Grizzly Declines

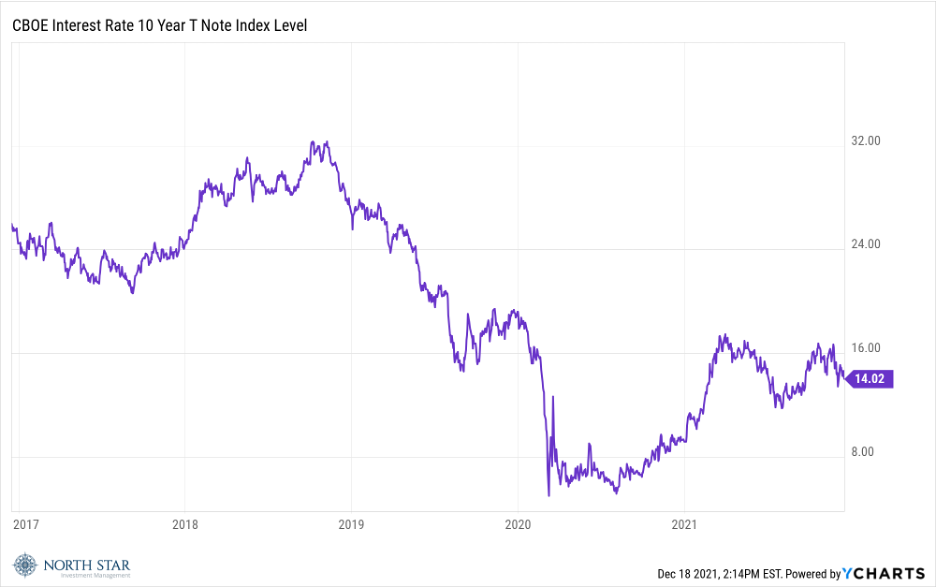

Shortly after we posted last week’s “Where Are the Bears?” commentary, our ursine friends awoke from their slumber Monday morning, mauling investors who had celebrated another record close on the S&P 500 the previous Friday. The twin terrors of Fed tightening and Omicron spreading dominated the narrative, leading to a grizzly 1.94% decline in the S&P, a 2.95% drop in the Nasdaq, and a 1.71% slide in the Russell 2000. On Wednesday, the Fed announced that it was accelerating its tapering of bond purchases and predicted three rate hikes in 2022. Despite this seemingly negative news for the bond market, the yield on the 10-year U.S. Treasury note dropped 9 basis points to its lowest level in two weeks at 1.401%. The “recency” effect leads one to feel comfortable that the ceiling on rates is below 1.75%. We caution investors to jog the memory back to just 3-years ago when the 10-year reached 3.20% and seemed headed higher.

As such, we continue to recommend keeping maturities very short in duration, and over-weighting inflation protected securities such as TIPs. The dollar rose 0.6%, holding near a 52-week high. Gold, which is our preferred dollar hedge, advanced 1% to close still approximately 5% below its value at the beginning of the year. The relative strength of gold and other precious metals may be related to rising geopolitical concerns regarding Russia seemingly preparing for some form of military conflict with Ukraine. Bitcoin, which seems to have usurped gold as an alternative to sovereign currencies, continued its recent slide from its peak on November 9. It has now lost 30% since the top but is still up 100% from a year ago. We still believe the volatility in the internet currencies make them poor mediums of exchange but recognize that the holdings in BLOK (Amplify Transformational Data Sharing ETF) could fare well if the blockchain becomes an important ecosystem. Crude Oil, another volatile asset which we would underweight long-term, declined 1.1% during the week, although is still +49% YTD.

In our final commentary of 2020, we noted:

“The COVID-19 pandemic raged on, with daily new cases and deaths holding steady at record levels. On a positive note, two million doses of the vaccines have already been administered. The vaccines will clearly remain a headline for at least the first half of 2021.”

Unfortunately, the song remains the same, with a new omicron verse added to this sad tune. In fact, there are currently more people infected with the virus in the U.S. than in any of the previous waves. Please exercise caution and use good common sense during the upcoming holiday season.

To Rally or Not To Rally?

That is the question. Statistically stocks have been shown to perform well during the year-end trading period, otherwise known as the Santa Claus Rally. Will the twin terrors of Fed be tightening and COVID-19 spreading ground Santa’s sled? Stay tuned. The economic calendar is light, with December Consumer Confidence on Wednesday in focus. The index was 15% lower in November than in June, primarily due to concerns over inflation. Any improvement in December would be a surprise given the recent news flow.

Possible stocking stuffers came Monday morning as banks in China lowered the one-year loan prime rate for the first time in 20 months, and Moderna Inc. said its vaccine increased antibody levels against the omicron variant. But markets remained under pressure as economists reduced their U.S. economic growth forecasts after Senator Joe Manchin rejected Biden’s roughly $2 trillion spending package over the weekend. The markets will be closed on Friday in observance of Christmas.

We are celebrating the 10th anniversary of the North Star Opportunity Fund this week. Please visit our website to learn more about our exciting “Micro to Macro” strategy.

Stocks on the Move

+12.7% Pfizer Inc (PFE) operates as a pharmaceutical company. The Company offers medicines, vaccines, medical devices, and consumer healthcare products for oncology, inflammation, cardiovascular, and other therapeutic areas. Healthcare stocks dominated all other sectors in the S&P 500 last week as M&A activity picked up and the resurgence of COVID-19. In addition to raising 2022 sales guidance last week, Pfizer Inc agreed to acquire biotech company Arena Pharmaceuticals (ARNA) in a $6.7B deal.

