Last Week

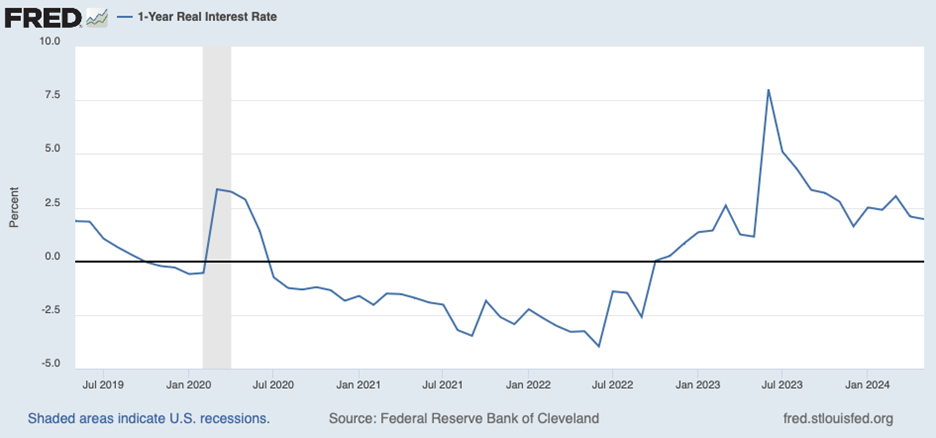

On the surface, the stock market rally continued with the S&P 500 fractionally higher to cap on a five-week win streak, its longest such run since early February. However, peeling back the onion skin reveals weakness across all equities industry sectors and market caps from small caps to blue chips, with the notable exception of mega-cap Technology darlings (think Nvidia). Declining issues more than doubled advancing issues, the Dow Jones fell 2.3%, the S&P Small and MidCap Indexes were both down 1.3%, while the Nasdaq Composite gained 1.4%. The strength in the Tech sector was fueled by terrific earnings from Nvidia (NVDA), which emboldened momentum investors to jump on the fast-moving AI train. The weakness in everything else can be attributed to the renewed hawkish Fedspeak combined (oddly) with mounting evidence of a slowing economy. The FOMC minutes released on Wednesday reinforced the “higher for longer” narrative, with Chairman Powell and other Fed officials at various podiums during the week continuing to lament that the restrictively high-interest rate policy (we consider positive real interest rates shown in the graph below – when short term rates exceed inflation – as restrictive) had not demonstrated the intended impact on slowing the economy. Meanwhile, that slowness in the economy was evident from the earnings reports from major retailers Target (TGT) and Lowe’s (LOW), as well as in the University of Michigan Consumer Sentiment Survey.

The bond market was quiet, with the 10-year Treasury inching up 5 basis points to 4.47%. The dollar was slightly higher, while crude oil and gold both weakened modestly.

On the surface, beneath the surface, from any angle, it was a terrible week for Chicago sports fans, with the Cubs and Sox combining to lose 11 straight games. We are also saddened by the passing of basketball legend Bill Walton over the weekend. Although not a Chicagoan, The Big-Red-Head was one of our all-time favorites with incredible positive energy.

This Week

The markets were closed on Monday in observance of the Memorial Day holiday.

The Conference Board’s monthly survey, due later today, is expected to show a modest decline in consumer confidence, but the most significant economic release will be the personal consumption expenditures price index for April on Friday. The consensus estimate is for a 2.7% year-over-year increase, the lowest level in three years, but still above the Fed’s stated target of 2%. Unless there is a bigger drop in that data, one can expect the Fed hawks to be in flight, with Minneapolis Federal Reserve Bank President Neel Kashkari continuing to highlight the possibility of another rate hike if necessary.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.