Last Week

If you asked somebody how the weather was that day, the answer would depend on several factors, with their location being the most important variable. The same dynamic holds when people ask, “How was the market today?” The answer depends on the individual securities in their portfolio on any given day. (On any given Sunday, the Chicago Bears find interesting ways to lose football games. We digress). During the last few weeks, as the Nasdaq Composite has pushed to new record levels, the S&P Value Index (IVE) has fallen for ten straight days, and for those 10 days, there have been more declining than advancing issues. Indeed, while the Nasdaq closed the week +0.3%, the rest of the equity markets dipped, with the S&P 500 slipping 0.6% and the Russell 2000 sliding 3.0%. It was also a tough week for bond investors as the yield on the 10-year Treasury increased 25 basis points to 4.4%, near the high-end of its 2024 trading range.

Rather than fundamental analysis, animal spirits continued to set the trading tone. Bitcoin, the poster child for those animal spirits, surged over 5% to crack the $100k ceiling. We believe that rational investors will eventually prevail and that many speculators will suffer painful losses. This week’s Barron’s points out that a cryptocurrency called Fartcoin (pardon the vulgarity) now has a market cap of $564 million, which is greater than 38% of all publicly traded securities. That dynamic does not smell right to us.

The most significant economic data was the November inflation report, mostly unchanged at a 2.7% year-on-year increase. The inflation rate seems stuck at these levels, with increased risks of trending higher in 2025 if the incoming administration assesses tariffs and tax cuts. As such, inflation-protecting securities are becoming more attractive.

This Week

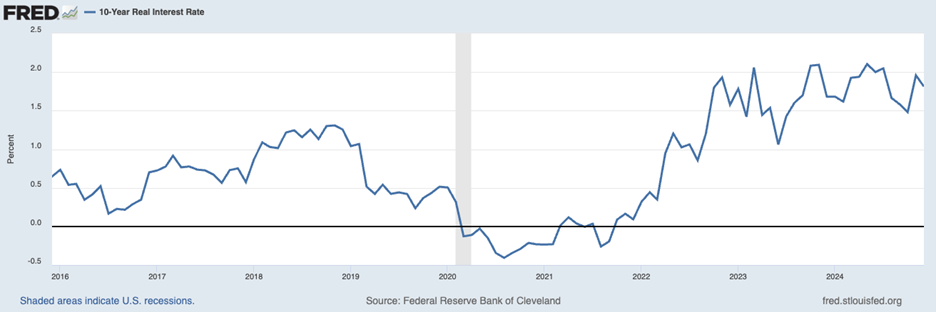

Monetary policy will be in focus, with the Federal Reserve grabbing the spotlight. The Fed’s final rate decision of the year will come on Wednesday, with near certainty that the Fed will deliver a quarter-point interest rate cut, despite that the U.S. Federal Reserve’s 4.58% effective federal funds rate is among the highest among the largest free market economies in the world. Last week, the European Central Bank (ECB) lowered its key rate by 25 basis points to 3.00%, the Bank of Canada lowered its benchmark lending rate by 50 basis points to 3.25%, and the Swiss National Bank also lowered its benchmark lending rate by 50 basis points to 0.50%. Additionally, China is engaging in very aggressive monetary policies as it is on the precipice of a recession. Finally, the United States’ 4.58% effective Fed Funds Rate is well above reported inflation in the United States, as shown in the below graph, which shows that since early 2023, the real interest rate has been trending at more than 1%, which represents a contractionary monetary policy.

On Tuesday, the Census Bureau will report November U.S. retail sales data. After the Fed decision, the focus will shift to Friday’s November personal income and outlays report, which includes the Fed’s favorite inflation gauge, the core personal consumption expenditures price index. That reading could sway investors’ expectations about the path of interest rate cuts in 2025.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.