Last Week:

TKIF! (Thank Kudlow It’s Friday)

The market drifted through Thursday’s close, as investors slumbered through a mixed bag of economic reports and earnings releases, an escalation of unrest in Hong Kong, a clear message that interest rate policy is on hold during the congressional testimony by Fed Chair Jerome Powell, and the Trump impeachment inquiry. White House economic adviser Larry Kudlow sparked a nice rally in Friday’s trading by telling reporters in Washington that talks with China were nearing an agreement stating that “we are coming down to the short strokes” and are “in daily communication with them every single day.” I believe the “short strokes” refers to when you are approaching the green in golf, but my personal experience is that there can be a lot of strokes before the ball ends up in the cup. I hope Kudlow’s golf game is much better than mine.

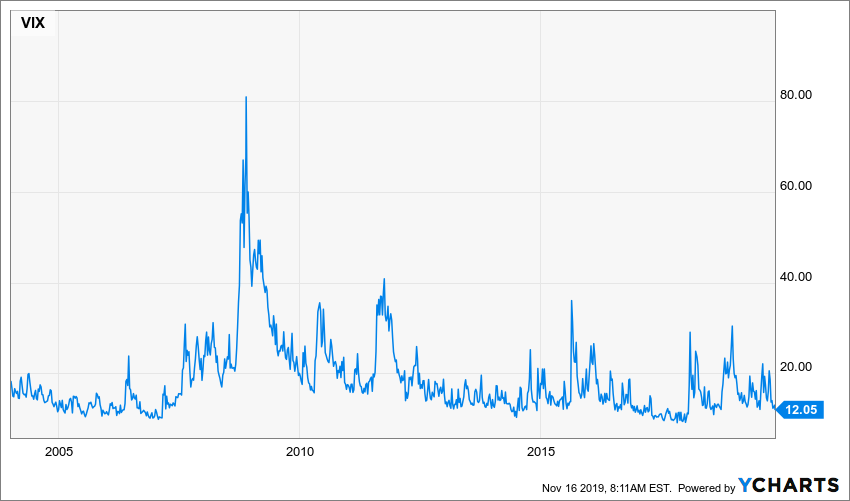

The S&P posted a 0.89% gain to reach a new record high, while the yield on the Ten-Year Treasury dropped 10 basis points to 1.83%. The Finex spot Dollar index closed down fractionally at (what I am told) an important support level of 98. We continue to believe that any significant weakness in the Dollar would be a warning sign that capital is leaving the U.S., which would have an adverse effect on the economy and markets. It’s a thin line between complacency and resiliency, but clearly investors are continuing to display one or the other, as volatility has disappeared with the VIX (CBOE Volatility Index) reached its lowest level since April, and remains near historic lows.

The last wave of earnings reports trickled in and continued to beat the low bar set, with the blended decline for S&P 500 improving to -2.3% from -2.5% the week earlier. A 39.7% drop in Energy sector earnings accounts for most of the decline.

This Week:

The Conference Board releases its Leading Economic Index for October. Expectations are for a reading that indicates a slow and steady economy. The Housing Market Index will be out on Monday and residential construction data will be released on Tuesday. The housing market has really never heated up since the financial crisis, but instead has shown consistent modest improvement. Ask any realtor and they will certainly tell you there is no bubble in the housing market now.

Undoubtedly the ups and downs of the trade negotiations with China will remain in the news, particularly as the Huawei waivers are set to expire on Tuesday. (Prior to the market opening on Monday Reuters reported that the US Government was intending on announcing a 90-day license extension to allow Huawei to continue doing business with American firms. Additionally, The People’s Bank of China overnight lowered one of its key interest rates for the first time since 2015.)

Stocks on the Move:

AMAT +10.8%: Applied Materials is one of the world’s largest suppliers of semiconductor manufacturing equipment, providing materials engineering solutions to help make nearly every chip in the world. Applied Materials stock soared Friday after the chip equipment maker reported better-than-expected results for its fiscal fourth quarter. AMAT is a 1.16% holding in the North Star Opportunity Fund.

OESX +15.2%: Orion Energy Systems Inc is a developer, manufacturer, and seller of lighting and energy management systems. On November 6 OESX released the best improvement of quarterly results, and the biggest beat over expectations, of any company that I have ever followed in my 36-year career. The share price closed down that day as one analyst continued to obsess on the possible lumpiness in the Company’s business since one customer accounts for a very high percentage of their sales. Fortunately the share price has been rising consistently after that original (bizarre) reaction. OESX is a 5.93% holding in the North Star Opportunity Fund and a 3.15% holding in the North Star Micro Cap Fund.

PCOM +11.6%: Points International Ltd is a Canadian company which is engaged in providing web-based solutions to the loyalty program industry. For fiscal third quarter, Total revenue increased 4% to $98.0 million compared to $94.4 million and net income was $1.1 million or $0.08 per diluted share, compared to $1.5 million or $0.10 per diluted share. We continued to execute on our strategic initiatives during the quarter as we balanced appropriate investments with our aggressive growth plans,” said Rob MacLean, CEO of Points. “Our Loyalty Currency Retailing segment continues to drive our performance as both new and existing partners are generating solid results, with nine of our top ten partners generating double-digit gross profit growth. We are also building pipeline momentum in Points Travel and Platform Partners, with new partnerships and upcoming launches setting the stage for accelerated growth in Q4 and 2020.” PCOM is a 1.22% holding in the North Star Micro Cap Fund.