Shifting Sentiment

Growing up in the 1970s and 1980s, a favorite pastime game was tug-of-war. Two teams pull on different ends of a rope until one group can get the flag in the middle past whatever obstacle separated the two groups – the game was particularly entertaining when the obstacle was a big, deep mud puddle. Win or lose, the game was fun because a player either won and got to see others pulled into the mud or lost and got to play in the mud. Unfortunately, the intensifying tug-of-war between the “sky is falling” inflation team and the “transitory” inflation team is nowhere near as fun.

The news flow supported the “sky-is-falling” team, and the commodity and bond markets responded accordingly. The evidence of inflationary pressures was evident in multiple channels: (1) corporate earnings results commentary; (2) Fed comments; and (3) economic data that includes significant media attention to retail gasoline prices trends. Major consumer products companies such as Procter & Gamble (PG) commented that it would need substantial price increases to maintain margins given input cost trends. Similarly, Fed Chair Jerome Powell indicated that price data increasingly support plans for tapering soon; specifically, he referenced that the Fed is focused on whether inflation “expectations” are rising as a result of recent and current upward price pressures. Lastly, there was so much media coverage of rising retail gasoline prices that President Biden was peppered with questions, to which he responded that he believes price relief could come sometime in 2022 (certainly possible, but not suggesting any near-term relief). Consumer sentiment has weakened along with the rising gas prices, seemingly overshadowing the normal bump in sentiment, otherwise known as the “wealth effect” of rising stock prices. The North Star Research Team will be listening to dozens of earnings reports this coming week to see if corporate management teams are incrementally cautious on margin outlooks, which would likely challenge sentiment further.

Commodity and bond markets reacted rationally to the inflationary pressures, as oil prices rose more than 1.00%, gold futures rose, and the U.S. 10-year Treasury yield rose 7 basis points to 1.64% after nearly touching 1.70% earlier in the week.

