Last Week:

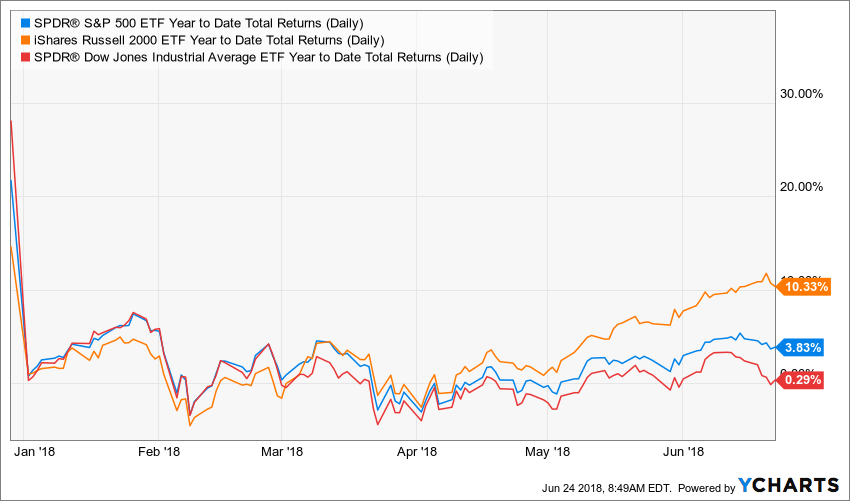

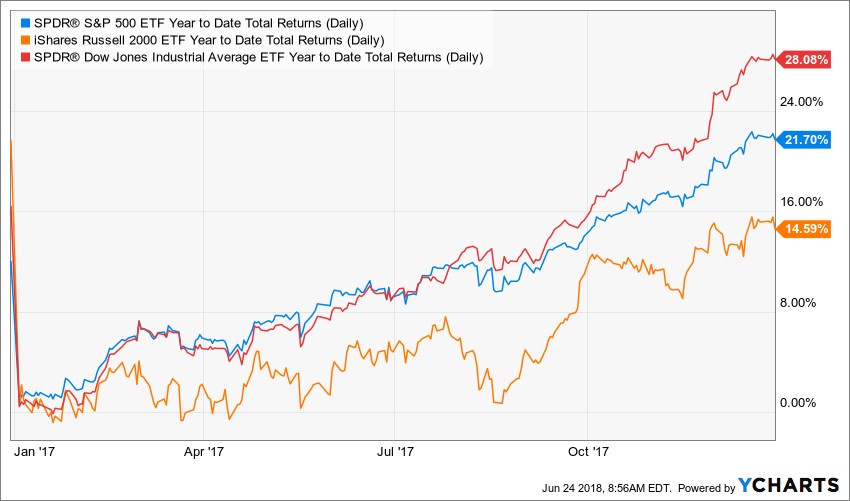

Resilient? But wait, you might be thinking, didn’t the market decline last week? Indeed, the S&P 500 did lose 0.89% and the DJIA 2.72%, while the Russell 2000 managed to post a fractional gain. Given the escalation in trade tensions, I think those results show tremendous resiliency. By way of comparison, the Shanghai Composite Index fell 4.4% for the week, and is now down 13% this year. Rather than dumping equities, investors (traders?) appear to be continuing to rotate into small cap stocks, with the Russell 2000 now up 10.33% YTD, essentially catching up from the underperformance in 2017.

If you put 2017 and the first half of 2018 together, all three indices are up around 25%. Small cap companies as a group have much lower percentage of their revenues generated internationally, so the strong dollar and trade barriers are less problematic for them. Additionally, the profitable small cap companies tend to pay the maximum corporate tax rate, so they will be primary beneficiaries of the lower rates in 2018. We are encouraged that the narrative has expanded beyond small caps as an index (the Russell 2000), to which small cap companies will benefit, or at least not suffer, from the recent developments. On the other hand, the upcoming earnings season will be tempered by cautionary language about the going forward impact of these trade frictions.

The yield on the Ten-Year Treasury dropped 2 basis points to 2.90%. Economists focused on yield curve shape analysis and tend to focus on the difference between the Ten-Year U.S. Treasury Yield and the and Two-Year U.S. Treasury Yield and are increasingly citing the narrowest spread (at 34 basis points) since 2017. The narrow current spread compares to a historic multi-decade average of approximately 150 basis points (excluding the extreme years of the Nixon administration), according to QVM Group. An inverted yield curve has been a good predictor of an oncoming recession.

