Last Week:

Earnings season is underway with 26% of the companies in the S&P 500 having reported actual results for Q2 2020. The good news is that the percentage of companies reporting actual EPS above estimates (81%) is above the five-year average, with companies reporting earnings that are 11.4% above the estimates, which is also above the five-year average. The same holds true for revenues as the percentage of companies reporting actual sales above estimates (71%) is above the five-year average, with companies reporting sales that are 3.0% above estimates, which is also above the five-year average. The bad news is that even with that improvement, blended earnings are tracking for a -42.4% decline, with only the Utility sector reporting year-over-year growth. The rest of 2020 remains blurry with analysts predicting a (year-over-year) decline in earnings in the third quarter (-24.0%) and the fourth quarter (-12.3%) of 2020. Whereas there may be some vision into the third quarter, as we are a month into it already, the fourth quarter forecasts are really just guesstimates at this time with so many unknowns. In the U.S., COVID-19 new cases are surging to record numbers and deaths are topping 1000 per day again. The election is less than 100 days away, creating multiple levels of uncertainty. On a related note, the relationship between the two largest economies in the world, The U.S. and China, seems to be quickly deteriorating. Let’s not forget the fall of 2018 when the “trade war” sent stocks into a 20% tailspin.

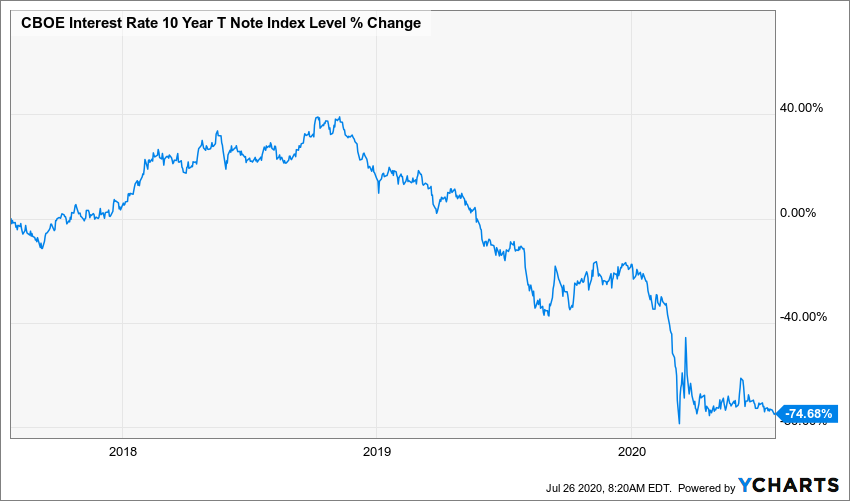

Recent weakness in the dollar and strength in gold reflects the growing concern over the future for the U.S. economy. During the past week, the dollar declined 1.6% and is now down 8.4% since late March, while gold gained almost 5% to close over $1900/ounce for the first time. Meanwhile the yield on the Ten-Year Treasury slipped 4 basis points to 0.59%. These extraordinarily low interest rates continue to reflect a high level of pessimism about the future, while at the same time providing the underpinning for elevated P/E levels on stocks. There lies the conundrum that all investors face; to buy stocks at elevated levels or suffer the slings and arrows of outrageously low interest rates? In either case, if one believes that the bond market is telling us anything then it would be rational to ratchet down one’s return expectations as the patient (U.S. economy) looks to be on life support:

This graph shows how the yield on the Ten-Year Treasury has collapsed over the last 20 months.

