Last Week:

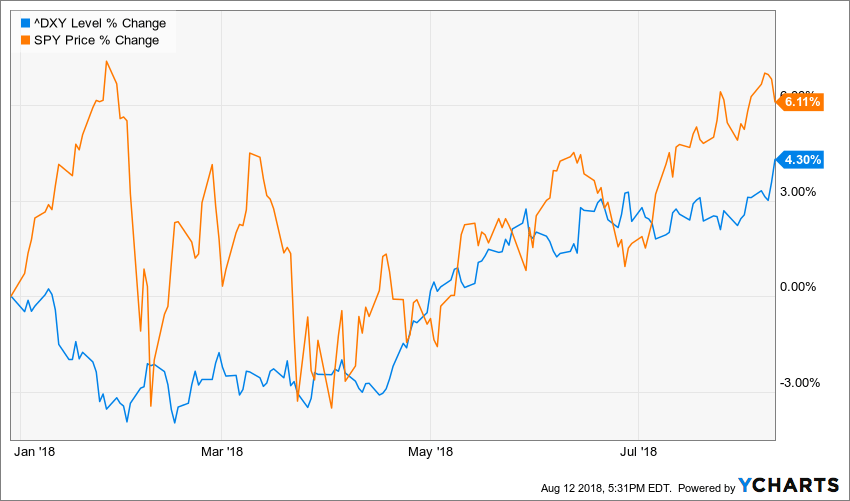

The S&P 500 slipped 0.25%, the yield on the Ten-Year Treasury slid 10 basis points to 2.85%, while the U.S Dollar strengthened over 1% to a new 2018 high. The chart below shows the link between the strength in the dollar and the S&P this year, particularly since the end of March when the “Trade War” dialogue started dominating the headlines.

It’s hard to tell how the dollar and market would have reacted without all the noise around tariffs, as corporate earnings have been terrific during this period. As the second quarter earnings season wraps up, it looks like there will be almost 25% growth in earnings on nearly 10% revenue growth (a rare double-double for basketball fans).

The crisis in Turkey dominated the news on Friday, as the lira plunged 14% in response to President Trump doubling tariffs on that nation’s steel and aluminum exports, leading to a modest sell-off in pretty much all risk- assets. Whenever there is an international economics issue, we turn to Professor Robert Z. Aliber for his advice. He counsels that the situation in Turkey is symptomatic of a brewing global debt crisis, as the age of quantitative easing ends, and monetary conditions tighten. The world is still awash in liquidity, but to quote JP Morgan Chase CEO Jamie Dimon,” I don’t want to scare the public, but we’ve never had QE (before). We’ve never had the reversal.” Stay tuned.

Tiger Woods captured 2nd place in the 2018 PGA Championship. He hasn’t won a major championship in over 10 years now, but he sure draws a big crowd. I played my annual golf outing at the beautiful Northmoor during the week. The good news is that I only lost one ball. Score provided upon request.

This Week:

It will probably be a very quiet week, with earnings season essentially over, and many traders enjoying their houses in the Hamptons. July retails sales will be released on Wednesday, with housing starts on Thursday, and leading indicators on Friday. Then again, these days you never know what might tweet might surprise the markets.

Stocks on the Move:

Every weekend we go through our holdings to see which companies experienced the largest price changes. This last week we had 11 companies with double-digit price changes. This stock specific volatility has been on the rise all year, but as the winners and losers cancel each other out, the overall market continues to display a remarkable absence of volatility. The good news for active managers is that this environment should be conducive for outperformance. The bad news for value managers is that momentum still seems to be ruling the roost, with enormous attention placed on the short-term horizon.

Winners:

Johnson Outdoors, Inc. (JOUT) +19.6%: Favorable marketplace momentum for new products, particularly in Fishing and Camping, fueled a 10 percent increase in total Company net sales of $170.8 million compared to $155.7 million in the previous year quarter. Net income in the fiscal third quarter rose to $23.8 million, or $2.37 per diluted share, a 44 percent increase compared to $16.6 million, or $1.65 per diluted share, in the previous year third quarter. “Unprecedented growth in our flagship Fishing brands throughout the year underscores the importance of our ongoing emphasis on consumer insight driven innovation. Delivering this same level of continuous new product success across our entire brand portfolio is a key priority, and we are working to further strengthen organizational capacity and capability to do so,” said Helen Johnson-Leipold, Chairman and Chief Executive Officer. “Future plans will focus on strategies targeted on fully leveraging our company-wide digital transformation and data analytics to enhance accelerated profitable growth for all channels long-term.” Johnson Outdoors is a global manufacturer and marketer of branded seasonal, outdoor recreation products. It offers products under Watercraft, Diving, Marine Electronics and Outdoor Gear. JOUT is a 3.8% holding in the North Star Micro Cap Fund.

