Last Week:

It was the worst week for the equity market since early February, with the S&P 500 declining 4.1%, erasing over half the gains for the year. Only a relief rally of over 1% in the last hour of trading Friday allowed the index to break a six-day losing streak. The twin headwinds of rising rates and trade tensions uprooted the pillar of strong corporate earnings, as cautionary language from third quarter reports undermined future growth expectations. PPG set the tone on Monday morning, cautioning that third quarter earnings were going to be negatively affected by rising costs and softening overall demand in China. The Luxury Goods space was also under intense selling pressure after LVMH issued cautious commentary on China during a conference call on Wednesday, noting that customs officials are more rigidly enforcing rules on bringing goods back into the nation. Despite the rough start to earnings season, the consensus still calls for a robust 19.2% blended S&P earnings growth for the third quarter, although those estimates as well as the estimates for the fourth quarter have been softening. Meanwhile the Fed has remained firm on its plan to continue to raise short-term rates, potentially now playing the role of the scapegoat for the decline in the market (according to President Trump “The problem, in my opinion, is Treasury and the Fed. The Fed is going loco, and there’s no reason for them to do it”). The recent swoon did seem to have been sparked by Fed Chair Powell’s remark on October 3rd that policy was a “long way from neutral” and added “we may go past neutral”. I’m not sure if that statement was “loco”, but it certainly sounds more hawkish than anything from a Fed Chair in the last ten years.

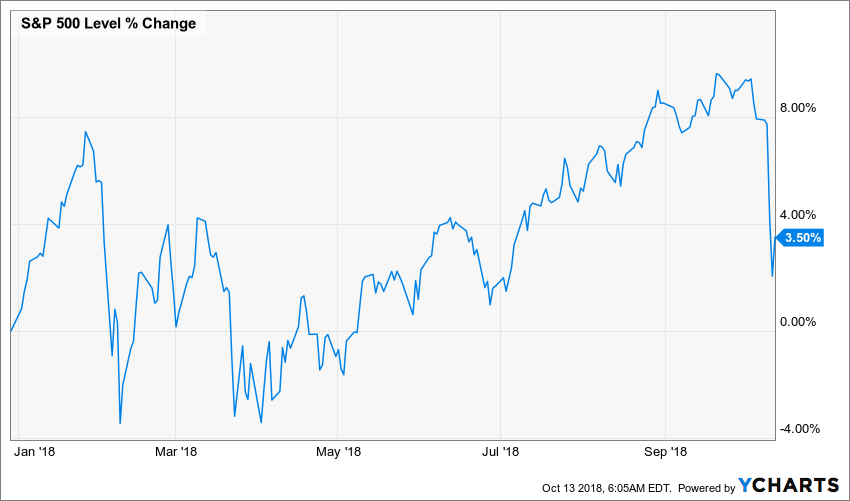

I’m not a chartist, but it looks like the short-term uptrend was clearly violated last week, with perhaps a new support level established on Thursday and Friday.

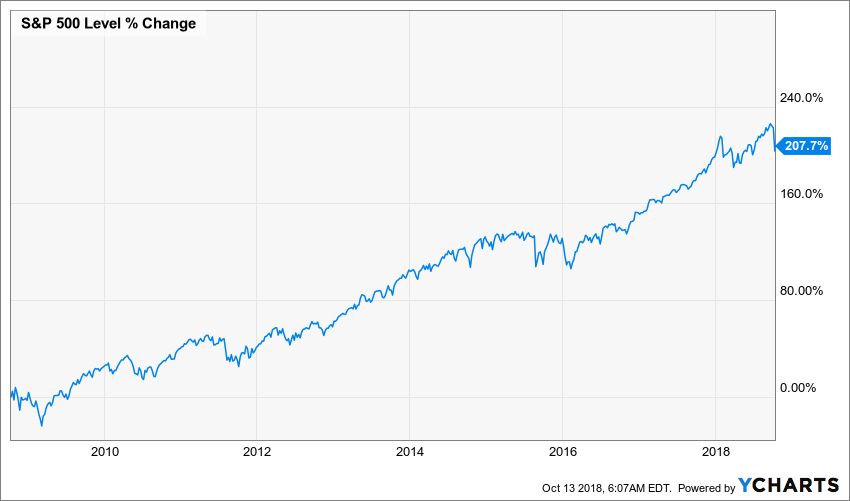

Taking a longer-term perspective, the recent decline seems less dramatic, with the long-term bull market still intact, as indicated by the Ten-year chart for the S&P:

This Week:

Corporate earnings will be in focus, with about 7% of the S&P 500 reporting third quarter results. Given the recent weakness in the stock market, it is possible that the White House might modify its trade tone, as President Trump was previously emboldened by the market’s rise in the face of the trade war with China. The economic calendar is busy, with U.S. retail sales, manufacturing index, industrial production, housing starts, and leading indicators all set for release. The FOMC meeting minutes will be out on Wednesday, which will carefully be analyzed given the recent hawkish narrative overhanging the market.

Stocks in the News:

Whereas approximately 80% of our 110 portfolio companies declined during the week, only one holding moved more than 10%.

American Airlines Group, Inc. (AAL) -12.9%: Shares are now down 39.5% this year and are trading at the Airline sector’s lowest P/E (8.9x) and P/S (0.34x) ratios. The Company does carry a substantial debt load, which could be concerning investors in the face of rising interest rates, one offset to American Airlines debt levels is the planes they own or lease; airline debt is highly-collateralized by equipment and hard assets. In the short-term, hundreds of flights were cancelled due to the tropical storms (although this should have minimal impact on earnings). Third quarter results are scheduled to be released on October 26. American Airlines Group operates over 6,000 flights per day to more than 300 destinations across the world from hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix and Washington, D.C. AAL is a 2.5% holding in the North Star Opportunity Fund.