Last Week:

If the proof of the pudding is really in the eating, then the current economic policy recipe seems to be valid as the US numbers remained terrific with very strong manufacturing and non-manufacturing ISMs, and jobless claims this week were 203,000, the lowest level since December of 1969. As we mature, however, we come to realize that there is more than just the pleasure of eating a tasty dessert as one must also consider the aftertaste and digestion. As such, the big news in the jobs report was a hint that the long-awaited acceleration in wages is taking place; average hourly earnings increased 0.4% last month, which took the year-ago figure up to an expansion high of 2.9%. Keep in mind that the February selloff was triggered by a similar jump in wages. The yield on the Ten-Year Treasury had a minor breakout to the upside to finish up 9 basis points to 2.94%, and the odds of a Fed rate hike later this month is now almost 100%. Additionally, the rest of the world continued to exhibit softness, as Germany’s July figures including factory orders, exports, and industrial profits, Taiwan’s exports, and China’s foreign exchange flows all fell short. Year-to-date, the World equity markets ex US is down 7.95% in dollar terms, with China down 13.05%. The S&P 500 declined 1.03% for the week and is up 8.06% year-to date.

It was a tough week for the momentum stocks, with the Nasdaq Composite losing 2.55%, although still positive 14.47% year-to-date. The selling began on Wednesday as Twitter’s Jack Dorsey and Facebook’s Sheryl Sandberg testified on Capitol Hill and worsened towards the end of the week. Tesla’s Elon Musk didn’t help matters by appearing to puff on a marijuana cigarette during a strange podcast Thursday night, leading to a 6% decline in TSLA’s share price on Friday. My back of the envelope calculation suggest that was about a $3 billion hit (double entendre intended).

It was also a tough weekend for some sports fans. The Stanford Cardinal made the USC Trojans look like they are indeed in a rebuilding mode. What a terrible end to the U.S. Open Tennis Tournament! I fell asleep with the Chicago Bears up 17 in the fourth quarter and woke up to see they lost. Hopefully Detroit Lion wide receiver Marvin Jones won’t get more than 10 fantasy points tonight in their game against the N.Y. Jets, so at least I can salvage the weekend with a win my fantasy football league.

Happy New Year to our Jewish clients and friends!

This Week:

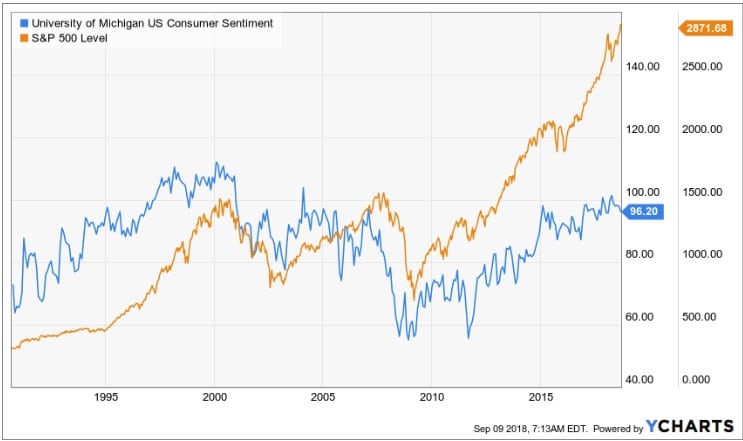

The economic calendar is busy, with August CPI, PPI, Retail Sales, and Industrial Production all expected to show a healthy economy. On Friday, The University of Michigan (Gottlieb) will release its Consumer Sentiment survey for September. Economists forecast an unchanged reading from August’s 96.2%, which is down about 5% from the reading in March. It is worth noting that the performance of the stock market has diverged from these readings over the last 6 months, since historically the stock market and consumer sentiment readings have been very tightly correlated (see charts below).

