Markets:

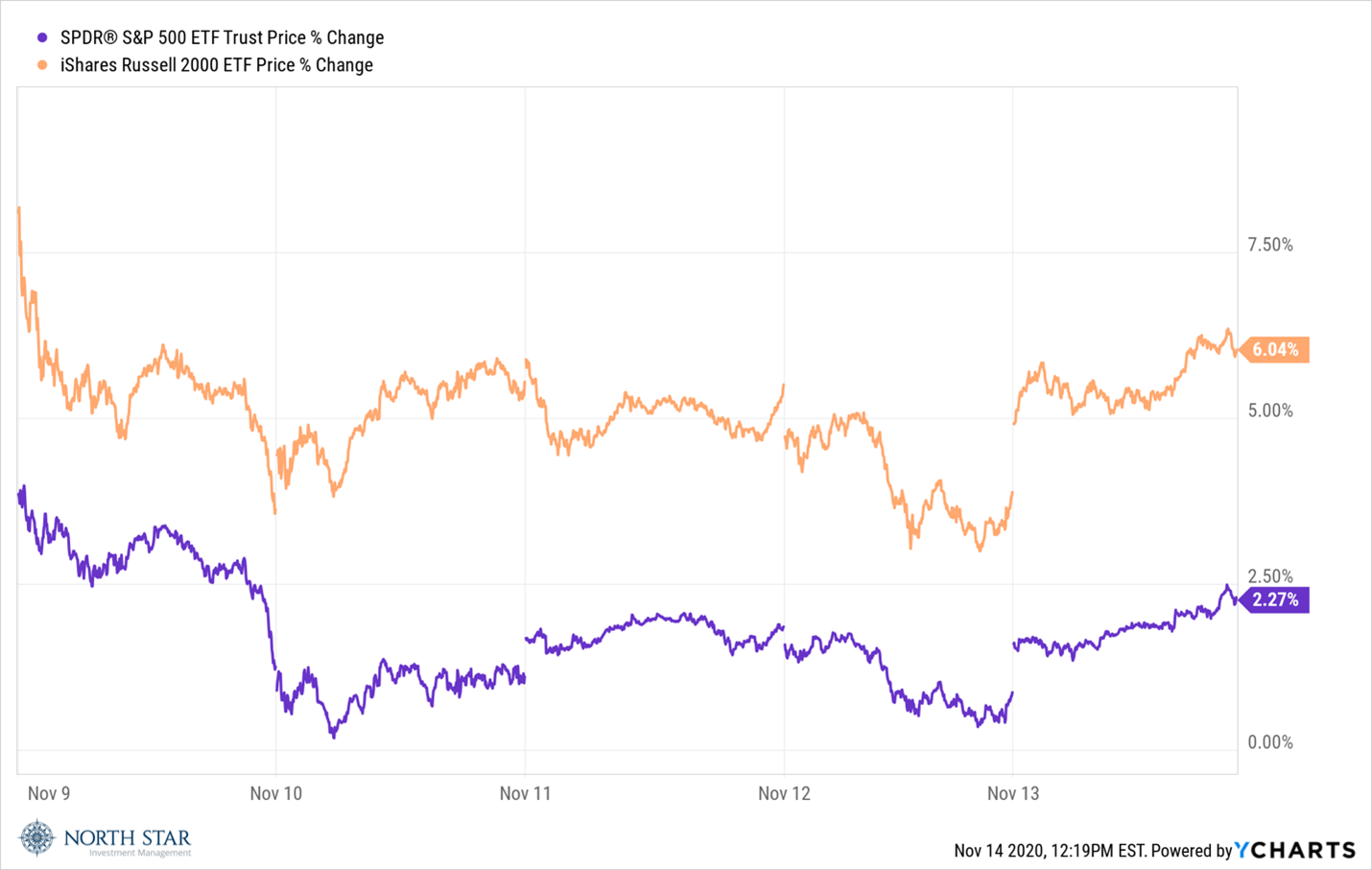

Monday morning Pfizer announced that early data from its coronavirus vaccine shows it is more than 90% effective with no serious side effects. The study should be concluded by the end of the month with the likelihood of emergency FDA approval to follow post haste. On that news the market surged on the opening and spent the rest of the week trying to hold those gains, with the S&P 500 finishing the week +2.27% and the Russell 2000 rocketed 6.04%! The first ten trading days of November have seen the biggest gains of the start of any month since January 1987.

