Last Week:

In the words of the legendary rocker Bruce Springsteen, “You can’t forsake the ties that bind”. In today’s market those “TIEs” are Trade, Interest rates, and Earnings.

Trade continues to dominate the narrative, probably because President Trump is a master at controlling the story line. Global trade is a complicated issue, particularly as we have had a long period of globalization resulting in a supply chain web that is interwoven with the imports and exports of goods. The loss of manufacturing jobs in the U.S. over the last few decades can’t be decoupled from all the other elements of that globalization, but it can be used as a negotiating tactic and a political tool. Moreover, the argument that some of our trading partners have been “cheating” does have merit. On Wednesday, there was a feel-good moment on the trade front following the meeting between President Trump and European Union President Junker, as they agreed to de-escalate the tariff talk, with a “promise” by the E.U. to import more U.S. soybeans and liquified natural gas.

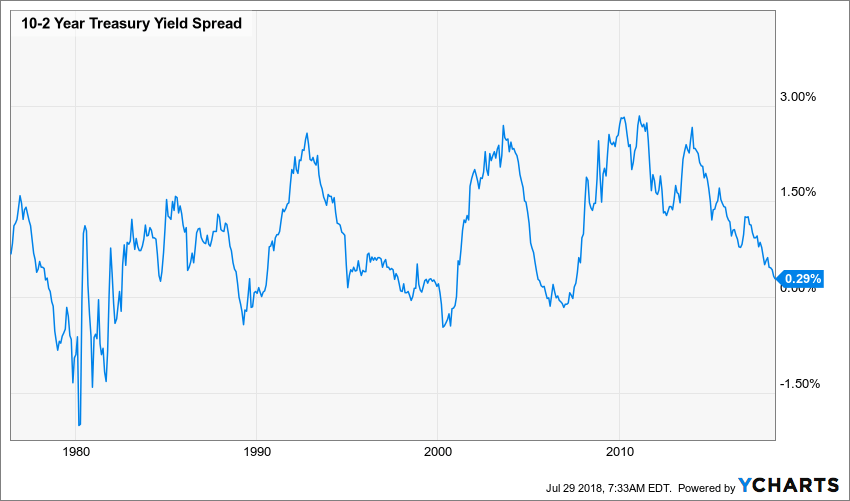

Interest rates remain a concern, especially the recessionary signal that a negative spread between the 10 and 2-year Treasuries would signal. That spread remained constant last week at a skimpy 29 basis points. Recessions do happen, and the chart below shows that the periods in the early 80’s, early 90s, 2001, and 2008 all were preceded by an inversion of that spread.

Earnings have been very strong, with a blended 21.3% growth on a 9.3% revenue increase. Some high-profile “misses” by Facebook, Netflix, Whirlpool, Intel, and Twitter, created another week of winners and losers that largely cancelled each other out, as the S&P 500 finished +0.61% but the Russell 2000 shed 1.97%, with most of that damage coming on Friday. Tariffs have been a hot topic on the conference calls, with 44% of the companies discussing tariffs, of which a little less than half see at least a modest negative impact.

This Week:

It will be another busy week of earnings reports, with 140 S&P 500 companies scheduled to report second quarter results. The Federal Reserve will announce its decision on interest rates on Wednesday, with near certainty that the committee will hold rates steady. A slew of other central banks will also be making policy decisions, most notably the Bank of Japan on Tuesday. The economic calendar is quite robust as well, with the highlight being Friday’s release of employment data from The Bureau of Labor Statistics. Economists expect another strong month of payroll growth, with around 190,000 new jobs and the unemployment rate ticking down to 3.9% in July. Traders will be paying special attention to wage growth for hints of inflationary pressures.

Stocks on the Move:

Acme United Corporation (ACU) +10.1%: The Company’s shares rallied, as investors seemed to get comfortable with the very strong guidance for the upcoming third quarter, despite somewhat tepid second quarter results. Acme United is a supplier of cutting, measuring, first aid and sharpening products to the school, home, office, hardware, sporting goods and industrial markets. ACU is a 2.1% holding in the North Star Dividend Fund and a 3% holding in the North Star Micro Cap Fund.

Advanced Micro Devices, Inc. (AMD) +14.8%: Revenue was $1.76 billion, up 53 percent year-over-year and 7 percent quarter-over-quarter. The year-over-year increase was driven by higher revenue in both the Computing and Graphics and Enterprise, Embedded and Semi-Custom business segments. The sequential increase was driven by higher revenue in the Enterprise, Embedded and Semi-Custom segment. Non-GAAP(1) net income was $156 million compared to a net loss of $7 million a year ago and net income of $121 million in the prior quarter. Non-GAAP diluted earnings per share was $0.14, compared to a loss per share of $0.01 a year ago and diluted earnings per share of $0.11 in the prior quarter. Advanced Micro Devices designs and produces microprocessors and low-power processor solutions for the computer, communications, and consumer electronics industries. AMD is a 4.5% holding in the North Star Opportunity Fund and AMD corporate bonds are a 2.8% holding in the North Star Bond Fund.

Heritage-Crystal Clean, Inc. (HCCI) +16.2%: Revenue for the second quarter was $100.3 million which represents a record high for a 12-week quarter and an increase of 16.1%, or $13.9 million, compared to the same quarter of 2017. Basic earnings per share was $0.26 in the second quarter of fiscal 2018 compared to basic earnings per share of $0.31 in the second quarter of fiscal 2017. Earnings during the second quarter of 2017 were favorably impacted by a settlement with the sellers of FCC Environmental of $3.6 million on a pre-tax basis and $0.11 per diluted share on an after-tax basis. Heritage-Crystal Clean provides parts cleaning, used oil re-refining and hazardous and non-hazardous waste services to small and mid-sized customers in both the manufacturing and vehicle service sectors. HCCI is a 1.4% holding in the North Star Micro Cap Fund.

PetMed Express. Inc. (PETS) -10.7%: Net sales for the quarter ended June 30, 2018 were $87.4 million, compared to $79.7 million for the quarter ended June 30, 2017, an increase of 10%.Net income was $12.6 million, or $0.62 diluted per share, for the quarter ended June 30, 2018, compared to net income of $9.3 million, or $0.45 diluted per share, for the quarter ended June 30, 2017, a 36% increase in net income. Additionally, the Company raised their quarterly dividend. PetMed Express is a nationwide pet pharmacy. The Company markets prescription and non-prescription pet medications and other health products for dogs, cats, and horses direct to the consumer. PETS is a 1.3% holding in the North Star Dividend Fund and a 0.5% holding in the North Star Opportunity Fund.

TRI Point Homes, Inc. (TPH) -13.5%: Net income available to common stockholders was $63.7 million, or $0.42 per diluted share, compared to $32.7 million, or $0.21 per diluted share in the year earlier period, but new orders fell 7% and the cancellation rate ticked up 1% in their second quarter. TRI Pointe Group is engaged in the design, construction and sale of single-family attached and detached homes. The company’s operations are organized in two principal businesses, including homebuilding and financial services. TPH is a 1.5% holding in the North Star Opportunity Fund.