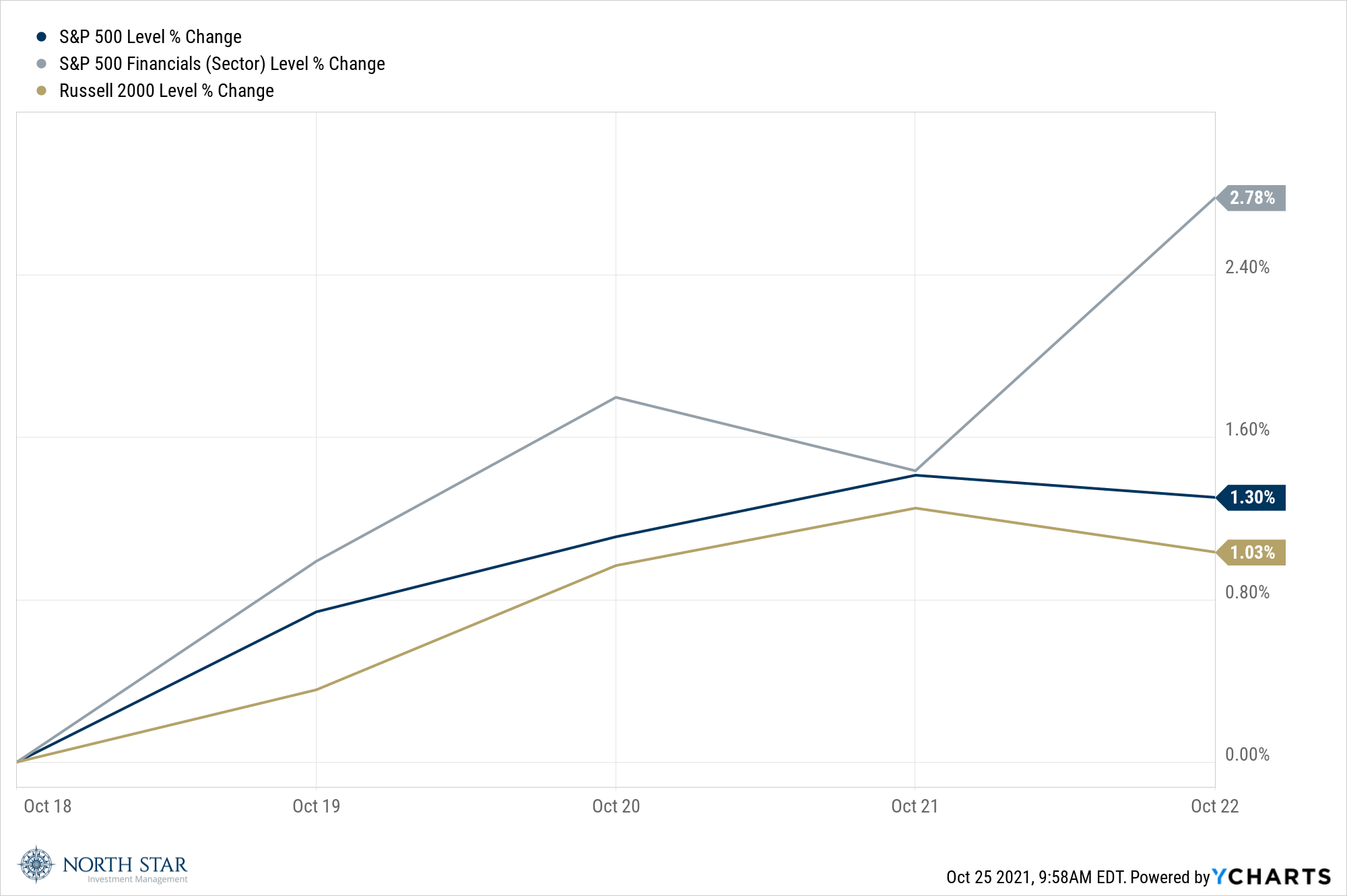

The stock market played Chutes and Ladders, with equity prices climbing more on strong corporate earnings than sliding on the above-mentioned inflationary concerns. The S&P gained 1.30% to yet another record high on Thursday, its 55th record in 2021 and its first since early September. One of our favorite sectors, the Financials, performed particularly well, gaining 2.78% for the week. Small caps gained 1.03%, but the Russell 2000 remains approximately 3.00% below its high set in early March.

Rising Inflation Fears

Earnings season news flow will likely dominate the news this coming week, one of the busiest earnings weeks of the year. Any sales-related earnings misses among the highest-profile companies reporting results would be a surprise. Given rising inflation fears, the mood of the financial markets will likely be more dependent on the comments from companies regarding margin stability in light of input cost trends.

The Chinese real estate news flow remains negative, with rising defaults, although China Evergrande has avoided the worst-case scenarios circulating a few weeks ago. This week, corporate earnings will continue to drown out the news from China, but we expect more focus on the Chinese economy once the quarterly earnings season winds down in a few weeks.

Stocks on the Move

+11.9% The Blackstone Group Inc (BX) operates as an investment company. The Company focuses on real estate, hedge funds, private equity, leveraged lending, senior debts, and rescue financing. Last week, BX smashed earnings expectations by reporting Q3 earnings of $1.28/share (beat by $0.36) and revenue of $3.04B (+108.2% y/y). Chairman and CEO Stephen Schwarzman accredited the results to “outstanding investment performance, with the third quarter capping the best twelve-month period for fund appreciation.”

BX is a 5.5% position in the North Star Opportunity Fund.

+11.1% KKR & Co Inc (KKR) operates as an investment firm. The Company manages investments such as private equity, energy, infrastructure, real estate, credit strategies, and hedge funds. Last week, the stock’s rally was most likely due to investors anticipating strong secular trends and robust M&A activity. Additionally, the Company announced the purchase of Kobalt’s Music Royalties portfolio for ~$1.1B. The portfolio consists of 62,000 music publishing copyrights for a diverse group of highly acclaimed artists and songwriters.

KKR is a 3.4% position in the North Star Opportunity Fund.

-11.5% CatchMark Timber Trust (CTT) operates as a real estate investment trust. The Company engages in timberland ownership and management, which includes about 435,000 acres of such property, without ownership of any forest products and other manufacturing operations (logging/wood products). CTT fell for the second week in a row from news of the REIT exiting its Triple T joint venture and slashing its quarterly dividend by almost 45%.

CTT is a 0.8% position in the North Star Dividend Fund.

-11.4% Healthcare Services Group Inc (HCSG) provides housekeeping, laundry, linen, facility maintenance, and food services. The Company offers its services to the healthcare industry, including nursing homes, retirement complexes, rehabilitation centers, and hospitals. Last week, the Company reported Q3 EPS of $0.13, missing by $0.13 per share. On the top line, revenue of $415.59M beat by $5.11M. The Company is facing a variety of headwinds including a broad workforce exit due to vaccine mandates, challenges with labor availability, and cost inflation.

HCSG is a 1.7% position in the North Star Dividend Fund.

-16.4% Consolidated Communications Holdings Inc (CNSL) offers telecommunications services. The Company offers local and long-distance telephone, high-speed internet access, and digital television services to individuals and businesses in the States of Illinois, Pennsylvania, and Texas. Last week, Citigroup analyst Michael Rollins downgraded CNSL to Sell, the third rating change from Citi since June. Nothing has changed in terms of the business over this period and the Company continues to execute its fiber-first strategy.

CNSL is a 1.2% position in the North Star Micro Cap Fund.

+19.0% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. Last week, Greenlight’s David Einhorn spotlighted Green Brick Partners, its largest holding, in a letter to Partners last week, citing how the company is extremely undervalued and posed for strong continued success.

GRBK is a 1.8% position in the North Star Micro Cap Fund.

On a very sad personal note, my mother, Alma Kuby, died on Friday, October 22nd, which was the 66th anniversary of her marriage to Raymond Kuby. She was a wonderful mother, wife, grandmother, great-grandmother, friend, and mentor. She will be dearly missed.