Last Week

The “lady who is sure all that glitters is gold” and invests only in gold, was the sole happy camper on Wall Street, as the market posted its worst weekly performance since October. While gold historically has not been the most effective inflation hedge over the long-term, where the best long-term solution has been high-quality equities, gold has certainly attracted investors during times of systemic dysfunction like the financial crisis in 2008 and 2009, as well as during periods of geopolitical turmoil such as the recent escalation in the Middle East.

The equity markets sell-off was triggered by a hotter-than-anticipated consumer price index (CPI) report published on Wednesday. Geopolitical tensions also rattled investors, and cautionary comments about the economy from JPMorgan CEO Jamie Dimon on Friday generated another leg down for stocks. The damage was widespread, with the S&P 500 sliding 1.6% and the Nasdaq Composite losing 0.5%. The Russell 2000 fared the worst, declining 2.9%, as small caps continue to be the most levered group to expectations of Federal Reserve rate cuts, and the recent economic data has muted those expectations. Declining issues overwhelmed advancing issues by more than 5-1. Every equity sector finished in the red, with Telecommunications, Financials, Basic Materials, and Health Care all down more than 3%. The bond market was also under pressure, with yields increasing through the curve. The 10-year rate finished up 12 basis points to 4.5%, having touched its highest rate since November at 4.59% on Thursday.

The first quarter earnings season got off to a slow start, with JP Morgan’s results and Jamie Dimon’s comments dominating the narrative. The results for the quarter were quite good, with revenues and net income exceeding expectations. On the other hand, the guidance for net interest margins and expenses for the rest of the year disappointed investors. Moreover, Mr. Dimon once again highlighted his concerns about the risk of a significant economic downturn, stating that “Many economic indicators continue to be favorable”, nevertheless, “looking ahead, we remain alert to a number of significant uncertain forces.” Topping the list of concerns were the “unsettling” global landscape, including “terrible wars and violence” and “persistent inflationary pressures, which may likely continue.” Another headwind facing the economy, according to Mr. Dimon, is the Federal Reserve’s tight monetary policy with efforts to reduce its balance sheet and maintain high short-term interest rates. We greatly respect Mr. Dimon, but it should be noted that his forecasts have tended to be cautionary, including his warning about an impending “economic hurricane” in June 2022.

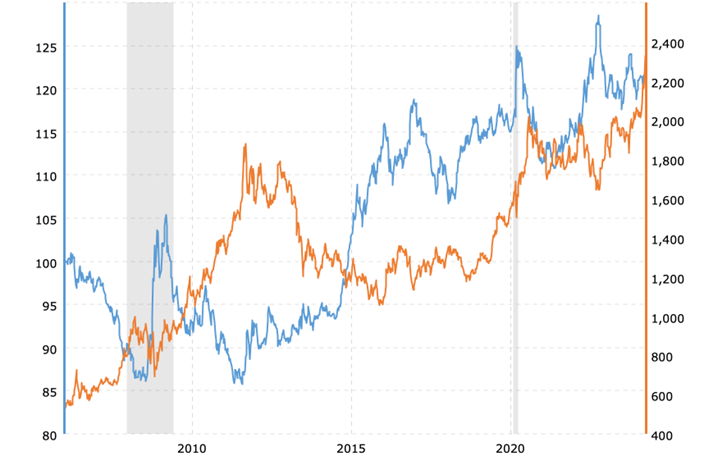

The dollar moved 1.4% higher, perhaps suggesting that foreign investors view our financial assets more favorably, with the steady and growing U.S. economy and short-term rates 2% higher than our inflation rate. Gold closed at a new record high of $2,356 an ounce, and since gold prices and the dollar are normally inversely correlated (see graph below), that certainly suggests the recent positive correlation in prices is more related to geopolitical violence and possible central bank purchases by China.

Gold Prices and U.S. Dollar Correlation – 10-Year Chart

The daily LBMA fix gold price with the daily closing price for the broad trade-weighted U.S. dollar index over the last 20 years. Source: macrotrends.com.

This Week

Earnings season will pick up speed, with more than 40 S&P 500 companies reporting results for the first quarter, including Netflix, Johnson & Johnson, Proctor and Gamble, UnitedHealth Group, and Bank of America.

The economic calendar includes the March retail sales report on Monday and a reading on U.S. industrial production on Tuesday. Housing starts and existing home sales data will also be on the docket.

Geopolitics will also remain in focus following Iran’s attack on Israel over the weekend.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.