Last Week

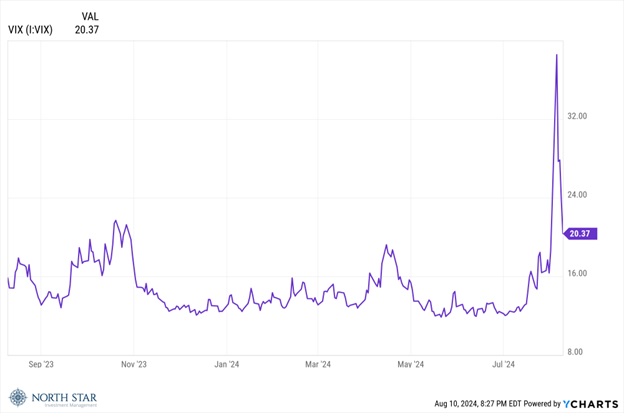

It was the worst of times on Monday and the best of times on Thursday, with wild swings that left equities slightly lower by the closing bell on Friday. The selling pressure from the end of the previous week, following the hawkish Fed meeting and soft economic data, accelerated on Monday, as the S&P 500 slumped 3%, marking its worst trading session since September 2022. A healthier reading on the economy from the ISM Services index and the largest drop since September in weekly initial jobless claims calmed recession fears, leading to the best day in the market since November 2022 on Thursday. Whereas the S&P 500 essentially broke even for the week, the Nasdaq declined 0.2%, the Russell 2000 slid 1.3%, and declining issues outnumbered advancing issues by a factor of 4-3. Volatility traders were in the center of the action, as the Fear Index (VIX) had a wild spike on Monday before reversing course later to finish lower for the week, albeit still at an elevated level.

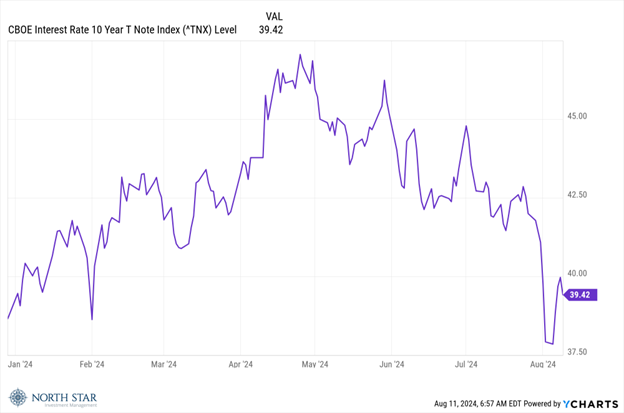

The bond market also had a wild ride, with the yield on the 10-year Treasury touching its lowest levels of the year before finishing up 14 basis points at 3.93%.

Whereas traders’ attention was largely focused on macro events, the second quarter earnings season also contributed to the news flow. Following those releases, S&P composite earnings growth moderated from 11.2% to 10.8%, which would still represent the highest quarterly earnings growth since 4Q 2021.

Given the heightened level of trading volatility, companies that “missed” the forecast and/or lowered their outlooks suffered larger-than-normal declines in their share prices. Those declines might prove to be compelling entry points for investors with a long-term focus.

Speaking of declines, the White Sox finally snapped their record-losing streak last Tuesday! Meanwhile, the Cubs moved out of last place, passing both the Reds and the Pirates powered by a 4-game winning streak. 2 of those wins were against the White Sox.

This Week

Second quarter earnings season winds down, with reports from retailers Home Depot and Walmart providing another look at consumer health. Additionally, the Census Bureau will report retail sales data for July on Thursday, with a consensus forecast for a 0.3% month-over-month gain.

The CPI report on Wednesday will likely be the big market mover, with a year-over-year increase of 2.9% expected. The number is especially important as it could impact the impending Federal Reserve interest rate cut anticipated at its September meeting. We continue to see shelter costs as the key to headline inflation declining to the Fed’s target of 2%; recent shelter inflation data has been encouraging, but progress is rarely linear.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.