Riding the Wave

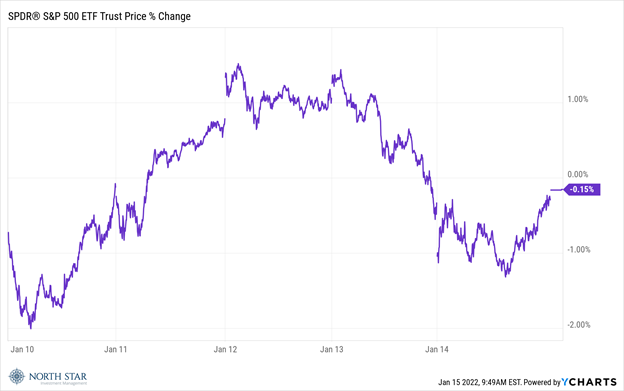

Looking at the graph of S&P 500 last week jogged the memory of a sine wave from middle school math class.

A sine wave or sinusoid is any of certain mathematical curves that describe a smooth periodic oscillation. A sine wave is a continuous wave.

The market action certainly felt like a slightly unsettling continuous wave for those who suffer from motion sickness. The selling pressure from the previous week accelerated early Monday morning, with the S&P 500 reaching its lowest level since December 21, representing a 4.4% decline from the January 3 record high. By Wednesday morning the market had recouped all those losses, as the “buy the dip” crowd dominated the action. A combination of soft economic data and cautionary guidance from earnings reports engendered another downward move on Thursday and into Friday morning, with the losses once again largely erased by a rally in the afternoon. By the closing bell on Friday, the S&P had posted a modest 0.30% decline, with the Russell 2000 dropping 0.80%. The Oil and Gas sector fared the best, advancing 4.96% as crude oil reached a two-month high. Consumer stocks performed poorly, as retail sales in December fell by a much worse than forecast 1.9%. Another sign of near-term economic softness came from the weekly new claims for unemployment, which exceeded estimates at 230,000.

Earnings season got off to a bumpy start after J.P. Morgan Chase, the top U.S. bank by assets, reported better than expected quarterly profit and revenue, but shares fell the most in two years after warning that cost pressures were likely to dampen earnings growth in 2022. JPM shares remain slightly positive YTD, and the Financial sector performed in the middle of the pack, with a decline of 0.76% for the week.

The dollar weakened modestly, while gold gained 1%, and the yield on the Ten-Year Treasury was unchanged at 1.77%; this sub-2% yield is well-below recent inflation reports in the mid- to high-single digits, suggesting significantly negative real yields. Unless government bond yields rise to levels closer to inflation report levels, then asset price appreciation should continue, favoring real estate and equities and precious metals. The VIX, otherwise known as the “Fear Index”, also finished the week unchanged, and continues to reflect a general lack of investor concern about downside risk in the stock market perhaps suggesting that all selloffs simply provide the opportunity to ride the next wave higher.

Earnings Season is Heating Up

The U.S. markets were closed on Monday in observance of the Martin Luther King, Jr. Day holiday.

Earnings season will heat up with 38 S&P 500 companies reporting results for the fourth quarter. Overall, earnings for S&P 500 companies are forecasted to be up 21.8% this quarter even with all the additional wage and supply chain costs pressures during the period. The forward P/E ratio of 21.1x is about 20% higher than the long-term average but seems reasonable given the sub-2% Ten-Year Treasury yield, which is less than half the average during “normal” times. We also take note of all the small-cap bargains, following a year of tremendous earnings growth with negligible share price gains.

The economic calendar features updates on housing starts, building permits, existing home sales and the Philadelphia Fed Index. Home prices have risen rapidly during the pandemic, and with inventories at extremely low levels, we believe increased housing starts in 2022 could provide a nice economic tailwind for the economy. It will be a quiet week for Fed officials with a blackout period in place ahead of the FOMC meeting set for January 26th.

Covid-19 developments will continue to be a contributing factor influencing most other headlines. There is a light at the end of the tunnel, with a modest downturn in cases in some of the places that experienced surges in December. Nevertheless, there are more people currently infected in the U.S. than at any other time, and economic activity will likely be constrained as a result.

Stocks on the Move

-11.3% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. Last week, Build-A-Bear Workshop presented at the annual ICR Conference and gave guidance for record profitability in 2022 due to the progress of the Company’s strategic initiatives including its digital transformation and omnichannel capabilities.

BBW is a 3.0% position in the North Star Micro Cap Fund.

-10.7% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories. Last week, Boot Barn presented at the annual ICR Conference. The North Star Research Team believes highlights include strong new store unit growth, the expansion of BOOT’s exclusive brands, and margin enhancement from a full price selling model as well as economies of scale in purchasing.

BOOT is a 4.6% position in the North Star Micro Cap Fund.

-10.9% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

PRTS is a 2.7% position in the North Star Micro Cap Fund and a 1.5% position in the North Star Opportunity Fund.

-12.3% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news lasts week.

SEV is a 0.7% position in the North Star Opportunity Fund.

Other Stocks Mentioned

JPMorgan Chase & Co (JPM) provides global financial services and retail banking. The Company provides services such as investment banking, treasury and securities services, asset management, private banking, card member services, commercial banking, and home finance.

JPM is a 1.3% position in the North Star Opportunity Fund.