Last Week:

P=MV

P=Momentum

M=Mass

V=Velocity

The S&P 500 set another record on Thursday, as the upward momentum powered stocks through the destabilizing news flow from the Middle East. A minor sell-off on Friday following a tepid jobs report left the S&P 500 slightly below that record, but still +0.9% for the week. The yield on the Ten-Year Treasury inched up 3 basis points to 1.82%. For those of you who were off the grid and missed the developments, Iran launched a rocket attack on a U.S. base in Iraq in retaliation for the airstrike that killed Qassem Soleimani. Iran also accidentally shot down a Ukrainian jetliner, killing all 176 people on board, after mistaking it for a cruise missile. The positive reaction of markets to the events seems to be based on the assumption that the attack on the Iraqi base was specifically designed not to injure Americans. An alternative theory is that our military has the capability to move troops out of harms way when a missile is launched. In any event, recent events have certainly increased the short-term risks in the Middle East. This renewed instability could prove to be a powerful enough force to blunt the market’s momentum. Then again, the market is up 38.9% since December 24, 2018 despite a decline in corporate profits, a trillion-dollar fiscal deficit, an impeachment of the President, Brexit, a global slowdown, and a contraction in the U.S. manufacturing sector. If the underlying physics formula applies, then it is going to take a large and fast force to break the upward momentum.

The market rallies

Momentum stocks dominate

Planet Earth shudders

(This week’s blog is dedicated to the University of Chicago, where I went to school from kindergarten through business school. Apparently, we learned some basic physics formulas, how to write a haiku, and the importance of questioning the consensus opinion. Unfortunately, as you may have noticed, we never got around to grammar or spelling.)

This Week:

Developments in the Middle East could affect the market.

China’s delegation led by Vice Premier Liu He will arrive in Washington Monday before an expected phase-one deal signing on Wednesday. The deal is expected to include commitments from China to respect American intellectual property and not manipulate its currency. Another positive sign is that the Treasury Department is proposing to revive twice-yearly talks with China to discuss economic relations between the countries.