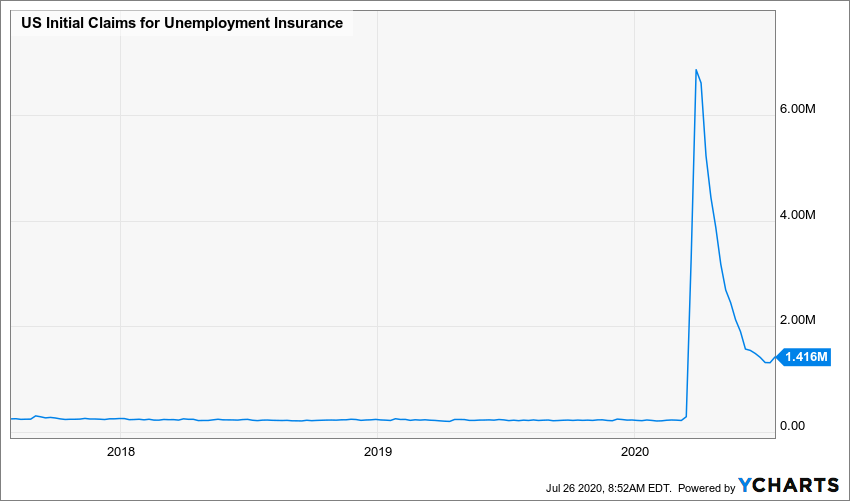

The recent economic data has shown strength in the housing market and minor upticks in the ISM data for the month of June, although the weekly initial claims for unemployment rose for the first time in almost 4 months and registered at over 1.4 million. By way of reference, the “normal” level before the pandemic was around 200,000 new weekly claims.

The stock market remained resilient, with the S&P 500 declining a modest -0.28%, with most of the weakness coming at the end of the week as the mega-cap tech stocks took a breather after driving the market close to record levels over the last few months. The Nasdaq actually surged early in the week before posting its first consecutive daily losses in 48 days on Thursday and Friday.

This Week:

All eyes will be on Congress as much of the helicopter money will be running out at the end of the month. Unlike in March when there was swift bipartisan support for a massive multi trillion-dollar spending appropriation, now there is a wide gap between the size and scope of the next package.

As has been the case for four long months, COVID-19 developments will continue to dominate the narrative. The market rallies on promising vaccine and therapeutic advances into the teeth of the stiff winds of the surge in cases and deaths.

It will be the busiest week of earnings season with 192 S&P 500 companies reporting results for the second quarter. As previously discussed, it will be the worst quarterly earnings since 2009, with the future remaining uncertain. So far about 50% of companies have provided forward guidance, which is up substantially from only 20% during the first quarter earnings season. This period of unprecedented dislocation creates tremendous dispersion between the COVID-19 winners and losers.

The economic calendar will be busy, with Consumer Confidence on Tuesday and the University of Michigan Sentiment Index on Friday perhaps of significance.

Stocks on the Move:

AMD + 26.1%: Advanced Micro Devices, Inc. designs and produces microprocessors for the computer and consumer electronics industries. Rival Intel said it was delaying the launch of its newest processor chip, providing a boost for AMD’s new Ryzen 4000 Series processors that are built via an advanced 7-nanometer manufacturing process, and are expected to help AMD compete effectively with Intel in the high-end gaming market, as well as the massive mainstream consumer PC market. AMD is a 3.19% holding in the North Star Opportunity Fund, AMD Corporate Bonds are a 2.52% holding in the North Star Bond Fund.

CNTY +10.8%: Century Casinos, Inc. is a casino entertainment company. Shares have traded in a wide range as the company attempts to reopen properties. CNTY is a 0.87% holding in the North Star Micro Cap Fund.

TACO +18%: Del Taco Restaurants, Inc. is the second largest Mexican American quick service restaurant chain by units in the United States. Second quarter results were better than expected with total revenue decreasing 13.9% to $104.6 million compared to $121.5 million in the fiscal second quarter 2019, and a net loss of $0.6 million, or $0.02 per diluted share, compared to net income of $2.1 million, or $0.06 per diluted share, last year. John D. Cappasola, Jr., President and Chief Executive Officer of Del Taco, commented, “Our restaurant teams, franchise partners and support staff are doing exceptional work supporting our people, serving our guests and strengthening our brand as we successfully navigate the business recovery phase of our strategy while preparing for brand acceleration. Despite the pandemic-induced headwind affecting our industry, our system-wide comparable restaurant sales continue to improve sequentially and are slightly positive thus far in the fiscal third quarter, led by our franchise base who is sustaining positive comparable restaurant sales across a broad 14 state geographic footprint.” TACO is a 2.19% holding in the North Star Micro Cap Fund.

Final Thought:

To quote Warren Buffet, “only when the tide goes out do you discover who has been swimming naked”. In 2020 the COVID-19 undertow has pulled the bathing suits off many companies who were not expecting such rough waters. Earnings season gives us an opportunity to take notice of those companies who seem likely to come to shore in good shape. My cautionary comments earlier are designed to encourage investment discipline at a time when great short-term challenges are present.