Last Week

The stock market continued to rock and roll, setting record highs on Monday, Tuesday, and Thursday. All the large cap indices finished in the green with the S&P 500 and Dow Jones Industrials both gaining + 0.6%, the Nasdaq Composite adding +1%. It was a mixed bag for small caps, with the Russell 2000 slipping – 0.1% and the S&P Small Cap 600 gaining a similar amount. Whereas most investors focus on the Russell 2000 for small caps, the S&P 600 uses a profitability filter resulting in a higher quality basket of small caps that has traditionally outperformed.

The Goldilocks economic scenario remained in evidence, as the August PCE came in at an annual rate of just 2.2% and the final reading of the University of Michigan’s consumer-sentiment index in September rose to 70.1 the highest level in five months (Michigan Alums, including some select North Star team members, might have their confidence bolstered by the Wolverines surprising victory in the Big House versus the USC Trojans). There is still room for improvement as the index still stands well below the 101 level reached in February 2020.

Chinese equities and China-focused U.S. companies also got a bump during the week as a fresh set of stimulus measures took effect in the world’s second-largest economy. The MSCI China index surged over 20% for the week but remains down 25% over the last three years.

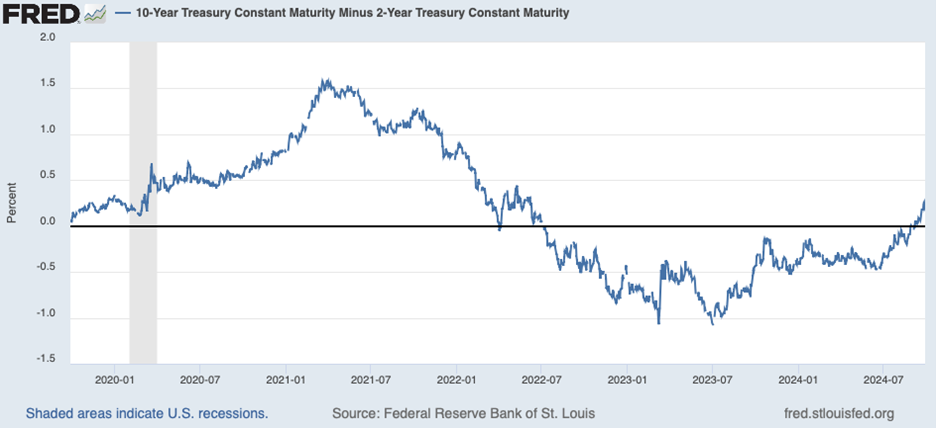

The U.S. Dollar continued its recent trend of drifting lower while the price of gold set a record high again. Crude Oil slumped over 5% which led to a modest decline in Oil & Gas equities, which was one of only three sectors that were in the red (Health Care and Financials were the other two). All was quiet on the bond market front, with the yield on the 10-year Treasury inching up 2 basis points to 3.75%. Since the Fed announced its 50-basis point interest rate reduction on September 18, the spread between the 10-year U.S. Treasury yield and the 2-year U.S. Treasury yield has more than doubled from 0.09 to 0.20 on Friday, September 27. This oft-cited barometer of economic prospects is now soundly above the negative (“inversion”) readings that persisted from mid-2022 until very recently. While the deep inversion in 2023 (see graph below) suggested market participants were concerned that Fed policy was too restrictive, risking recession, the current positive level suggests market participants are less concerned a recession may be looming.

On the Chicago Sports Scene, the Bears evened their season record at 2-2 by beating the L.A. Rams at Soldier Field. We are excited about the prospects for a winning season, although we recognize that the strength of the Vikings, Packers, and Lions, will make winning the division challenging.

This Week

The health of the U.S. labor market will be in focus with the release of the September jobs report on Friday. Economists expect 140K job additions for the month and for the unemployment rate to keep steady at 4.2%. The Job Openings and Labor Turnover Survey (JOLTS) is also worth attention as it might provide a more forward-looking read on the labor market. The consensus calls for 7.7 million job openings, which is well below the peak of 12.2 million reached in March 2022.

Earnings reports from Nike (NKE), Carnival (CCL), Levi Strauss (LEVI) and Constellation Brands (STZ) will provide further color on the U.S. consumer.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.