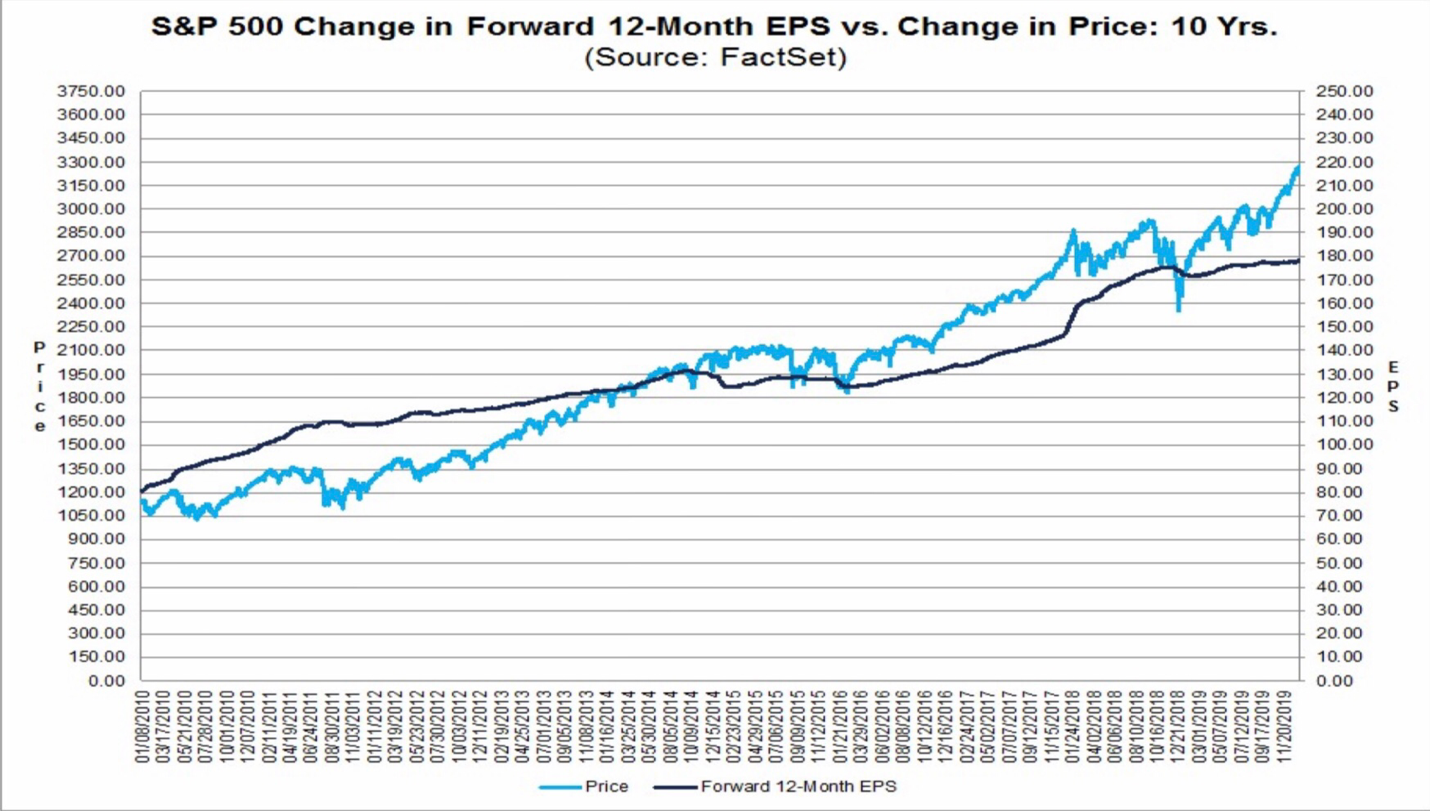

Fourth-quarter earnings season will ramp up with twenty-six S&P 500 components releasing results, with banks as usual among the first reporters. A further 45 names are set to publish earnings the following week, before things get really busy: 238 S&P 500 components report over the subsequent two weeks. The estimated earnings decline for the S&P 500 is -2.0%. If -2.0% is the actual decline for the quarter, it will mark the first time the index has reported four straight quarters of year-over-year earnings declines since Q3 2015 through Q2 2016. The forward 12-month P/E is at 18.4, based on earnings growth resuming at a 7.5% rate in 2020. As the chart below illustrates, this valuation is on the high side of recent multiples.

Healthcare and Retail companies could also be in the headlines with the JPMorgan Healthcare Conference in San Francisco and the ICR Conference in Orlando both kicking off on January 13. Peter Gottlieb will be attending the latter and will provide a comprehensive review upon his return.

Stocks on the Move:

PRTS +23.4%: US Auto Parts Network, Inc. is one of the largest online providers of aftermarket automotive parts and accessories. The Company named David Morris, formerly the SVP of Merchandising and Inventory Control at Icahn Automotive LLC, as its new Chief Merchandising Officer. “David has spent his entire career creating opportunities and ensuring quality in the automotive industry,” said US Auto Parts CEO Lev Peker. “He has a tremendous track record with Icahn Automotive, and we are excited for him to bring that same strong approach to CarParts.com and JC Whitney.” Additionally, Craig-Hallam research analyst Ryan Sigdahl initiated coverage with a BUY rating and $4 price target. He noted that swift action has been taken to stabilize the company’s e-commerce business and lay the foundation for profitable growth going forward, and that Q1-20 is positioned to be the “aha” moment for investors. Sigdahl says valuation is attractive and he has a one-year price target of $4, but he also sees a path to a $10+ stock over the next few years. Lastly, he notes nearly 50% insider ownership and 11 different insiders/directors have purchased a total of 2.2M shares on the open market since May 2019. PRTS is a 4.79% holding in the North Star Micro Cap Fund.

LEE -13.1%: Lee Enterprises is a leading provider of high quality, trusted, local news, information and a major platform for advertising in 50 markets. There was no company specific news to account for the decline. Shares are now off 27.1% since reporting earnings on December 12. LEE is a 0.82% holding in the North Star Opportunity Fund and LEE Corporate Bonds are a 2.41% holding in the North Star Bond Fund.