Pick-up in Sentiment

I can see clearly now the rain is gone

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

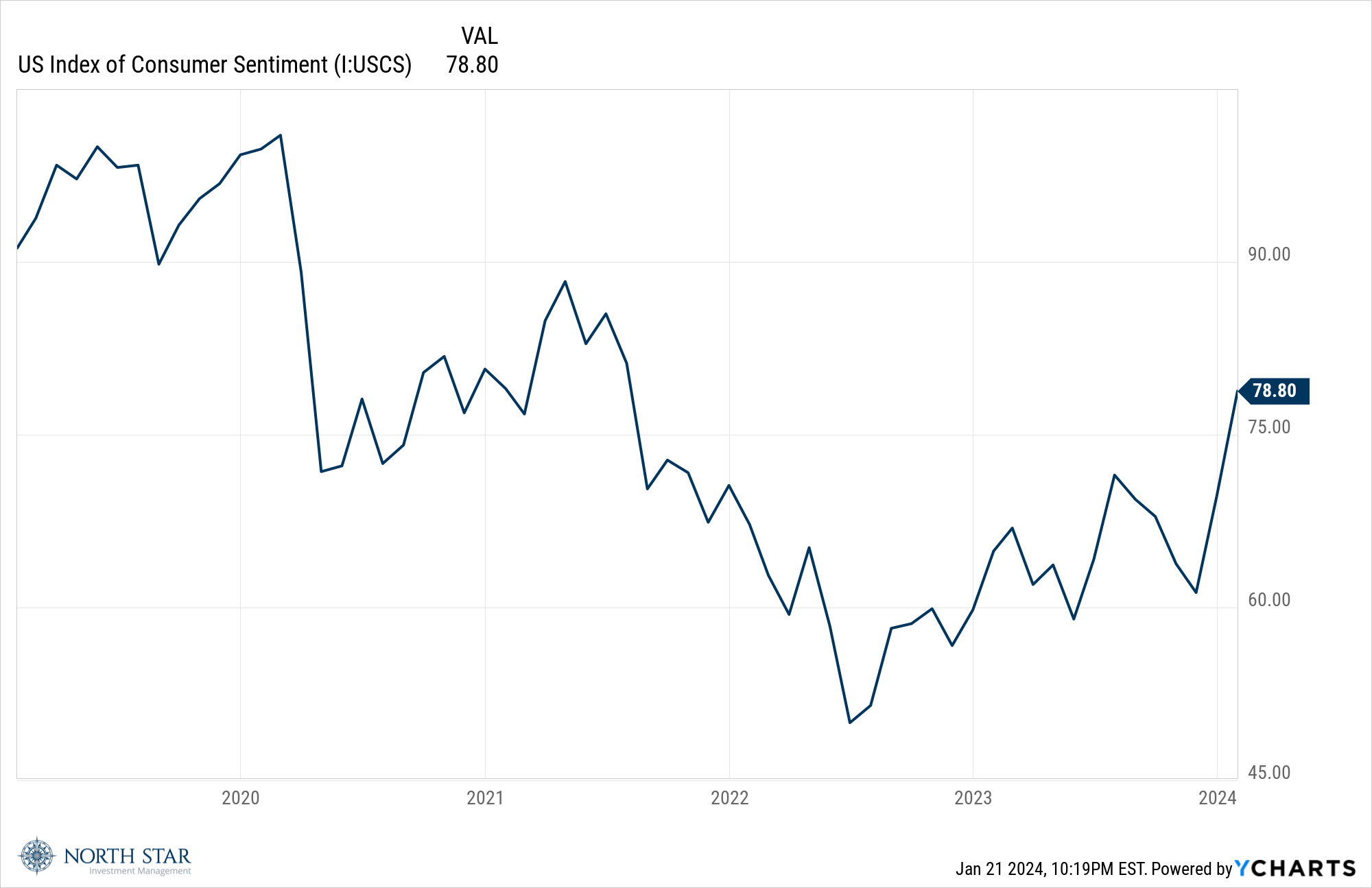

For the past 18 months, the dissonance of a healthy economy and extremely depressed consumer sentiment has baffled us at North Star. While the economy delivered solid growth, with full employment and rapidly moderating inflationary pressures, consumer sentiment remained mired at sub-pandemic levels, anchored near the depths of the 2008-2009 financial crisis. On Friday, the University of Michigan Consumer Sentiment Index showed that blinding dark clouds of pessimism finally lifted!

