Balanced Signals

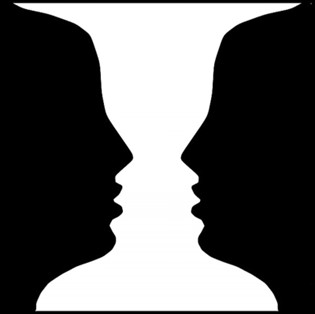

The concept of bistable perception, in which observers perceive the same information in two different ways, might help explain the current state of the financial markets as well as the political landscape. We will leave the unstable domestic politics and the heartbreaking geopolitical environment to other commentators and focus on whether the recent economic news suggests sunny skies or torrential storms for the market. Front and center last week were jobs data, oil prices, and interest rates. The employment picture included the JOLTS (Jobs Openings Labor Turnover Survey), the ADP private sector jobs report, and the September nonfarm payrolls report.

The JOLTS showed a jump of 600,000 job openings in August, suggesting a “hot” labor market. As the graph above shows, it is not uncommon for there to be those types of monthly increases while the overall trend is directionally lower.

Moreover, ADP reported that private job growth in September tailed off to just 89,000 from 180,000 in August. Apparently, the private sector did not fill a very high percentage of the job openings during the month. The whopper of a report came on Friday when the U.S. jobs report showed a stronger-than-expected labor market alongside slowing wage gains. Employers added 336,000 jobs in September, the strongest gain since January, but with another month of modest 0.2% wage increases.

Inflation hawks and those obsessed with the Fed’s “higher for longer” mantra viewed this composite labor market image as troublesome; while meshing these images together at North Star, we see a stable jobs market with lessening wage pressures.

Oil prices plunged by 10% during the week. Bulls embrace lower energy prices’ positive influence on consumers and businesses, while bears see it as a sign of an impending recession.

Interest rates continued to trend higher, particularly the longer-term rates, which pushed to levels not seen since 2007. The 10-Year Treasury gained 21 basis points to 4.78%, having touched 4.88% earlier on Friday. The positive view would be that the 10-2 spread inversion narrowed to its lowest level in a year, perhaps muting the recession warning bells that have been ringing loudly for so long. A large amount of U.S. Treasury new issuance is required to fund ongoing deficits, which may also be pushing up yields to get financings completed.

The stock market produced mixed results, with the S&P 500 gaining 0.5%, the Nasdaq rising 1.6%, the Russell 2000 losing 2.2%, and nearly three times as many declining issues as advancing issues.

Big Money at Bat

Inflation will be in focus, with the September PPI on Wednesday and CPI on Thursday. We think the trend of moderating inflationary pressures will be reinforced by those releases.

Earnings season kicks off with 12 S&P 500 companies reporting results for the third quarter. Expectations are for a 0.3% decline in year-over-year composite earnings, which would result in 4 consecutive quarterly declines. The big money center banks will be up to bat first, with Citigroup, JP Morgan Chase, and Wells Fargo all reporting on Friday the 13th. Additionally, on that spooky day, The University of Michigan releases its Consumer Sentiment Survey for October. With some recent, albeit modest, relief at the gas pump of an average $0.10 decline last week, some improvement in Consumer Sentiment would not surprise us, but a national average closer to $3.00 per gallon (Georgia is lowest average, below $3.00, and California is highest, around $7.00 per gallon) would probably be needed to enhance sentiment meaningfully – perhaps just in time for the holidays! Despite full employment and healthy economic data, consumer sentiment has been stuck at depressed levels throughout 2023, perhaps another case of bistable perception, with some seeing a healthy and others a sickly economy. We are not superstitious but recognize that it could be a freaky Friday.

It was a thrilling Thursday last week as the Chicago Bears snapped their 14-game losing streak with an impressive 40-20 victory over the Commanders in the nation’s capital. Inquiring minds want to know whether 13-4 is a possibility for this reenergized squad.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.