PFE is a 1.7% position in the North Star Opportunity Fund.

+10.4% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. After slumping earlier in the week from news of slow November videogame and videogame accessories sales, the stock jumped on news that Donerail Group will make a revised offer. The offer will be at a lower price than its proposal in August of $36.50. The North Star Research Team met with the Company on November 9th, 2021, to discuss the original rejected offer; the company commented they consider all takeover proposals, but found Donerail’s valuation of Turtle Beach to be insufficient.

HEAR is a 1.4% position in the North Star Micro Cap Fund and a 0.9% position in the North Star Opportunity Fund.

+10.4% Bluerock Residential Growth REIT Inc (BRG) owns interest in a portfolio of more than 50 apartment properties in Virginia, Tennessee, Georgia, Florida, Michigan, and Illinois. The REIT generally invests in joint ventures with local partners, while holding a controlling position. There was no specific company news last week.

BRG is a 0.3% position in the North Star Opportunity Fund.

-11.0% Compass Diversified Holdings (CODI) is an investment holding company. The Company acquires controlling interests in profitable small to middle market businesses in niche industries as well as works with management to pursue growth opportunities and provide strategic support. Last week, Moody’s completed a periodic review of CODI with no change in the credit rating and stated considerations such as the company’s high financial leverage being slightly outside the Ba3 rating range, and projections that debt/EBITDA leverage will improve to the mid-3x over the next 18 months driven by earnings growth from add-on acquisitions.

CODI is a 0.6% position in the North Star Dividend Fund and 0.8% position in the North Star Opportunity Fund.

-20.4% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. Last week, Sono Group’s stock price declined despite receiving two Buy ratings – Berenberg Capital Markets with a $21 price target and Craig-Hallum Capital Group with a $23 price target.

SEV is a 0.4% position in the North Star Opportunity Fund.

-11.7% ABM Industries Incorporated (ABM) is a facility services contractor. The Company provides air conditioning, engineering, janitorial, lighting, parking security, and other outsourced facility services to commercial, industrial, and institutional customers. Last week, ABM shares fell the most intraday since March 2020 as the Company’s Investor Day took place on news of lower-than-expected FY2022 profits. The Company’s guidance “assumes an easing in COVID-19-related disinfection services and work orders.”

ABM is a 0.2% position in the North Star Dividend Fund.

-18.0% Flexsteel Industries Inc (FLXS) manufactures and sells wooden and upholstered furniture for the retail, contract, and recreational vehicle (RV) furniture markets. The Company’s products are sold to furniture dealers, department stores, and RV manufacturers. Flexsteel slid last week as the Company announced a FY2022 business update anticipating strong topline growth, but significant supply chain challenges negatively impacting near-term profitability in the first half of the year.

FLXS is a 0.4% position in the North Star Dividend Fund.

-11.2% AstroNova Inc (ALOT) designs, develops, manufactures, and distributes a broad range of specialty printers and data acquisition and analysis systems, including both hardware and software. Its target markets are apparel, automotive, avionics, chemicals, computer peripherals, and communications. Last week, Zacks Investment Research downgraded the stock from a hold rating to a strong sell rating.

ALOT is a 0.3% position in the North Star Micro Cap Fund.

-13.5% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories. On Monday, December 13th, CEO Jim Conroy joined Jim Cramer to comment that even with over 500 brick-and-mortar locations, a couple hundred more stores are likely to be built.

BOOT is a 1.4% position in the North Star Micro Cap Fund.

-15.2% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. Last week, a series of share blocks traded at market value of $135M. The week prior, insiders sold $221,286 of the company’s shares.

BBW is a 0.9% position in the North Star Micro Cap Fund.

-10.2% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels. Last week, Century Casinos fell as the Omicron variant continued to put pressure on travel and leisure stocks.

CNTY is a 0.4% position in the North Star Micro Cap Fund.

-10.2% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. Last week, Green Brick slipped after commencing an equity offering of 2 million depository shares at $25/share.

GRBK is a 0.7% position in the North Star Micro Cap Fund.

-16.5% Q.E.P. Co Inc (QEPC) manufactures, markets, and distributes tools and related products for the home improvement market. The Company’s brand names include QEP, O’Tool, and Roberts. Products include trowels, floats, tile cutters, wet saws, spacers, nippers, and pliers that are marketed for the use in surface preparation and installation of ceramic tile, carpet, marble, and drywall. There was no significant company news last week.

QEPC is a 0.6% position in the North Star Micro Cap Fund.

-10.0% Orion Energy Systems Inc (OESX) designs, manufactures, and implements energy management systems for commercial and industrial customers. The Company’s management system is comprised of high intensity fluorescent lighting systems, InteLite intelligent lighting controls, and Apollo Light Pipes. There was no significant company news last week.

OESX is a 0.9% position in the North Star Micro Cap Fund and 0.7% position in the North Star Opportunity Fund.

-10.0% Delta Apparel Inc (DLA) designs, markets, and manufactures branded and private label active and headwear apparel. The Company’s products are sold to boutiques, department stores, outdoor and sporting goods retailers, college bookstores, screen printers, and the US military. There was no significant company news last week.

DLA is a 0.6% position in the North Star Micro Cap Fund.