Carnage Continues

The market definitely sang the blues as the Dow Jones Industrial Average notched its fifth consecutive week of losses, down 2%, while the S&P dropped 2.9%, the Nasdaq slid 3.5%, and the Russell 2000 declined 1.06%.

It was a worn-torn Monday

And stocks were really bad

Tuesday the news was still sad

Yet an end of day rally was had

Wednesday stocks made a significant advance

On hopes that a peace treaty had a chance

Those hopes were dashed on Thursday

Surging CPI data and plummeting Chinese stocks added to the fray

On Friday stocks tanked, as data showed that consumer sentiment sank while inflation expectations showed the cost we must pay.

Whereas news on the pandemic was the primary driver of economies and markets for most of the last two-years, now the war is the dominant determinant. In the very short run that influence is most visible in the energy market, given Russia’s position as one of the largest exporters of natural gas and crude oil. Crude oil prices actually finished slightly lower during the week after surging to over $130 a barrel on Monday. Less transparent is the ultimate impact on supply chains and global trade as a result of the economic sanctions. As the week progressed, the carnage in Ukraine worsened while hopes of meaningful peace negotiations were dashed on Friday risk after Ukraine’s top diplomat said he didn’t see progress. The U.S. responded with more economic sanctions, adding vodka, caviar and diamonds to the list of banned Russian imports, while President Biden moved to revoke the country’s preferential trade status, which would lead to higher tariffs on Russian goods.

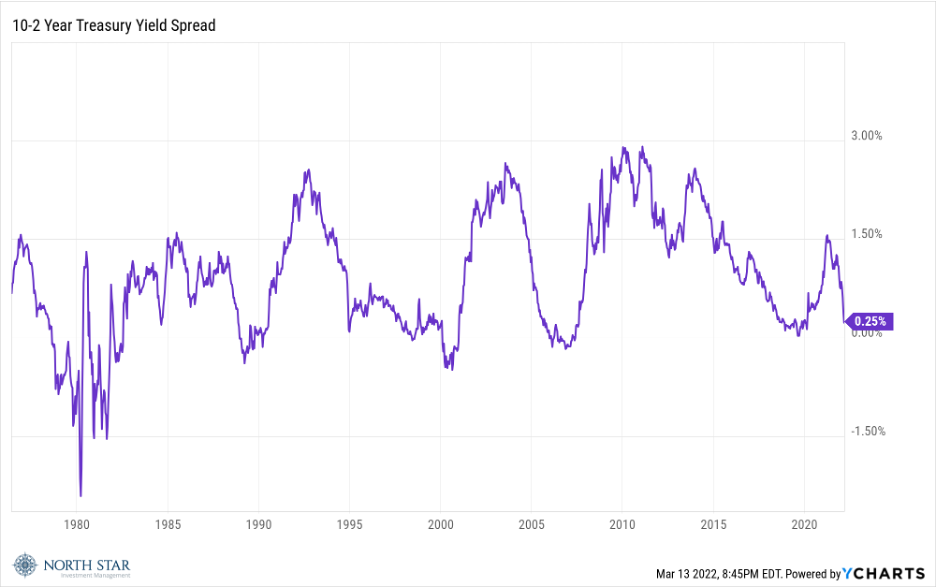

The bond market exhibited some signs of stress with the yield on the 10-year Treasury rising 28 basis points to top 2%, while the 2-year Treasury followed in step to reach 1.75%. The flattening of the curve combined with the rising rates have begun to stoke stagflation concerns. We believe those concerns are premature, while recognizing the uncertain outcome and impact of the war in Ukraine have increased that risk.

In searching for a more optimistic perspective, we found some solace in a Barron’s article that suggested “solving the world’s Putin problem could unlock a better future for everyone. A financial system that disfavors oligarchs might be one that spreads the benefits of rising wealth more broadly. A global economy that doesn’t rely on a few authoritarian states for energy could pay dividends in climate and health. And a world where tyrants can’t order their troops into a neighbor’s home and hide behind the threat of nuclear war would be safer for all and less disruptive to markets.”

That future would warrant a resounding chorus of Beethoven’s “Ode to Joy”!

On the Battlefront

Turning back to the grim present realities, the Russian onslaught in Ukraine will continue to dictate the tone of the markets. On Saturday, Russia’s Deputy Foreign Minister Sergei Ryabkov suggested that it could try to destroy foreign shipments of weapons to Ukraine, branding them “legitimate targets.” On Sunday, an American journalist was killed and another was wounded by Russian forces in the town of Irpin outside the capital of Kyiv as they were traveling to film refugees.

The battle against inflation will also be in focus, with February PPI expected to show a double-digit gain from a year ago, which would be a record increase since the data was first calculated in 2010. Producer price trends are often reflected in consumer prices with a short lag, so any divergence from expectations could be significant. The Federal Reserve meets next week and will nearly certainly announce a 25 basis point rate hike. The Fed’s current thinking on additional rate hikes, particularly how it has been influences by the war, will be closely watched.

The North Star Research Team will be meeting with many of our favorite consumer products company at the Roth Capital Conference on Monday and Tuesday. Shares of consumer products companies have been under intense pressure, including the worst performance off all sectors last week with a -6% decline. With great balance sheets, high-quality engaged management teams, strong business niches, and depressed valuations, we think that terrific bargains are available.

Stocks on the Move

-12.9% Allied Motion Technologies Inc (AMOT) designs, manufactures, and sells motion control products into applications that serve various industry sectors. The Company supplies precision motion control components that incorporated into a number of end products, including high-definition printers, barcode scanners, surgical tools, robotic systems, wheelchairs, and weapon systems. Allied Motion Technologies posted fourth quarter 2021 earnings of $0.20 and revenue of $96.79M. Full year revenue grew to over $400M with strength in Medical and Vehicle markets and challenges in Medical and Aerospace & Defense markets. The Company completed 3 acquisitions during the year, including one during the quarter.

-17.8% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. Build-A-Bear slid last week despite posting solid earnings including Q4 2021 EPS of $0.97 and revenue of $129.96M. In general, even companies with mild to moderate earnings misses have been disproportionately punished despite strong fundamentals and temporary headwinds.

-10.6% Hamilton Beach Brands Holding Company (HBB), through its subsidiaries, markets and designs electric household and specialty houseware appliances, as well as commercial products for restaurants, bars, and hotels. Hamilton Beach reported fourth quarter 2021 earnings of $0.90 per share and revenue of $197.8M. The Company experienced significant supply chain disruption in China with third-party manufacturers struggling to produce at elevated order levels. For the year, revenue reached a record high, and the company is expanding successfully into the fast-growing health and wellness market with products like air purifiers.

-11.1% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

-10.7% Sharps Compliance Corp (SMED) operates as a provider of waste management services. The Company offers containment, transportation, treatment, and tracking of medical waste, and the disposal of unused medications as well as other used health care materials. There was no significant company news last week. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.