Slow Ride

The simple yet classic lyrics from Foghat’s “Slow Ride” tune encapsulate the lukewarm economic news last week that buoyed equity markets: (1) job openings at the lowest level since March 2021; (2) a decline in consumer confidence; (3) tame inflation data; and (4) moderating job growth. As we mentioned last week, “Weaker economic news seems like good news lately, so a weaker-than-forecast jobs number would likely buoy equity markets.” In that regard, the marginally weaker economic news flow did not disappoint, and stocks rallied accordingly. Bulls certainly seemed to take the economic data as a signal the Fed can now “Take it easy” on the hawkish rhetoric.

The S&P 500 registered its best weekly performance since mid-June, rising 2.5%, with the Technology sector leading the charge with a 4.4% advance and small caps jumping 3.6%. Advancing issues overwhelmed declining issues by almost 4-1, while only the Utility sector suffered a decline. The bond market also embraced the slow ride as the yield on the 10-year Treasury slipped seven basis points, while the 2-year rate dropped 18 basis points, resulting in a flattening of the recession-predicting yield curve inversion.

So-so Employment.

Two employment-related reports last week may help subdue the Fed’s consistent hawkish rhetoric. First, on Tuesday, the preliminary monthly Job Openings and Labor Turnover Survey (JOLTS) report for July of 8.8 million was a decline of 338,000 from 9.2 million in June, 9.6 million in May, and 10.3 million in April. This data set has little-to-no historical seasonality, so we see the recent monthly declines as quite dovish. Second, on Friday, the monthly employment report for August met expectations for approximately 180,000 new jobs created, well below the average of 271,000 for the trailing twelve months. Importantly for Fed forecasts and future commentary, the prior month job creation revisions were negative again. Just as the May and June reports were revised lower in August, the June and July reports were revised lower in the August report on Friday. So, both jobs-related reports certainly suggest U.S. employers are starting to accept Foghat’s advice to “Take it easy.”

So-so Consumer.

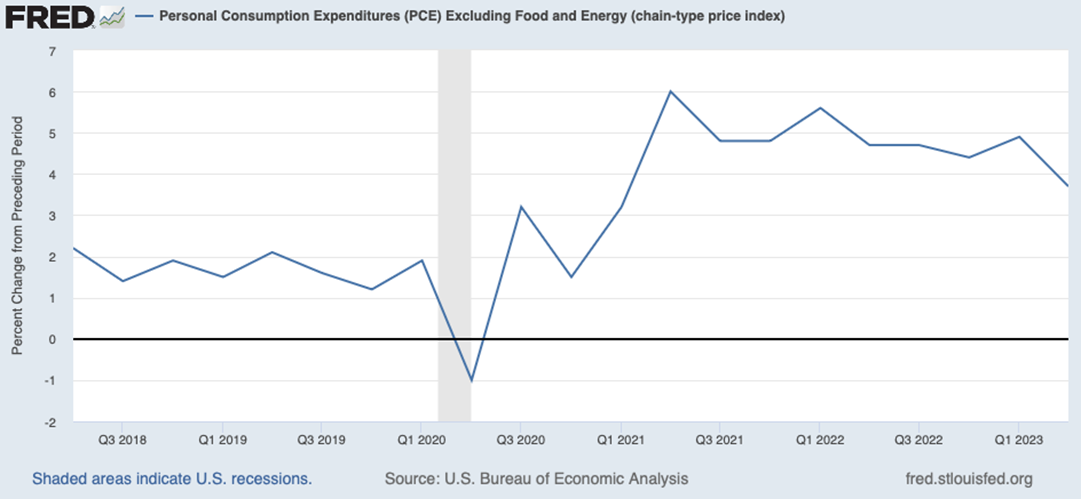

Both consumer-related reports last week were consistent with the dovish employment-related reports. On Tuesday, the Conference Board Confidence Index declined to 106.1 from a downwardly revised 114.0 in July. Similarly, the inflation data reported on Thursday suggested cooling price trends; the PCE Index, excluding Food and Energy, declined to 3.7% in 2Q23 from 4.9% in 1Q23 (see chart below). This was the first reading below 4% since 1Q21 and well below the peak of 6.0% in 2Q21. There is at least one Fed official who agrees with our dovish take on recent inflation trends: “Excluding housing costs, which have eased but flow through to official inflation gauges with a lag, 12-month core inflation using the consumer price index was 2.6% in July, (Federal Reserve Bank of Atlanta President) Bostic said. “Given the lagging nature of rental prices in the calculation of [official inflation gauges], underlying inflation may well be close to our target already,” he said. Perhaps households and businesses are starting to take a “slow ride” approach to spending, which is a possible trend the Federal Reserve would certainly welcome.