Small caps have had a terrific run recently; in fact, the cover story in Barron’s in which we were quoted (These 5 Small Stocks Could Benefit From an Economic Rebound By Daren Fonda, November 16, 2020) focused on the timeliness of small cap stocks.

There was also dramatic movement in the yield on the Ten-Year Treasury, which almost touched 1% on Monday, and finished the week at 0.89% up 7 basis points. These levels are the highest yields since the pandemic shut down the economy in March.

Stimulus:

No progress. Don’t hold your breath; the bipartisan cooperation that led to the CARES Act in March has vanished in the political winds of Washington.

Economy:

There was no whiff of inflation. The CPI was unchanged in October as the cost of staples such as groceries and electricity rose slightly, but those increases were offset by price declines for gasoline, car insurance, clothing, home furnishings and medical care. Producer prices also remained muted with a modest 0.3% increase in October.

There was a crack in the armor of the U.S. consumer as the preliminary reading for the University of Michigan’s consumer sentiment index in November was 77.0, down from 81.8 in October. Economists surveyed by Dow Jones were expecting 81.5. “Consumer sentiment fell in early November as consumers judged future economic prospects less favorably, while their assessments of current economic conditions remained largely unchanged,” Richard Curtin, chief economist for the Survey of Consumers, said in a release. At North Star we especially monitor the future economic prospects as a potential canary in the coal mine.

Earnings:

Third quarter earnings beat estimates by a record percentage, but still are on track for a year-over-year decline of -7.5% on a -1.7% revenue decline. Looking at future quarters, analysts predict a year-over-year decline in earnings in the fourth quarter (-10.9%) of 2020. However, they also project a return to earnings growth starting in Q1 2021 (14.5%).

COVID-19:

The U.S. has reported a continued escalation of daily new cases with no flattening of the curve in sight. Daily deaths have consistently registered over 1000, the highest level since April. The situation is particularly dire in our home state of Illinois, where Gov. Pritzker threatened that if things don’t improve across the state, another lockdown may be the only option left, and said that the state has reached “crisis” level. It seems likely that a vaccine will be available in limited quantities in December, with a ramp up in distribution over the following six months. There is concern that people will ignore the warnings over the Thanksgiving holiday which could lead to a surge in cases and deaths.

This Week:

Once again, the market will start the week on a high note following the news that Moderna’s COVID-19 vaccine was 94.5% effective in its recently completed trial.

Economic reports to watch include updates on retail sales, existing home sales and jobless claims. Earnings season will finish with a trickle of reports, although it will be a busy one for retail earnings, and investors may be in for good news if strong October trends hold through the end of the year. COVID-19 news will be the dominant narrative, with the post-election noise grabbing headlines but probably not moving markets.

Stocks on the Move:

Our Financial Sector holdings were very strong on the rotation into value trade, without any company specific news:

Bank of America Corp (BAC) +11.1%, is a 2.10% holding in the North Star Opportunity Fund and BAC/PRE is a 1.46% holding in the North Star Bond Fund.

Bar Harbor Bankshares (BHB) +13.0%, is a 2.02% holding in the North Star Dividend Fund and a 1.01% holding in the North Star Micro Cap Fund.

Bank of Hawaii Corp (BOH) +21.5%, is a 2.44% holding in the North Star Dividend Fund.

First Hawaiian Inc (FHB) +22.9%, is a 2.15% holding in the North Star Dividend Fund.

Old National Bancorp (ONB) + 15.5%, is a 1.06% holding in the North Star Dividend Fund.

First Busey Corp (BUSE) +13.1%, is a 1.11% holding in the North Star Micro Cap Fund.

JPMorgan Chase & Co (JPM) +10.6%, is a 1.18% holding in the North Star Opportunity Fund and a 1.78% holding in the North Star Bond Fund.

Wintrust Financial Corp (WTFC) +10.3%, is a 1.93% holding in the North Star Dividend Fund.

Winners who had significant news last week:

+15.5% Trinity Industries, Inc. (TRN) manufactures transportation, construction, and industrial products. The Company’s products include tank and freight railcars, inland hopper and tank barges, highway guardrail and safety products, and ready-mix products. Last week, the company announced its plans to enter into a joint venture – called RailPulse — with Norfolk Southern, GATX Corporation, Genesee & Wyoming and Watco to accelerate rail modal transformation. TRN is a 1.05% holding in the North Star Dividend Fund.

