Tasty

The financial markets gave us tasty reasons to be thankful, with the S&P 500 advancing 1.5% the NASDAQ gaining 0.7% and the Russell 2000 rising 1%. Advancing issues outnumbered decliners 2.5-1, and all the equity sectors finished in the green. The yield on 10-year Treasury dropped 12 basis points to 3.69% and has now declined over 50 basis points in the past month. Meanwhile, the yield on the 2-year Treasury note remained around 4.5%, translating into an inversion of 75 basis points in the 10-2 Treasury spread. We believe the 4.5% yield on the 2-year Treasury is an attractive piece of the puzzle for the fixed income portion of portfolios. The dollar inched lower, which in this environment is constructive for the financial markets, while crude oil slid 5%, and gold inched higher. Gold, copper, and silver all seem investable at these levels, particularly if our outlook for a more normal economy in 2023 proves correct. In addition to the tracking ETFs for gold and silver, we also are positive on NEM, PAAS, SII, and FCX. Small caps are also well positioned for a rebound under that scenario, and we believe many of our holdings in our funds are trading at bargain prices; in our view, small cap U.S. stocks offer significantly more earnings visibility than multi-national large and mega-cap stocks, especially given the uncertainty in the Chinese economy and the ongoing conflict in Ukraine.

The news flow that supported the healthy markets were better than expected earnings from retailers and reasonable minutes from the Federal Reserve’s November meeting. In other words, the economy is holding up and the painful period of unprecedented rate hikes is near an end – at least in magnitude, as the recent series of 75 basis point hikes seems likely to slow to 50 basis point increments before a possible outright pause in rate hikes altogether.

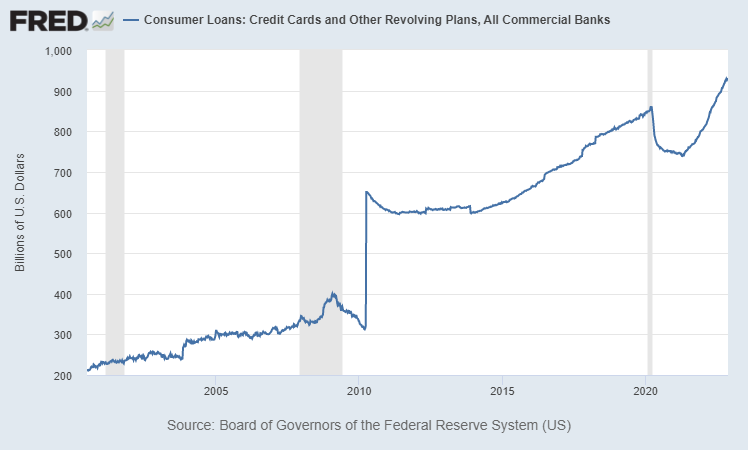

There are a few company-specific characteristics we are avoiding at this time due to our view that there is lower-than-average earnings visibility. First, businesses that rely on consumer credit-based purchases, such as major appliance and automobile purchases. Second, businesses with emerging secular challenges, such as office properties and related businesses. And finally, global businesses with earnings dependence on the Chinese economy.

Too Cold

The economic calendar includes November Consumer Confidence on Tuesday, October JOLTS job openings on Wednesday, October Personal Income and Spending on Thursday, and the big daddy of reports, November Nonfarm Payrolls on Friday. We expect modest softening from all those reports, hopefully in that Goldilocks “not too cold” taste range.

There is growing unrest in China, which led to markets opening lower on Monday. Additionally, the war in Ukraine rages on as winter sets in. We continue to pray for peace.

Stocks on the Move

-11.6% Movado Group Inc (MOV) designs, manufactures, retails, and distributes watches, as well as jewelry, tabletop, and accessory products. Its brands include Movado, Hugo Boss, Lacoste, Ferrari, Coach, and Tommy Hilfiger. Last week, MOV reported third quarter earnings per share of $1.31 vs $1.36 one year ago and revenue of $211.4M, down 2.9% y/y. Chairman and CEO Efraim Grinberg highlighted “topline growth in constant currency” and “solid profitability in an increasingly difficult macro environment.” Due to foreign exchange impacts, the company lowered FY net sales guidance between $740M and $750M versus the previous outlook of $780M to $790M.

+10.7% Territorial Bancorp Inc. (TBNK), headquartered in Honolulu, Hawaii, is the stock holding company for Territorial Savings Bank. Territorial Savings Bank is a state-chartered bank which was originally chartered in 1921. TBNK has 29 branches in the state of Hawaii. There was no significant company news last week.

+10.7% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.