Last Week

It’s been a long and winding road to the place where small caps and other non-magnificent stocks found the answer to the “when will I be loved” refrain. If last Thursday’s market action is any indicator, perhaps that love has finally blossomed. Remarks from Fed Chair Powell, combined with a softer-than-expected CPI report, generated a dramatic surge in the broader market. As we mentioned last week, “we think any weakness in the shelter component would drive a bond market rally and an overall more “risk-on” equity markets tone.” That was certainly the outcome, as the Thursday CPI report showed June shelter costs rose just 0.2% from May to June (this component of CPI has not been lower than 0.4% in any other month of 2024).

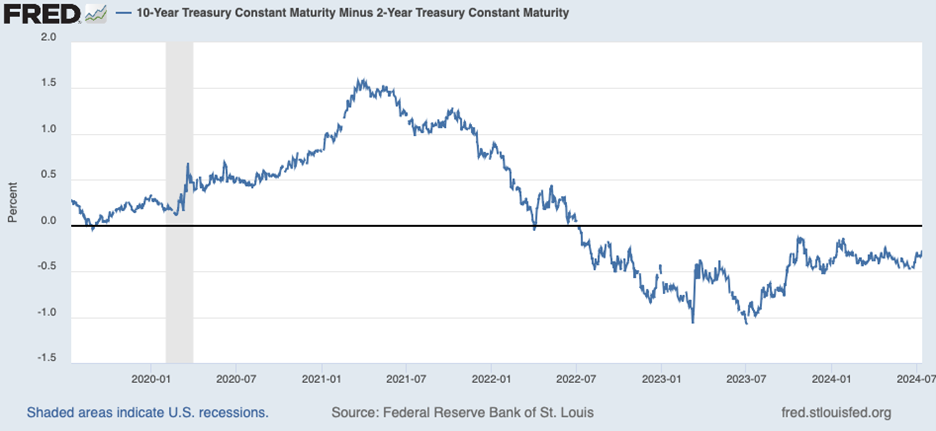

The “risk-on” equity markets tone was palpable. Advancing issues outnumbered declining issues by a factor of more than 4 to 1, small caps gained more than 5%, mid-caps gained over 4%, and the S&P 500 increased 0.9%. The Magnificent Mega Cap Tech stocks inched up 0.2% but shed no tears for them as the Nasdaq Composite is just fractionally below its record high and has surged 22.6% in 2024. The dollar retreated less than 1%, while gold prices advanced a similar percentage. The bond market rallied as well following the tame inflation reading, with the yield on the 10-year Treasury falling 8 basis points to 4.19%, its lowest level since the end of March. The 10-2 spread inversion narrowed 3 basis points to 0.27% (shown below). This inversion, which is oft cited as a precursor to a recession has now persisted for over 2 years. We think the likely explanation for this anomaly is that the Fed has simply kept rates higher than necessary for a long time, as the 2-year Treasury rate is heavily influenced by the Fed Funds rate, while the 10-year is largely dictated by the market.

The jobs market is showing obvious signs of cooling, and the inflation rate has been running at an annual rate of approximately 1% over the last three months, leading us to believe that multiple rate cuts are in order. If we are right, small caps and dividend-paying stocks should enjoy more weeks like the one we just celebrated.

Speaking of celebrating, the Cubs seem to have come back to life!

This Week

Earnings season will kick into gear with 45 S&P 500 companies reporting second-quarter results. The consensus calls for composite growth of 9.3% on 4.8% revenue growth. That growth is critical to justify that forward P/E multiples of 21x on the S&P 500, although weak earnings from consumer spending-related companies and financials would likely boost the case for Fed interest rate cuts. So far this earnings season, company reports have been decidedly mixed, with diversified consumer discretionary product company Helen of Troy (HELE) suggesting the consumer is stretched, which was echoed by major banks like JP Morgan (JPM), Citigroup (C) and Wells Fargo (WFC) seeing elevated credit costs, while AI-related infrastructure player Corning (GLW) raised sales guidance due to demand trends for fiber optic cable.

Retail Sales data for June will be released on Tuesday, with expectations that spending declined 0.1% month over month.

We will continue to refrain from commenting on the domestic and international state of political upheaval unless we identify any investment implications.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.