Last Week:

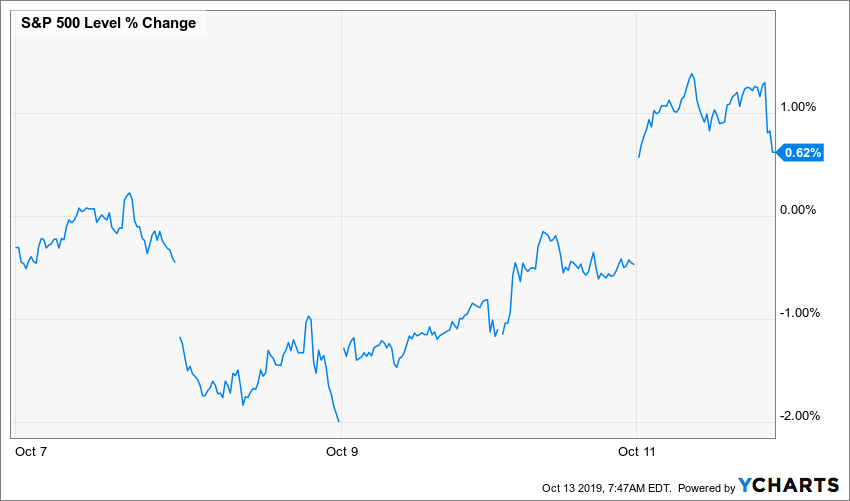

In the summer of 1983, while I was preparing to enter the training program at Drexel Burnham Lambert, the hilarious comedy “Trading Places” was released. The climax of the movie is the year-end release of the USDA report on the orange crop forecast, as all the traders wait for that report to either buy or sell orange juice futures. It’s a binary process, good crop equals sell while bad crop equals buy. For the last eighteen months it feels like the stock market has traded like orange juice futures, with President Trump’s China tweets replacing the crop forecast. On Thursday afternoon the tweets turned positive and voila the market reversed recent declines and rallied into the close on Friday, with the S&P posting a 0.62% gain for the week. After three months of a stalemate, and only days before another round of tariffs were scheduled to be implemented, Trump cancelled those tariffs as part of a “phase one” trade accord. The specifics of that accord are expected to take as long as five weeks to put on paper, so perhaps the market will get a respite from these crop reports for a while.

The bond market also responded sharply to the tweets, with the yield on the Ten-Year Treasury surging 24 basis points to 1.75%. Concerns that the continuation of the “trade war” between the two largest economies in the world will lead to a global recession have driven rates down to historic low levels. Interest rates tend to rise when those concerns ease.

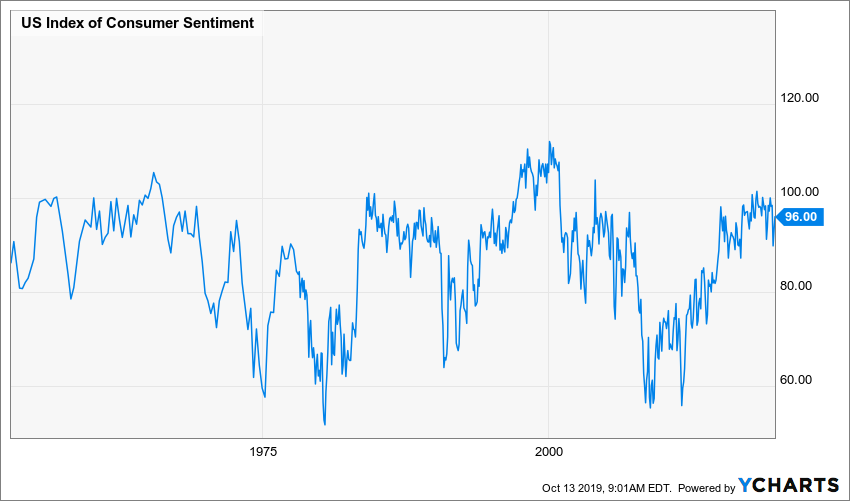

The economic data continued to paint a fairly upbeat picture, as the headline Consumer Sentiment Index came in at 96.0, which widely beat expectations of 92.0 as consumer sentiment was lifted by lower interest rates and subdued inflation expectations. We continue to watch consumer sentiment closely, as we believe that the economy and the markets are likely to remain stable as long as consumer confidence remains strong. A word of caution, this measure can turn negative quickly, particularly as it relates to the consumers view of current conditions.

This Week:

Major financial companies Bank of America (BAC), Wells Fargo (WFC) and JPMorgan Chase (JPM) are about to kick off the Q3 reporting season, and analysts expect S&P 500 earnings to drop for the first time in more than three years. Wall Street expects earnings for the S&P 500 to decline 3.2% in Q3. This figure improves to a 1% decline if the energy sector is excluded. Revenue is seen increasing by 3.5%. It’s worth noting that actual earnings usually exceed the lowered bar, as evidenced by the last two quarters that eked out modest profit growth despite forecasts of declines.

Retail sales data for September will be released on Wednesday. Consensus estimates are for a 0.3% gain after a 0.4% gain in August. Spend baby spend!

Stocks on the Move:

(NTN) +11.84%: NTN Buzztime, Inc. delivers interactive entertainment and innovative technology that helps its customers acquire, engage and retain its patrons. Most frequently used in bars and restaurants in North America, the Buzztime tablets, mobile app and technology offer engaging solutions to establishments that have guests who experience dwell time, such as casinos, senior living, and more. The Company’s shares exhibit significant volatility due to its thin float, low price, and uncertain future as their strategic review process continues. NTN is a 0.66% holding in the North Star Micro Cap Fund.

(PPSI) -21.73%: Pioneer Power Solutions, Inc. manufactures, sells and services a broad range of specialty electrical transmission, distribution and on-site power generation equipment for applications in the utility, industrial, commercial and backup power markets. The Company received an order of the Superior Court of California related to the case titled Myers Power Products, Inc. v. Pioneer Power Solutions, Inc., Pioneer Custom Electrical Products, Corp., et al., enjoining distributions to shareholders, including the announced one-time special cash dividend of $1.37 per share planned and, at the time of the court’s order, already in process to be paid on October 7, 2019. The ruling was issued after the close of business on Friday, October 4, 2019. Pioneer has indicated that it will contest the matter. On August 22, PPSI completed the sale of its liquid filled and dry type transformer businesses to private equity firm Mill Point Capital for $68 million. After this recent decline the Company’s market capitalization is $35.5 million. PPSI is a 1.08% holding in the North Star Micro Cap Fund and a 1.52% holding in the North Star Opportunity Fund.

(CNSL)-15.81%: Consolidated Communications Holdings, Inc. is a leading broadband and business communications provider serving consumers, businesses, and wireless and wireline carriers across rural and metro communities and a 23-state service area. Leveraging an advanced fiber network spanning 37,000 fiber route miles, Consolidated Communications offers a wide range of communications solutions, including: high-speed Internet, data, phone, security, managed services, cloud services and wholesale, carrier solutions. On September 27, Zacks Research upgraded the shares to a “Strong Buy” basically reflecting positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price. There has been no company specific news since that upgrade while the share price has declined 27%. CNSL will be reporting third quarter results on Halloween. CNSL is a 0.68% holding in the North Star Dividend Fund. CNSL Corporate Bonds are at 2.52% holding in the North Star Bond Fund and a 1.00% holding in the North Star Opportunity Fund.