A New Bull

A funny thing happened on our way to the recession; a new bull market developed. It took 248 trading days for the S&P 500 to rise 20% from its bottom, marking the longest bear market since 1948, but on Thursday that threshold was reached, and the new bull market was officially christened. There wasn’t much fanfare, and for the week the S&P only inched 0.4% higher, while 2023’s superstar index the Nasdaq composite was basically unchanged. Small caps have recently found some love, as the Russell 2000 gained 1.9%, following the previous week’s handsome advance. The fixed income market was also quiet with the yield on the 10-year Treasury creeping up 5 basis points to 3.74%, and the yield on the 2-year adding 8 basis points to 4.59%. The highest yields remain in the 3–6-month maturities, which we think represents a compelling risk-free return. The dollar and crude oil were slightly lower, and gold modesty higher, while the VIX (aka the “fear index “) reached its lowest level since before the pandemic.

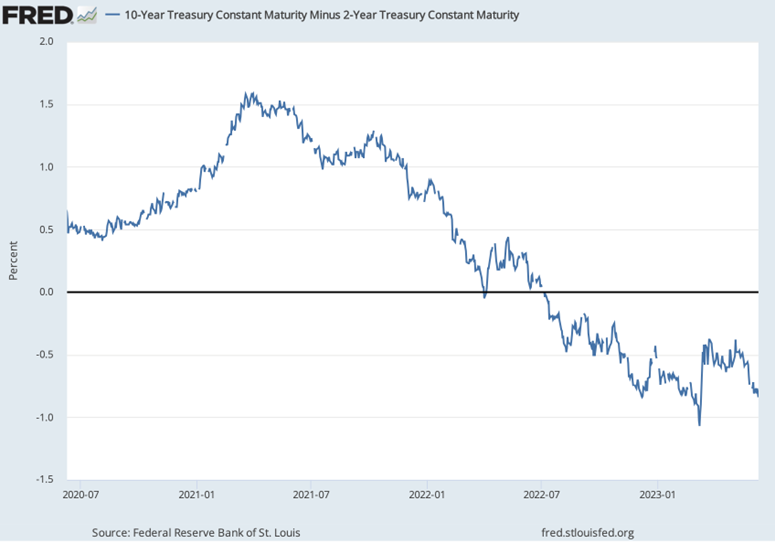

The economic data showed further signs of a slowdown, as the ISM’s Management’s Services PMI for May registered at 50.3 percent, 1.6 percentage points lower than April’s reading of 51.9 percent, while factory orders for April rose less than expected. The most significant data point as it relates to future Fed policy decisions was the surge in initial weekly jobless claims to their highest level since October 2021, suggesting that cracks are showing in the highly resilient labor market. As shown in the chart below, the widely respected recessionary indicator, the 10-year U.S. Treasury minus 2-year U.S. Treasury spread, has seemingly renewed its widening trajectory. This suggests that bond market participants are investing in preparation for a weak U.S. economic outlook. If such an outlook is correct, we may be quite close to the end of restrictive Fed monetary policy.

Testing 1, 2, 3

The new bull market will get its first test as there will be both important economic releases and an FOMC meeting. The inflation data on CPI and PPI on Tuesday and Wednesday respectively are both expected to show continued moderation. The Fed is expected to pause interest rate hikes in its decision on Wednesday, while The University of Michigan consumer sentiment index is forecasted to remain at a depressed, but improving, level on Friday. Stay tuned!