Winding Down

The U.S. financial markets were closed in observance of the Labor Day holiday on Monday. The economic calendar is quiet during the holiday-shortened week, with releases on factory orders, initial jobless claims, and consumer credit that are unlikely to move the markets. Monetary policy will remain in focus, with several FOMC speakers making the rounds and the Fed’s Beige Book for September scheduled to be released. Those speeches might be positive catalysts, given the recent data that we discussed earlier in the commentary.

The energy market could be volatile after details are released on Russia’s new OPEC+ supply cut agreement. Crude prices have been on a roller coaster ride between $70 and $85 per barrel in 2023 but surged last week to the top end of that range. We have a few investments with positive earnings leverage to rising energy prices and would be happy to discuss them.

The Cubs and the Brewers both remain hot. It looks like an exciting September is on deck in the NL Central. The Bears kick off the regular season at Soldier Field next Sunday versus the Green Bay Packers. Bear Down!

Stocks on the Move

The following stocks had share price movements of +/- 15% for the month…

+25% LSI Industries Inc (LYTS) posted another strong quarter on August 17th with fourth-quarter 2023 earnings per share of $0.30 and revenue of $123.6M, beating estimates by $0.11 and $4.95M, respectively. Project quotes remain at an elevated level, the supply chain is improving, and customer activity remains healthy.

+19% Hamilton Beach Brands Holding Co (HBB) indicated improving business conditions during its second-quarter earnings call on August 3rd. Although revenue will be flat year-over-year for FY23, the Company is “pleased” with incremental placements and promotions for the holiday selling season and expects gains in consumer market share.

+15% Flexsteel Inc (FLXS) reported a fourth-quarter beat with earnings per share of $0.36 and revenue of $105.82M, exceeding consensus estimates by $0.01 and $2.81M, respectively. Despite many macroeconomic headwinds this past fiscal year, the Company focused on initiatives designed to deliver profitable growth, as seen in the almost $4M increase in operating income, as well as the 580-bps improvement in gross margin for FY23.

+15% Gulfport Energy Corp (GPOR) was upgraded to Outperform/Overweight rankings by KeyBanc and J.P. Morgan at the beginning of August following its strong second-quarter results and increased guidance for FY23.

-16% Superior Group of Companies Inc (SGC) delivered second-quarter results on August 7th that showed the Company is nearing the light at the end of the tunnel. The Branded Products segment is seeing strength, the Office Gurus or call centers segment is remaining steady, and the over-inventoried Healthcare Apparel segment is finally improving. In an extraordinarily cautious move, the Company lowered its full-year 2023 outlook to $550M-$560M in sales vs. $579M in 2022 and $0.45-$0.55 per share vs. $0.62 in 2022.

-18% Century Casinos Inc (CNTY) reported a mixed quarter with a $(0.06) per share loss for Q2 2023 and record revenue of $136.8M. This is a transitional period for the Company as it navigates taking over two properties in new gaming jurisdictions while facing inflationary cost pressures from wage inflation.

-19% Denny’s Corp (DENN) retreated during the month after delivering disappointing results on August 1st. Earnings per share of $0.14 and revenue of $116.9M missed estimates by $0.02 and $3.74M, respectively. The pricing environment in fast-casual dining is very competitive as restaurants aim to capture more share through deals.

-17% Sphere Entertainment Co (SPHR) released its first earnings report on August 22nd since the company spun off from Madison Square Garden Entertainment Corp (MSGE). SPHR generated $129.1M in revenue and a $70.3M operating loss for the fourth quarter. The Sphere venue remains on track to open on September 29th, 2023.

-21% PetMed Express Inc (PETS) reported a disappointing quarter on July 31st, mostly related to acquisition costs, with an aftershock that carried into August. Revenue increased 11.5% year-over-year for the first quarter of fiscal year 2024, and the auto-ship/PetPlus membership now makes up almost 49% of revenues

-33% Accuray Inc (ARAY) reported a very noisy quarter on August 9th with an earnings miss related to a $2 million write-off from a customer bankruptcy.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.