Clear Path to Cuts

The foundation of the bear case for the economy and the financial markets during 2022 and 2023 was the “higher for longer” mantra from the Federal Reserve. In other words, the Fed’s tight monetary policy would lead to a deep recession before inflation reached the 2% target level that was established (without any specific logic). On Tuesday, the CPI dipped to 3.1%, supporting our suggested Fed mantra of “Higher Than Necessary.” Accordingly, the following day, the Federal Reserve finally abandoned its Uber-Hawk posturing, and its dot plot showed a forecast of cutting its key interest rate by three-quarters of a percentage point in 2024. Traders in the Fed funds futures market are actually pricing in twice that amount, or 1.5 percentage points, worth of cuts in the year ahead, according to the CME Group’s FedWatch indicator. That would reduce the benchmark funds rate to a target range of 3.75%-4%. All financial assets rallied in response, with stocks registering their seventh straight week of gains, which is the best winning streak for the S&P 500 since 2017. Small caps topped the leaderboard, with the Russell 2000 surging 5.6%, while the S&P 500 Index was up 2.5%, and the Nasdaq rose 2.9%.

Bond investors were also rewarded, with the yield on the 10-year Treasury sinking 32 basis points to 3.93% and the 2-year declining 24 basis points to yield 4.45%. The dollar slipped over 1%, and gold rallied similarly. Further downward pressure on interest rates could pressure the dollar and provide a nice tailwind for gold.

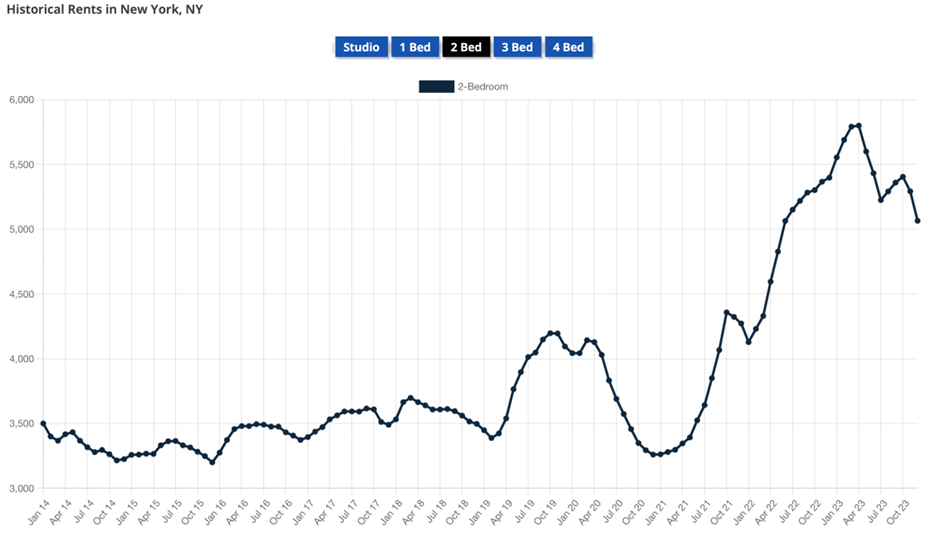

We expect further downward pressure on interest rates because we are optimistic that inflation will continue to wiggle downward, albeit not necessarily linearly. Supporting our perspective, various home rental tracking organizations have recently released data suggesting shelter costs, which are approximately 30% of some inflation indexes, are on a downward trend. For example, rent in cities like New York City and Atlanta is declining, which should leak into various inflation statistical series such as CPI in the coming months (sources: rentcafe.com and renthop.com). Further, the declines in the rent component of shelter costs should meaningfully benefit inflation reports in 2024, giving the Fed a clear path to rate cuts by mid-2024, if not sooner.

Source: renthop.com

In addition to the “not too hot” aspect of the downward trend in inflationary pressures, the “not too cold” dynamic of the Goldilocks scenario was supported by the report that U.S. retail sales unexpectedly rose in November as the holiday shopping season got off to a brisk start, suggesting that the economy was on track to post moderate growth, and further alleviated fears of a recession.

Hot Lump of Coal

The economic calendar is heavy with housing, manufacturing, and consumer sentiment data scheduled for release, with the focus primarily on the monthly update on core PCE. The Federal Reserve’s favored inflation gauge is expected to show a soft 0.2% month-over-month rise in November, resulting in the six-month annualized inflation rate of just above the magic 2.0% level. An unexpected “hot” number might result in a lump of coal in investors’ stockings, but we believe that outcome is unlikely.

The financial markets will be closed on Monday to celebrate the Christmas holiday. We wish you a Merry Christmas and hope the Santa Claus rally continues!

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.