Stocks on the Move:

We have approximately 110 equity holdings across the 3 North Star Funds. Recently I have been highlighting only the companies where there was a significant (around 10%) price movement the previous week, rather than summarizing all the news releases (which got lengthy and perhaps uninteresting). In the past week only one company posted a large price change, so as an experiment, I’m going to go into greater detail. Any feedback as to whether this more in-depth write-up has value would be appreciated. Unfortunately, it was a company that experienced a sharp price decline.

American Software, Inc. (AMSWA) -24.2%: Comparing the first quarter of fiscal 2019 to the same period last year, total revenues increased 2% to $27.4 million compared to $26.9 million in the same quarter last year. License fees decreased 58% to $1.7 million compared to $4 million for the quarter, while subscription fees increased 96% to $3.2 million compared to $1.6 million last year due to the increase in customer interest to deploy on the SaaS cloud environment. Operating expenses increased more rapidly, with gross R&D expenses equal to 17% of total revenues for the current period compared to 14% in the same period last year, primarily due to increased headcount from their Halo acquisition in the third quarter of fiscal 2018. As a percentage of revenues, sales and marketing expenses were 19% of revenues for the current and prior year period. G&A expenses were 15% of total revenues for the current period compared to 13% for the same period prior year, primarily due to expenses related to the Halo acquisition and audit-related fees. Adjusted net income was $2.2 million or adjusted earnings per diluted share of $0.07 for the first quarter compared to net income of $3.1 million or adjusted earnings diluted share of $0.10 for the same period last year. Looking at the balance sheet, the Company’s cash position and long-term investments remain strong with approximately $87.4 million, or approximately $2.85/share, at the end of July 31, 2018. H. Allan Dow, President, commented “We continued the transition to the Software-as-a-Service engagement model, which was evidenced by the 96% growth in our subscription fees over the same period last year.” He added “We’re very pleased that we have continued to achieve our financial objectives during this transition that is to continue growing revenue, which grew by 2% and to remain profitable, which we achieved $2.4 million in EBITDA in the quarter.” American Software develops enterprise management and supply chain related software and services. Its solutions consist of global sourcing, workflow management, customer service applications, and ERP solutions.

These results were only slightly lower than the one published estimate from an analyst. So why the dramatic share decline? It’s worth noting that the decline essentially was equal to the increase in the share price since their last earnings report in June, so perhaps the question should be expanded to include why did the shares advance 20% in the previous 2 months, and what changed? First, the one analyst who follows the Company downgraded the shares in front of the earnings report, noting that the share price had advanced past his $18 price target, and suggesting that the results were unlikely to move his estimates and price target higher. He was right, and in fact he lowered his price target to $17.50/share after the report. With no analysts recommending purchase, and a tough week for tech stocks in general, the momentum pendulum swung against the Company leading to the sharp decline. We still believe that AMSWA is a fine company, now trading at a reasonable discount to our expected value calculation, and currently sporting a 3.23% dividend yield (all future dividends must be authorized by the board). It does seem as if the environment has gotten a bit tougher in the short-run noting the change in the language from the June conference call, when the Company’s President concluded, “we’re very pleased with the overall results from our fourth quarter, and the total year results exceeded our expectations. We’re continuing to closely monitor the global economic conditions and our team’s progress to continue our growth. Our pipeline remains strong and our services organization is working near capacity. So we remain optimistic about the potential ahead for the 2019 fiscal year.” In the most recent call, the language was a bit more reserved, “In summary, we’re pleased with the overall results from our first quarter as we work for continued success, while closely monitoring the global economic conditions so that we are prepared to assist our customers with managing through today’s uncertain trade challenges.” This tougher environment, as their customers contend with the confusion created by the potential disruptions of the global supply chain, could be a positive for AMSWA in the long-run, as Mr. Dow points out “As the trade wars pick up, there is a potential where they have to shift their production and sourcing requirements and where they may be able to bring product from, and we actually provide some great solutions to help them navigate their way through that. So we’re trying to reinforce that our solutions are probably the right thing to be investing in right now as opposed to may be any other places they could place their bets and invest their money.” AMSWA is a 3.5% holding in the North Star Dividend Fund and a 3.2% holding in the North Star Micro Cap Fund.