An Economy Off Life-Support

After much reflection we have come up with the novel concept that good news is actually good news. On Friday, the Labor Department reported that the U.S. economy added 528,000 jobs in July, more than twice as high as expected, and the unemployment rate ticked down to 3.5%, matching the lowest level since the late 1960s. We think this report offers solid evidence that the economy is off life support and can absorb a return to “normal” monetary policy, since the increase in rates from near zero to around 2% apparently did not motivate companies to stop hiring and start firing. Treasury yields moved higher and the ursine recessionistas (aka the “good news is bad news” bears) argued that the Federal Reserve would continue its aggressive interest rate hikes to cool the economy and dampen inflation. Yes, rates are going higher, but in the words of Bon Jovi:

Woah, we’re half way there

Woah, livin’ on a prayer

In other words, we believe (pray?) that as the year progresses the economy will cool off, but still be healthy with the forecasted 3.5% short term rates. The “prayer” part comes from the hope that the there are no more surges in the pandemic and the geopolitical turmoil.

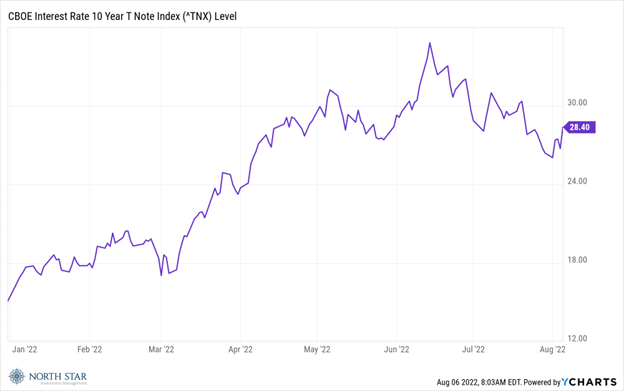

Whereas the yield on the 10-year Treasury did jump 20 basis points to 2.84% following the strong jobs report, it still represents a historically low level, and is essentially the same rate as four months ago.

Meanwhile, corporate earnings continued to exceed expectations, without the feared dire forward looking guidance cuts. Following the solid reports, and with 87% of companies now having reported second quarter results, the growth rate for the second quarter is 6.7% today, compared to an earnings growth rate of 5.8% last week and an earnings growth rate expectation of 4.0% at the end of the second quarter (June 30). Revenue growth has been much stronger at 13.6%, but margins have been squeezed by the rising input costs. Estimates for earnings growth in the back half the of the year remain around 6%.

It was a “risk on” week in the stock market, with most of the gains coming on Wednesday without a specific catalyst, although sharply declining energy prices and a muted response from China following House Speaker Nancy Pelosi visit to Taiwan made have contributed to the positive sentiment. The S&P posted a 0.4% gain, while the Nasdaq jumped 2.2%, and the Russell 2000 advanced 1.9%. Crude oil declined almost 10% during the week to finish at under $90 a barrel, and the Energy sector was the worst performer sliding 6.4%.

Winding Down

Earnings season will wind down, with just 23 S&P companies reporting results, including The Walt Disney Co (DIS) on Wednesday.

On the economic calendar, the CPI report on Wednesday and the University of Michigan Consumer Sentiment Survey on Friday are of particular interest. Economists forecast an 8.7% year-over-year rise in CPI for July, which would only represent a 0.2% increase from June. Consumer Sentiment for August is expected to have modestly improved from its recent record lows. Consumers who enjoy driving to Wingstop should be feeling much better with gas prices having declined for over 50 straight days, and an 18.8% decrease in bone-in chicken wings prices from a year ago.

Stocks on the Move

Whereas we recorded more advancing than declining stocks last week, the biggest movers were on the downside.

-20.1% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. Last week, Orion announced a FQ1 loss of $(0.09) that missed consensus estimates by $0.08 and revenue of $17.9M, down 49.0% y/y and missed consensus estimates by $6.9M. The Company attributed the poor performance during the quarter to supply chain challenges and major customers continuing to push back projects. OESX also announced a CEO transition with Mike Altschaefl retiring in November and Michael Jenkins, EVP and COO, assuming the role.

-11.1% Alico Inc (ALCO) primarily operates two divisions: Alico Citrus, one of the nation’s largest citrus producers, and Land Management, which includes leasing and related support operations. Last week, Alico announced a FQ3 non-GAAP loss of $(0.21) which missed estimates by $0.27 and revenue of $25.94M (-25.6% y/y) which missed estimates by $2.96M. The Company also revised its FY2022 guidance down due to the freeze of the Valencia crop that hit in late January. Additionally, certain ranch land sale transactions were pushed out to FY2023.

-18.6% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. Last week, RCKY posted Q2 non-GAAP earnings of $0.34 per share versus $0.99 in the prior year period. Revenue, on the other hand, of $162M was up 23.1% y/y and beat estimates by $16.28M. The company continues to see integration issues of the brands acquired from Honeywell, as well as increased outbound freight costs.

-24.1% Great Lakes Dredge & Dock Corporation (GLDD) offers marine services. The Company deepens and maintains waterways, shipping channels, ports, creates and maintains beaches, excavates harbors, builds docks and piers, and restores aquatic and wetland habitats. Last week, GLDD announced a second quarter GAAP loss of $(0.06) per share and revenue of $149.4M, which missed estimates by $0.26 and $34.35M, respectively. CEO and President Lasse Petterson said the quarter saw short-term supply chain delays and inflationary pressures, as well as unfavorable weather and site conditions that negatively impacted production and margins.

+22.3% Allied Motion Technologies Inc (AMOT) designs, manufactures, and sells motion control products into applications that serve various industry sectors. The Company supplies precision motion control components that incorporated into a number of end products, including high-definition printers, barcode scanners, surgical tools, robotic systems, wheelchairs, and weapon systems. Last week, AMOT announced Q2 non-GAAP earnings of $0.36 and revenue of $122.7M. The industrial market demand remains strong, and the Company is benefiting from steps it took to offer new solutions, as well as successful acquisitions it has made over the last few quarters.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.