Last Week

The stock market’s weekly win streak reached six while notching its 46th and 47th record closes of the year. During this period, the equally weighted S&P Index (RSP) has mirrored the performance of the S&P 500, highlighting the broadening of the rally outside of the “Magnificent 7”. Additionally, rather than igniting inflationary concerns, investors viewed the combination of strong earnings and a robust retail sales report as good news. The S&P 500 and Nasdaq Composite both gained approximately 0.8%, with almost twice as many advancing issues as declining issues. Small caps were the biggest winners, as the Russell 2000 posted nearly double the gain of the other indexes. The Oil & Gas sector was the bottom performer following crude oil prices into the red in response to the decreased likelihood that Israel would attack Iran’s oil infrastructure.

On the earnings front, strength in the Financial sector offset weakness in the Industrial sector, leading to an increase in the expected growth rate for the quarter to 3.4% from 2.9% the week earlier. The Financials are benefiting from a rebound in investment banking and dealmaking, with their outlook likely to continue to improve as short-term interest rates decline, offset by some as-expected increases in credit losses in recent Financials sector earnings reports. Another earnings highlight came from Netflix (NFLX) which topped profit and subscriber growth expectations.

The yield on the 10-year Treasury was unchanged at 4.07%, which is a win given the strong economic data. The 10-2 spread remained positively sloped, suggesting that recessionary fears remain muted. Gold reached new record highs as geopolitical tensions stayed elevated. The upcoming U.S. presidential election is highlighting multi-trillion annual U.S. budget deficits as far as the eye can see.

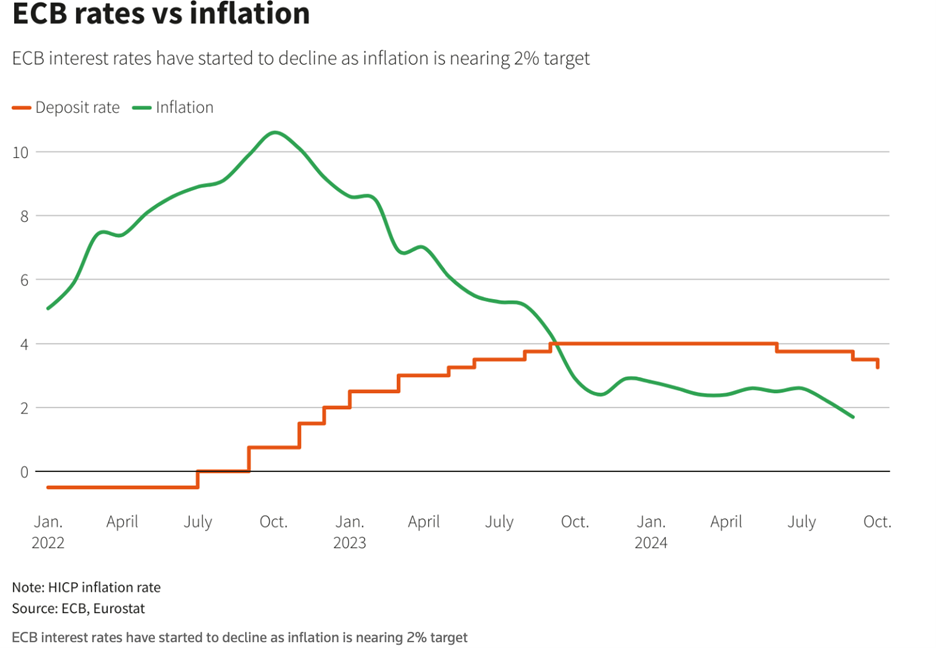

The investment community seems to be focusing more on international economics lately, and there were major events in both Europe and Asia last week. In Europe, the ECB lowered its three key interest rates by 25 basis points for the third time in 2024, marking the first time it lowered rates at back-to-back meetings in 13 years. Further cuts seem likely, given that ECB rates are still above reported inflation levels (see chart below).

In Asia, the Chinese government suggested more stimulus support for its ailing real estate sector. It announced almost $600 billion to increase its “whitelist” of real estate projects eligible for loans to assist real estate development progress. In addition, just today, the Chinese central bank announced a 25-basis point cut to each of the one-year loan prime rate (LPR) and the five-year LPR has been trimmed to 3.6%. The one-year LPR influences corporate loans and most household loans in China, while the five-year LPR serves as a benchmark for mortgage rates. These are just the latest announcements in a series of Chinese government stimulus measures that will likely continue as China deals with millions of empty residences, as well as many real estate projects at various points in ongoing construction.

There was no significant news on the Chicago Sports Scene, as the Bears had a bye week. It was great to see Lonzo Ball back on the court for the Bulls after missing three years of action.

This Week

Earnings season will be in full swing with 112 S&P 500 companies reporting quarterly results. During the next few weeks, the likely key driver of equity markets performance during this earnings season will be company comments on the outlook for revenue and earnings growth in coming quarters and 2025.

The economic data calendar is light, with Thursday’s release of the Manufacturing and Services PMIs of the most significance. A pickup in the Manufacturing PMI would be welcome, as it has been in contraction for a prolonged period.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.