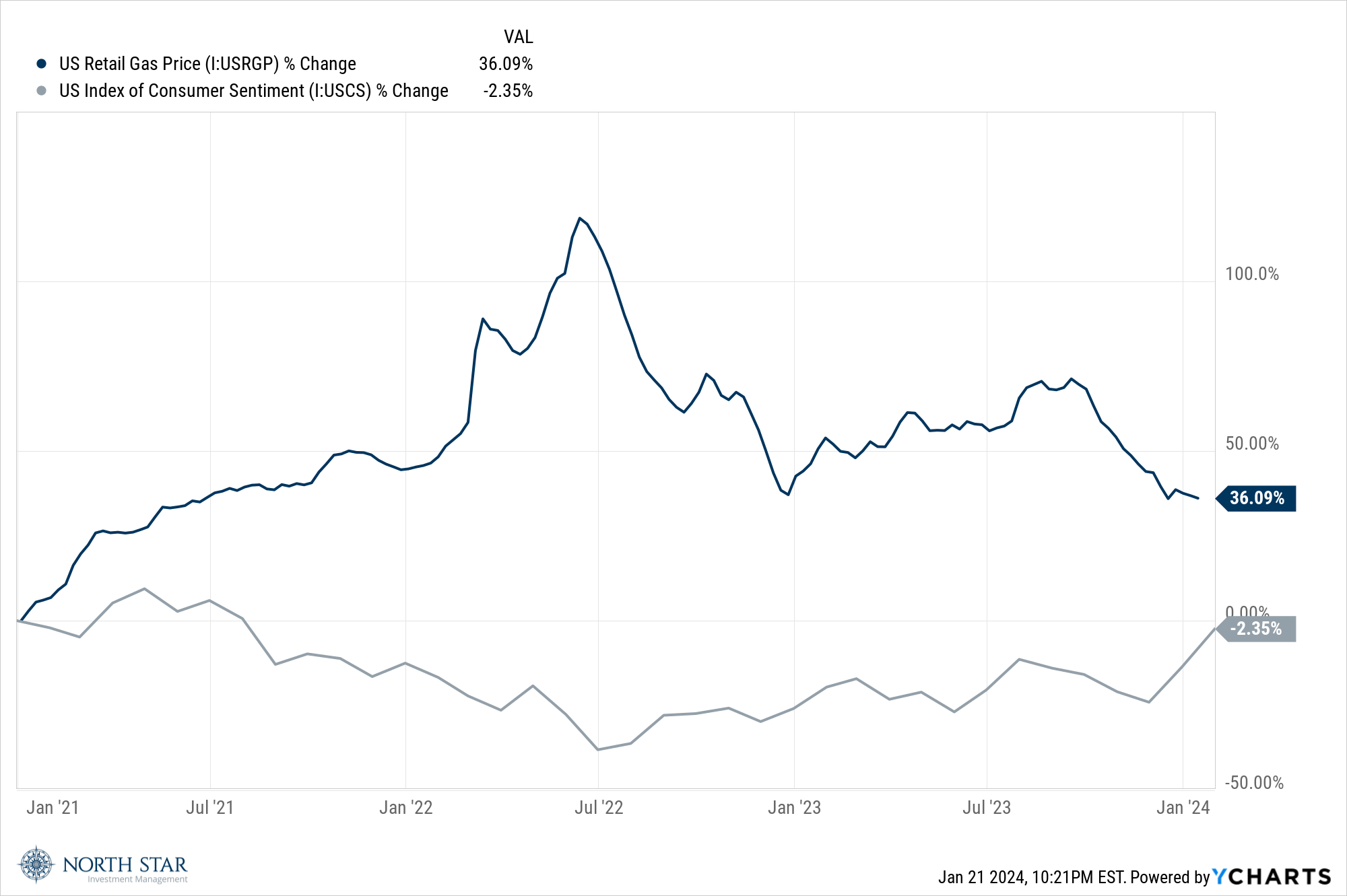

Consumer sentiment leaped 13% in the first half of January from December, the Michigan survey said, after a sharp rise the prior month. Consumer sentiment has now surged 29% since November, the most significant two-month increase since 1991; the pick up in sentiment was broad-based, spanning consumers of different ages, incomes, education, and geography. Over the years, we have noted the negative correlation between gas prices at the pump and consumer sentiment. The frequent trips to the gas station to fill up the family car or work truck seems to have a disproportionate effect on average American’s view on inflation and overall view of the economy. As such, the recent steep decline at the local station might help explain the improved sentiment. Adding gas prices to the chart above illustrates that relationship.

Got the Groove Back

Earnings season should be in focus, with 75 S&P 500 companies reporting results. At North Star, we will play the Beatles classic “Don’t Let Me Down” before each release.

On the economic calendar, the key releases include the preliminary Q4 GDP reading in the U.S. and the global flash PMIs. Expectations call for continued slow and steady growth.

On Friday, the BEA will release the personal consumption expenditures price index for December. Economists forecast a 2.6% year-over-year increase, with the core PCE, which excludes food and energy prices, showing a 3% increase. Those readings would be the lowest since March 2021, and the rate for the last six months would be even lower, actually below the 2% Fed target rate.

The Bank of Japan, the European Central Bank, and the Bank of Canada are all scheduled to make monetary policy statements and interest rate decisions. In the U.S., Federal Reserve members will be on a jawboning blackout period of no public talks ahead of the next FOMC meeting on January 30-31.

The University of Chicago Maroons got their groove back, beating the Brandeis Judges 72-55, and then played a terrific game, albeit losing to the #13 ranked NYU Violets. The Maroons versus the Violets is always a colorful contest.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.