Unchanged and Uninspired

There was certainly a lack of consistent direction and movement magnitude across major indices last week. The indexes certainly had mixed results, with the Nasdaq Composite shedding -0.6%, the S&P 500 rising 0.7%, and the Russell 2000 gaining 1.5%. The Dow Jones Industrial Average was the top performing index thanks to its Energy and Financial sector constituents, extending its winning streak to 10 days. Beaten-down bank shares soared and high-flying, possibly overbought, tech stocks sputtered. As small-cap oriented, value investors, we enjoyed seeing the Russell’s strong performance, likely in anticipation of possibly less-hawkish Fed comments accompanying the July interest rate decision due out this coming week.

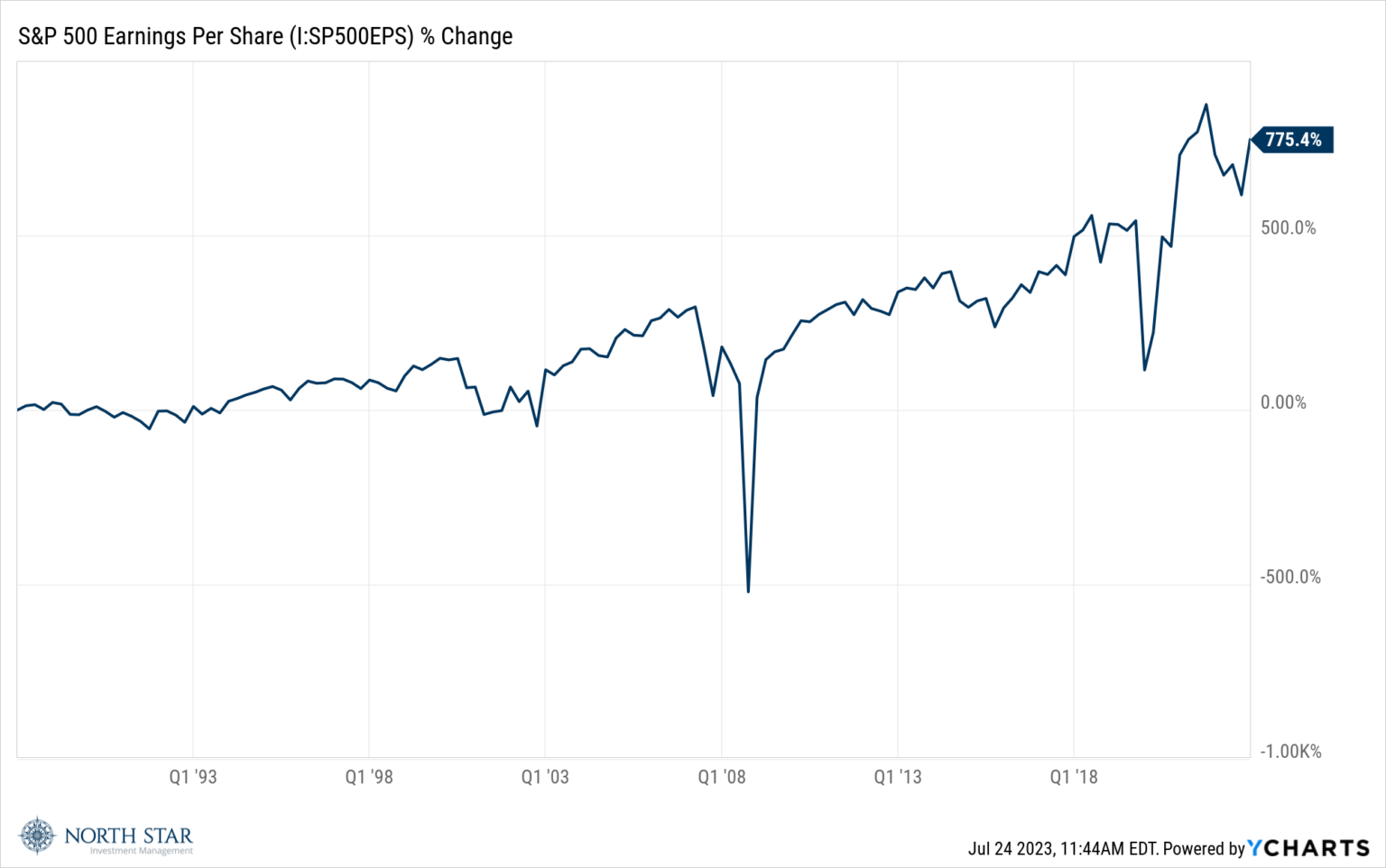

Overall earnings season is off to an uninspiring start, with about 18% of companies having reported results for the second quarter, and with the expected decline for the quarter worsening to 9% from 7.2% the week earlier. The forward guidance for aggregate S&P 500 companies is relatively unchanged, with the third quarter still being flat and growth expected to renew in the fourth quarter. Fortunately, the market looks forward to the stream of future profits, rather than simply applying a multiple on the most recent earnings, and the nature of capitalism has generated tremendous long-term growth in corporate earnings, despite occasional downturns.

The bond market was quiet, with the yield on the 10-year Treasury remaining around 3.83%, which only feels high because of the prolonged period of almost fifteen years of artificially low rates managed by monetary policy following the 2008-2009 financial crisis. Additionally, as we have mentioned in previous commentaries, stocks are not historically viewed as expensive when the earnings yield (the inverse of the P/E multiple) is higher than the 10-year Treasury rate, as is currently the case.

The Dollar bounced off its recent low, Crude Oil extended its recent advance, while Gold remained steady. Gold prices tend to perform inversely to dollar strength and dollar weakness in the short run, and therefore are similarly sensitive to longer-term interest rate trends projected by central banks. This is logical given that the carrying costs of any material, including gold, rise when interest rates rise and decline when interest rates decline.

Gimme Shelter

Earnings season kicks into full gear, with 166 S&P 500 companies reporting results for the second quarter, including Alphabet, Microsoft, and Meta Platforms.

On Wednesday, the FOMC will announce its monetary policy decision, and will raise the federal funds rate to a range of 5.25% to 5.5% according to all 106 economists polled by Reuters. A majority of those polled insist that will be the last increase of the current tightening cycle. Given this overwhelming consensus, any variance from this expectation will likely elicit a strong reaction in the equity markets.

On Friday, the BEA reports the Fed’s favorite inflation gauge, the core personal consumption expenditures price index, for June. Economists expect that number to cool to a 4.2% year-over-year rise from 4.6% in May. The bond market is certainly suggesting a more subdued economic and inflation future, as shown below in the chart of the U.S. Treasury 10-Year Yield Minus the 2-Year Yield; the spread remains close to a five-year wide, suggesting investors prefer to lock up money for 10 years at an annual yield below that available for locking up money for just 2 years.

Recently, the Fed has suggested that it is also considering a modified core PCE, adjusted to exclude shelter price trends, as shelter tends to be less liquid and therefore pricing changes significantly lags other goods and services. Such an adjustment by the Fed makes sense considering that in the U.S., just 14,000 homes sales are completed each day in comparison to almost 45,000 car sales per day, 4,500,000 airline tickets and more than 3,000,000 hotel rooms rented each night. Clearly, real-time changes in permanent shelter pricing are less available than for other big-ticket items.

On the Chicago sports scene, the Cubs and White Sox will be playing a couple games against each other early in the week.