Ingles Markets, Inc. (IMKTA) +18.7%: Net sales totaled $1.03 billion and net income totaled $24.5 million for the third quarter ended June 30, 2018, compared with $984.4 million and $11.5 million, respectively, for the third quarter of fiscal year 2017. Ingles Markets is a supermarket chain in the Southeast United States. It operates grocery retail stores offering grocery, meat and dairy products, produce, frozen foods and other perishables, and non-food products. IMKTA is a 1.2% holding in the North Star Dividend Fund and IMKTA corporate bonds are a 2.7% holding in the North Star Bond Fund.

NTN Buzztime, Inc. (NTN) + 15.8%: There was no news. NTN Buzztime provides interactive entertainment and dining technology to bars and restaurants in North America. Its main products are Buzztime, Playmaker, Mobile Playmaker, BEOND Powered by Buzztime and Play Along. NTN is a 0.9% holding in the North Star Micro Cap Fund.

Boot Barn Holdings Inc. (BOOT) + 14.9%: Net sales increased 16.2% to $162.0 million and net income was $6.8 million, or $0.24 per diluted share, compared to net income of $0.8 million, or $0.03 per diluted share in the prior-year period. Jim Conroy, Chief Executive Officer, commented, “We are encouraged by our very strong start to fiscal 2019 as sales, merchandise margin, and earnings per share were up significantly year-over-year and outperformed our guidance. Same store sales increased 11.6%, in line with our prior quarter. We expanded our merchandise margin in the quarter by 140 basis points, driven by more full-price selling and increased exclusive brand penetration. I am equally pleased that the positive momentum in the business continued in July.” Boot Barn Holdings operates specialty retail stores that sell western and work boots and related apparel and accessories. The Company operates retail locations throughout the U.S. and sells its merchandise via the Internet. BOOT is a 2.4% holding in the North Star Micro Cap Fund.

ARC Document Solutions Inc, (ARC) + 14.7%: There was no news. ARC Document Solutions is engaged in providing document management solutions to businesses, including non-residential segment of architecture, engineering & construction industry. Its offering include; onsite, digital, color & traditional reprographics. ARC is a 1.9% holding in the North Star Micro Cap Fund.

Motorcar Parts of America, Inc. (MPAA) + 12.1%: Net sales for the fiscal 2019 first quarter were $92.6 million compared with $95.5 million for the same period a year earlier, and adjusted net income for the fiscal 2019 first quarter was $2.8 million, or $0.15 per diluted share, compared with $8.3 million, or $0.43 per diluted share, a year earlier. “Notwithstanding weak results for the quarter, particularly in the month of April, we are encouraged by the industry regaining momentum and we expect a solid sales recovery in the quarters ahead,” said Selwyn Joffe, chairman, president and chief executive officer. “The company has reached a positive inflection point for future growth, with the sales and profitability outlook for the short and long term very encouraging,” Joffe said. He emphasized that sales for the quarter were impacted by customer allowances related to new business, customer stock adjustment accruals in connection with future update orders and the transition to the company’s new distribution center. Considering that optimism, the Company increased its repurchase program authorization to $37.0 million from $20.0 million. Motorcar Parts of America is a manufacturer, remanufacturer, and distributor of aftermarket automotive parts for import and domestic cars, light trucks, heavy duty, agricultural and industrial applications. MPAA is a 2.5% holding in the North Star Micro Cap Fund.

Crown Crafts, Inc. (CRWS) + 10.3%: Net income for the first quarter of fiscal 2019 was $264,000, or $0.03 per diluted share, on net sales of $15.5 million, compared with net income of $518,000, or $0.05 per diluted share, on net sales of $13.6 million for the first quarter of fiscal 2018. “While we saw an increase in net sales due to the addition of our two recent acquisitions, Carousel Designs and Sassy, this quarter presented some unusual challenges,” said E. Randall Chestnut, Chairman, President and Chief Executive Officer. “The bankruptcy and liquidation of one of our largest customers, which represented $3.4 million in sales in the prior year quarter, continued to affect the Company. Although we anticipate replacing a portion of the Babies “R” Us sales volume through reallocation to existing customers in the latter half of the year, the Babies “R” Us deeply discounted liquidation sale activity competed against our core business. This affected the Company in what has been our traditionally weakest quarter of the year and made it more difficult to cover our fixed costs,” he continued. “Additionally, as previously announced, in April 2018 we completed the move of the Sassy inventory from Grand Rapids, Michigan to our warehouse in Compton, California, which had a negative impact on diluted earnings per share.” Crown Crafts through its subsidiaries operates in the infant and toddler products segment within the consumer products industry. It designs and distributes, infant and toddler bedding and blankets, bibs, disposable products and accessories. CRWS is a 2.2% holding in the North Star Dividend Fund and a 2.0% holding in the North Star Micro Cap Fund.

