energy prices and faltering demand for a range of goods and services. On Friday, U.S. retail sales for April are forecasted to post a 10.6% decline, surpassing March’s 8.4% monthly decline as the steepest on record. Additionally, the Consumer Sentiment Index for May will likely be at its lowest level since 2011.

COVID-19 will continue to be the primary story line. Seventy percent of the States have partially reopened their economies in a variety of fashions, leading to real-time information on the effect on spread of the coronavirus by those policies. There will also be data from the progress of developing therapeutics, and vaccine updates.

A trillion here, a trillion there. The White House has started informal talks with Republicans and Democrats in Congress about next steps on coronavirus relief legislation, officials said on Sunday, but they stressed any new federal money would come with conditions. Over $3 trillion has been authorized by Congress since March with surprising bi-partisan support, but that price tag is expected to climb further and probably will become increasingly politicized. “We just want to make sure that before we jump back in and spend another few trillion of taxpayers’ money that we do it carefully,” Treasury Secretary Steven Mnuchin said. “We’ve been very clear that we’re not going to do things just to bail out states that were poorly managed.”

Final Thoughts:

This week’s submissions for songs from the quarantine are “ I Shall be Released” and “Closer to Free”.

Once again Bob Dylan makes the list with “I Shall be Released”.

“I see my light come shining

From the west unto the east

Any day now, any day now

I shall be released”

This song touches on the passive nature of being confined. We cannot release ourselves; we are at the mercy of the pandemic and under the restrictions of the government.

The BoDeans “Closer to Free” speaks to our most basic human desires.

“Everybody wants to live, like they want to live

And everybody wants to love, like they want to love

And everybody wants to be, closer to free”

Keep breathing, but not on anyone. We are indeed closer to free with each passing day.