This Week:

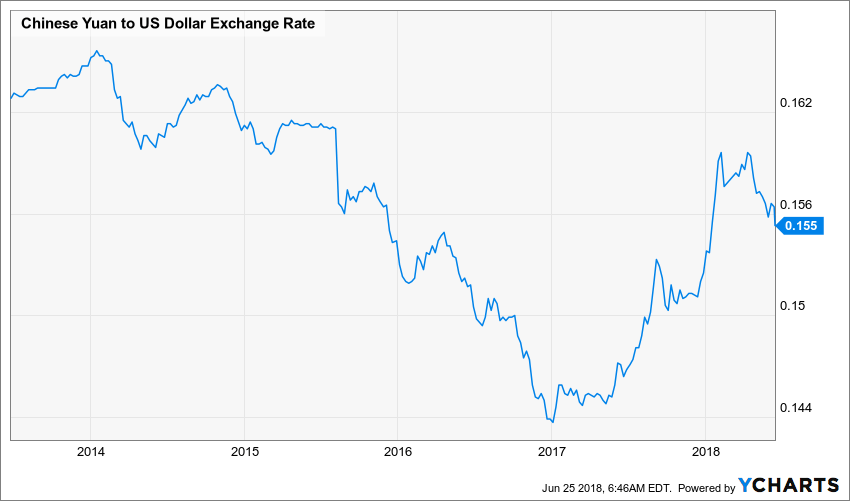

Trade talk will continue to dominate the headlines, as the US is set to impose tariffs on $34 Billion of Chinese imports on July 6th. China provided stimulus to its economy over the weekend by cutting rates for certain banks, in preparation for the economic fallout of extended trade tensions. The Yuan will be in focus, as depreciating the currency would be a viable tactic to combat the higher costs of the tariffs. It’s worth pointing out that prior to the outbreak of this trade war rhetoric, the Yuan had appreciated significantly, which was leveling the playing field for goods produced in the US.

Stocks on the Move:

American Software, Inc. (AMSWA) +17.7%: Total revenues for the quarter ended April 30, 2018 were $29.4 million, an increase of 12% over the comparable period last year. EBITDA decreased by 8% to $4.2 million for the quarter ended April 30, 2018 compared to $4.6 million for the same period last year. The overall financial condition of the Company remains strong, with cash and investments of approximately $87.8 million and no debt as of April 30, 2018. “We are pleased with our fourth quarter fiscal year 2018 results which reflect our investments in the innovative software and services needed to power the digital supply chain and help our customers reach new levels of productivity. Digitization drives a new wave of supply chain productivity which is more intelligent, responsive, scalable and collaborative,” said Allan Dow, president of American Software. “Our momentum continues towards SaaS subscriptions as the preferred customer engagement method which is highlighted by our 108% increase in Cloud Services Annual Contract Value (ACV).” American Software develops enterprise management and supply chain related software and services. Its solutions consist of global sourcing, workflow management, customer service applications, and ERP solutions. AMSWA is a 4.3% holding in The North Star Dividend Fund and a 3.9% holding in The North Star Micro Cap Fund.

There didn’t seem to be any news to account for the other companies experiencing high percentage changes last week.

Village Super Market, Inc. (VLGEA) +9.9% and Ingles Markets, Inc. (IMKTA) +7.5%: Ingles Markets is a supermarket chain in the Southeast United States. It operates grocery retail stores offering grocery, meat and dairy products, produce, frozen foods and other perishables, and non-food products. Village Super Market operates a chain of ShopRite supermarkets in New Jersey, eastern Pennsylvania and Maryland. It is engaged in retail sale of food and nonfood products. The increase in the share prices of VLGEA and IMKTA may have been in sympathy with strength in shares of Kroger (KR) which reported earnings that improved sentiment. VLGEA is a 0.7% holding in The North Star Dividend Fund and IMKTA is a 1.1% holding in The North Star Dividend Fund. Ingles Market bonds are a 2.6% holding in The North Star Bond Fund.

Arc Document Solutions, Inc. (ARC) -11.2%: ARC Document Solutions is engaged in providing document management solutions to businesses, including non-residential segment of architecture, engineering & construction industry. Its offerings include; onsite, digital, color & traditional reprography. ARC is a 1.1% holding in The North Star Micro Cap Fund.

NAPCO Security Technologies, Inc. (NSSC) +20.3%: NAPCO is engaged in manufacturing of security products, encompassing access control systems, door security products, intrusion and fire alarm systems and video surveillance products. NSSC is a 1.4% holding in The North Star Micro Cap Fund.