Losers:

PCTEL, Inc. (PCTI) -24.5%: Revenue for the quarter was unchanged at $21.6 million, and the Company posted a net loss of $1.2 million versus a net loss of $350,000 in the year earlier period. “The Company saw revenue growth for its Connected Solutions products in the enterprise Wi-Fi market during the quarter and the half but fell short of our expectations. RF Solutions revenue was down in the North American market in the quarter and the half, due to capital budget reductions by several U.S. carriers,” said David Neumann, PCTEL’s CEO. “We believe the carriers have reduced capital spending on legacy networks to prepare for more aggressive 5G deployments in 2019. Although this will negatively affect our 2018 results, PCTEL is positioned to take advantage of the long-term growth opportunities in our targeted markets, which require both performance critical testing solutions and antennas.” PCTEL designs and delivers Performance Critical TELecom technology solutions to the wireless industry. It supplies wireless network antenna and testing solutions. PCTI is a 0.7% holding in the North Star Dividend Fund.

Owens & Minor, Inc. (OMI) -22.8%: Shares continued their slide after the Company reported disappointing earnings the previous week. Owens & Minor is a healthcare logistics firm distributing low-tech, consumable medical supplies to acute-care hospitals. The company distributes products to healthcare service providers under various brands such as MediChoice and ArcRoyal. Owens & Minor reported financial results for the second quarter ended June 30, 2018, including consolidated revenues of $2.46 billion, representing an increase of 8.5% when compared to revenues of $2.27 billion in the second quarter of 2017. Third quarter dividend payment of $0.26 share were also approved. Quarterly revenue growth included contributions from Byram Healthcare of $128 million and two months of revenue contribution from Halyard S&IP of $168 million (before eliminations of $31.1 million). On a GAAP basis, the current quarter results were significantly affected by a non-cash asset impairment charge related to goodwill and intangibles of $165 million, or $2.73 per share, resulting in a consolidated operating income (loss) for the second quarter of 2018 of ($172) million compared to $32.8 million in last year’s second quarter. Quarterly net income (loss) was ($183) million, or ($3.07) per share, compared to $0.33 per share for the second quarter of last year. “Our teams remain laser focused on improving our operating performance. Our new strategy and capabilities are resonating with our customers, helping us to retain and win new business,” said P. Cody Phipps, Chairman, President & Chief Executive Officer of Owens & Minor. “Additionally, we are pleased to report that the recent acquisitions of Byram and Halyard are achieving our expectations. We believe the strategic moves we have made across the continuum of care with Byram and in meaningfully building our own brand products portfolio with Halyard S&IP have strengthened and diversified our overall business and have positioned Owens & Minor for sustained profitable growth in 2019 and beyond.” OMI is a 1.3% holding in the North Star Dividend Fund.

Salem Media Group, Inc. (SALM) -19.9%: For the quarter ended June 30, 2018 compared to the quarter ended June 30, 2017, total revenue increased 0.2% to $66.3 million from $66.1 million, and EBITDA decreased 40.8% to $6.0 million from $10.1 million. For the third quarter of 2018, the company is projecting total revenue to be between flat and an increase of 2% from third quarter 2017 total revenue of $65.4 million. The company is also projecting operating expenses before gains or losses on the disposition of assets, stock-based compensation expense, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense to be between a decline of 2% and an increase of 1% compared to the third quarter of 2017 non-GAAP operating expenses of $55.9 million. Salem Media Group is a domestic multimedia company with integrated operations including radio broadcasting, digital media, and publishing. The Company has three operating segments, Broadcast, Digital Media, and Publishing. SALM is a 1.5% holding in the North Star Dividend Fund and SALM corporate bonds are a 2.4% holding in the North Star Bond Fund.

U.S. Auto Parts Network Inc (PRTS) -13.4%: Net sales in the second quarter of 2018 were $77.0 million compared to $80.2 million in the year-ago quarter, and Adjusted EBITDA was $2.8 million compared to $3.8 million in the year-ago quarter. “During the second quarter, our sales and profitability were impacted by the customs issue discussed last quarter as well as a continued decline in e-commerce traffic. Although the seized automotive grilles accounted for less than 1% of our annual revenue, Customs was holding approximately 200 of our shipping containers that carried many of our other products and did not release the containers in an expeditious timeframe. As a result, we had significantly lower in-stock rates for both private label and branded products, as well as higher port and carrier fees associated with the unreleased product and increased legal costs associated with the product seizures and the bonding litigation. These factors culminated in lower sales, gross margins and higher operating expenses for the second quarter.” U.S. Auto Parts Network Inc is an online provider of automotive aftermarket parts and repair information. Its products are classified into three subcategories: collision parts, engine parts, and performance parts and accessories. PRTS is a 1.3% holding in the North Star Micro Cap Fund.