Last Week

“Tell it to me slowly

Tell you what

I really want to know

It’s the time of the season for (loving) cutting interest rates”

Mash up of Zombies (1968) and Chairman Powell (2024)

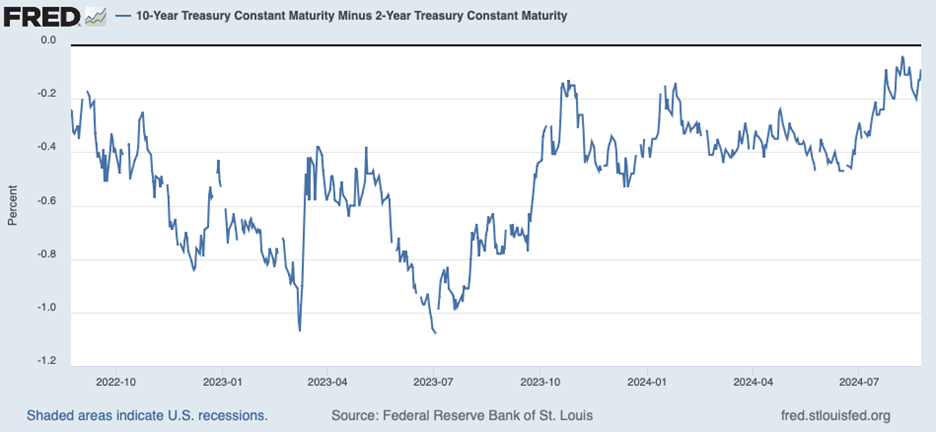

After several months of resolute statements by many Federal Reserve leaders that maybe only a pause in interest rate increases was warranted, Federal Reserve Chair Jerome Powell finally sang the tune that investors were calling for, with the strongest signal yet that interest rate cuts are coming. “The time has come for policy to adjust,” (translation: “cuts,”) Powell said at the Jackson Hole Economic Symposium, sparking a rally that moved stocks out of the red and into the green for the week. Small caps were the biggest winners, with the Russell 2000 gaining 3.6%, followed closely by the S&P MidCap Index, which jumped 2.8%. The S&P 500 and the Nasdaq Composite both moved 1.4% higher, with all the sectors participating except Oil & Gas, and advancing issues overwhelming declining issues by a factor of 4-1. Bond investors also celebrated as the yield on the 10-year Treasury dropped 8 basis points to 3.81%, and the two-year yield dropped 10 basis points to finish at 3.91%. The resulting 9 (rounded) basis points inversion in the 10-year Constant Maturity Minus 2-year Treasury Constant Maturity spread, an oft-cited barometer of recession expectations, is approaching the narrowest spread in the last two years. This improving indicator (see graph below) from the Federal Reserve suggests a metaphorical applause by financial markets towards Chairman Powell’s most recent comments. A further move into a positive spread between these two key bond yields would such a more optimistic outlook among bond market investors regarding global economic expansion prospects.

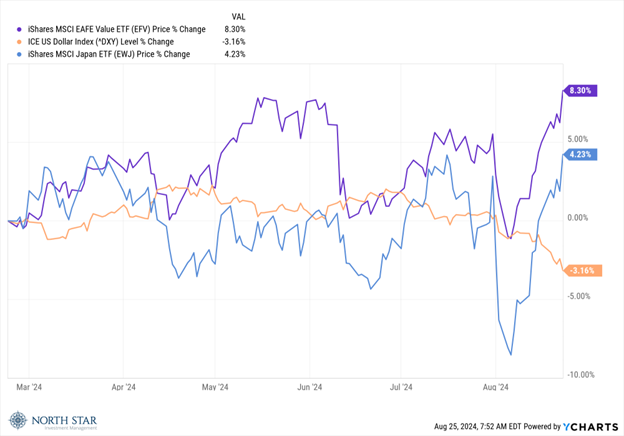

As Treasury yields have declined, so has the dollar exchange rate, leading to rallies in international equity markets denominated in the euro or yen. The weakness in the dollar should also create a short-term tailwind for the earnings of U.S. companies that derive revenues overseas, although the longer-term impact of a weak currency is more complex.

In addition to small caps, financial sector stocks, dividend-paying companies, and international equities, the lower short-term interest rates are also positive for precious metals, with gold moving to all-time levels during the past week.

Last week, consumer retailers reported the highest-profile corporate earnings reports. Target (TGT) and TJ Maxx (TJX) reported sales that impressed traders, sending those stocks higher, while Macy’s (M) sales report did not.

On the Chicago Sports scene, the White Sox lost their 100th game of the season, the Cubs are flirting with moving into second place in the NL East, while one could only hope that the Bears stellar preseason play will continue when the regular season opens on September 8th! Bear Down!

This Week

For what is traditionally a summer doldrums type of week for financial markets, all is probably not going to be quiet on the markets front. Without a doubt, the most-watched announcement this coming week will be the AI and technology sector bellwether Nvidia’s quarterly earnings report on Wednesday, August 28th. In what can be slow news and low-trading-volume week for many years as the summer comes to a close, such a high-profile earnings report could spark headline-producing volatility in the technology sector.

On the economic front, investors seem to have placed increasing emphasis on weekly jobless claims (initial and continuing) released each Thursday. On Friday, the Fed’s preferred inflation gauge, the PCE will be released, but with Chairman Powell’s recent comments emphasizing weakening labor market conditions, any inflation surprise would have to be quite dramatic to impact likely upcoming Fed actions.

We will also watch Thursday’s 2Q24 (June) GDP revision report. A meaningful downward revision from the initial 2.8% reported on July 25 might spark speculation of the need for larger or more rapid Fed rate cuts in the balance of 2024.

Given the intensity of financial market movements this summer, we have all earned a restful and relaxing upcoming Labor Day weekend. We wish everyone a safe and happy long weekend.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.