+10.3% Cisco Systems Inc. (CSCO) designs, manufactures, and sells Internet Protocol (IP)-based networking and other products related to the communications and information technology (IT) industry and provide services associated with these products and their use. The Company announced plans to acquire Banzai cloud, their second cloud-based purchase in two months. CSCO is a 1.10% holding in the North Star Opportunity Fund.

+13.0% Raytheon Technologies Corporation (RTX) operates as an aircraft manufacturing company. The Company focuses on technology offerings and engineering systems teams to deliver innovative solutions. Last week, Raytheon announced a $350 million acquisition of Blue Canyon Technologies. RTX is a 1.56% holding in the North Star Opportunity Fund.

+19.8% Acco Brands Corporation (ACCO) manufactures office products. The Company produces staplers, daily scheduling diaries, shredders, laminating equipment, presentation boards, and air purifiers. The company announced on Tuesday it will be acquiring PowerA, a provider of third-party video game accessories, for around $395 million. ACCO is a 2.90% holding in the North Star Dividend Fund.

+19.7% Crown Crafts, Inc. (CRWS) is a retailer company. The Company designs, markets, and provides home textile furnishings and accessories, toddler bedding, nursery and bath accessories, and juvenile specialty products. CRWS came out with fantastic Q2 earnings on Tuesday, noting revenue up 16.7% YoY and EPS of $0.24, which beat by $0.17. CRWS is a 3.98% holding in the North Star Dividend Fund and a 2.59% holding in the North Star Micro Cap Fund.

Other winners:

+ 14.6 % Graham Corporation (GHM) designs and builds vacuum and heat transfer equipment for process industries around the world. The company markets to chemical, petrochemical, petroleum refining, and electric power generating industries. GHM is a 1.01% holding in the North Star Dividend Fund.

+13.4% NorthWestern Corporation (NWE) provides electricity and natural gas in the Upper Midwest and Northwest. The Company serves customers in Montana, South Dakota, and Nebraska. NEW is a 1.07% holding in the North Star Dividend Fund.

+10.2% Northwest Natural Holding Company (NWN) builds and maintains natural gas distribution system, as well as invests in natural gas pipeline projects. Northwest Natural Holding serves residential, commercial, and industrial customers. NWN is a 1.83% holding in the North Star Dividend Fund.

+16.2% Steelcase Inc. (SCS) designs and manufactures products used to create high performance work environments. The Company offers products such as office furniture, furniture systems, interior architectural products, technology equipment, and seating. SCS is a 1.64% holding in the North Star Dividend Fund.

+10.8% Telephone and Data Systems, Inc. (TDS) is a diversified telecommunications company. The Company operates primarily in the cellular, local telephone, and personal communications service markets. TDS is a 2.51% holding in the North Star Dividend Fund.

+23.4% Blue Bird Corp (BLBD) designs and manufactures school buses. The Company provides alternative fuel applications through propane-powered and compressed natural gas-powered school buses. BLBD is a 1.61% holding in the North Star Micro Cap Fund.

+10.5% Boot Barn Holdings, Inc. (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other products. BOOT is a 3.69% holding in the North Star Micro Cap Fund.

+15.6% BG Staffing, Inc. (BGSF) provides workforce solutions. The Company recruits commercial and professional staff in information technology, accounting and finance, light industrial, and real estate fields. BGSF is a 2.04% holding in the North Star Dividend Fund and a 2.21% holding in the North Star Opportunity Fund.

+14.9% Denny’s Corporation (DENN) operates as a full-service family restaurant chain directly and through franchises. DENN is a 0.92% holding in the North Star Micro Cap Fund.

+22.3% SP Plus Corp (SP) provides vehicle parking solutions. The Company offers professional parking management, ground transportation, remote baggage check-in and handling, facility maintenance, security, event logistics, and other technology-driven mobility solutions. SP is a 3.45% holding in the North Star Micro Cap Fund.

+23.4% Superior Group of Companies Inc, (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. SGC is a 1.90% holding in the North Star Micro Cap Fund.

Two holdings that have been big 2020 winners were viewed as “stay at home” stocks and were under pressure:

-14.6% Turtle Beach Corp (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. HEAR is a 4.76% holding in the North Star Micro Cap Fund and a 1.70% holding in the North Star Opportunity Fund.

-19.6% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirror, engine, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other auto body parts. PRTS is a 5.28% holding in the North Star Micro Cap Fund and a 2.29% holding in the North Star Opportunity Fund.