Not So Hot

Our previous commentary was titled “Bad News Bears”, but perhaps “Bad News Bulls” or “Good News Bears” would be a more appropriate description. Indeed, stock traders continued to obsess on future Fed rate hikes, with good news such as the strength in the labor market seen as the most significant cause for concern. Bad news early in the week, specifically soft manufacturing data and a surprise sharp decline in jobs openings, triggered a 5% plus gain in the S&P 500, the biggest two-day rally since April 2020. Hawkish Fed speakers, an OPEC+ sizeable cut in their daily output quota, and a jobs number that Goldilocks felt was too hot led to steep sell-offs the rest of the week. Nevertheless, the major indexes all finished positive with the S&P gaining 1.5%, the Nasdaq up 0.7%, and the Russell 2000 advancing 2.3%.

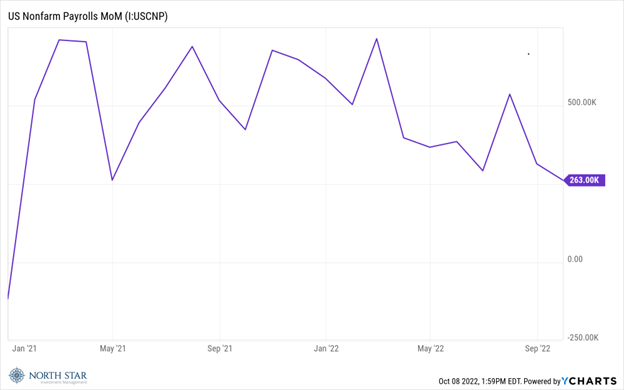

We note that the recent jobs numbers don’t seem as “hot” as they were characterized. In fact the 263,000 new jobs added was the lowest number in over a year, and the 0.3% monthly increase in wages also seems within the realm of normal. Recent hiring surveys and announced lay-offs suggest that further cooling in the labor market is likely.

We also take issue with that creating unemployment and wealth destruction in order to fight inflation are legitimate Fed policy objective. After waiting too long to start tightening, the Fed raised rates at the fastest pace in history, and the impact of those hikes are just now showing up in the economy. The relentless hawkish jawboning serves no additional purpose.

Crude Oil was the big winner of the week, jumping 16.5%, Gold rallied over 2%, while the Dollar inched slightly higher. Barron’s cover title is “The Powerful Greenback” with a picture of George Washington flexing his muscles. Could this cover story mark the top for the Dollar? Inquiring minds want to know.

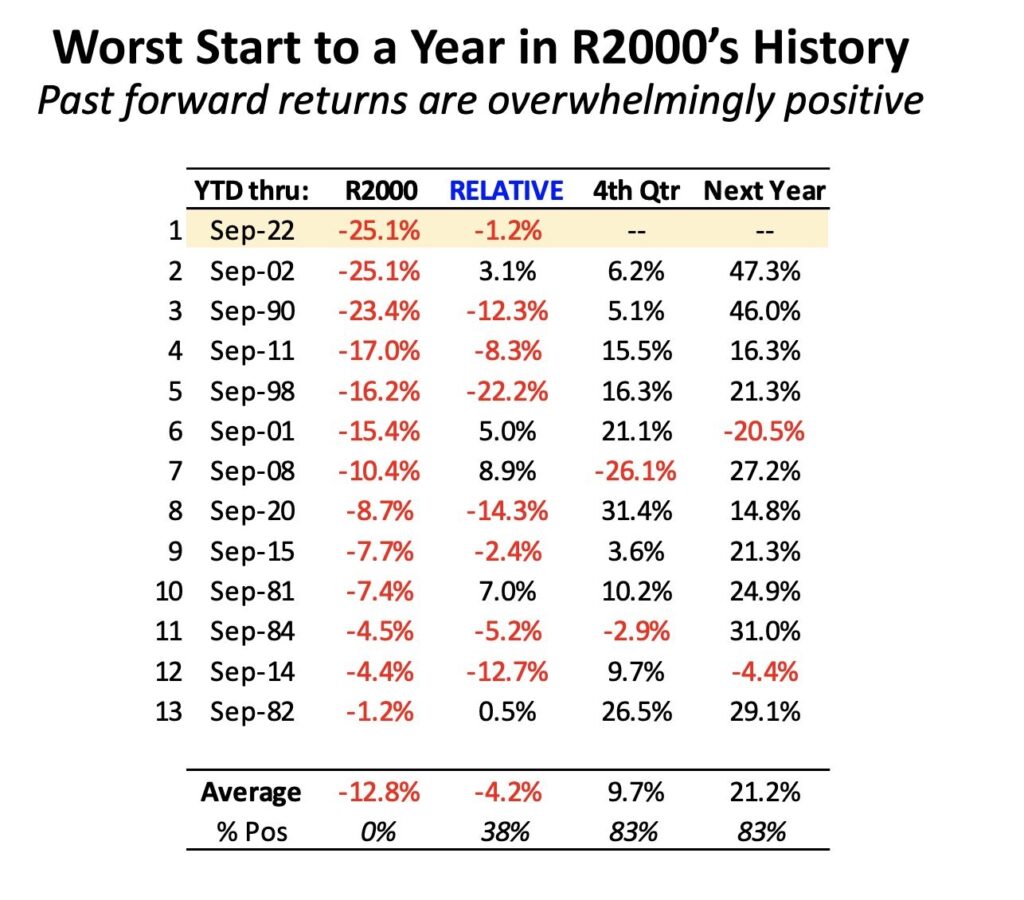

The yield on the 10-year treasury increased 9 basis points to 3.89%, and the 10-2 spread remained inverted at -41 basis points. The relatively high short-term Treasury rates, at over 4%, seem to represent a reasonably good return for investors safe capital, and small caps offer interesting rebound potential for risk-capital. While the Russell 2000 has suffered its worst year-to date-performance through September on record, following previous painful downturns, the index produced superior returns in the following 12-months. In fact, in the recent summer equity markets rally from mid-June to mid-August, the Russell 2000 rallied approximately 15% versus approximately 13% for the S&P 500 and approximately 11% for the Dow Jones Industrial Average. We believe that similar outperformance of Small Cap Equities is likely when investors begin to focus on stock picking fundamental- and valuation-based investing as Central Bank monitoring fatigue emerges.

Source: Perritt Capital Management

Sentiment, Inflation, Earnings, Oh My!

The economic calendar is extremely busy, with sentiment and inflation gauges in focus. On Tuesday the National Federation of Independent Businesses releases its Small Business Optimism Index for September, with the consensus estimate calling for a reading near a decade low. The minutes from the late September FOMC meeting will be available on Tuesday. There should not be any surprises as in the numerous post-meeting conferences, Fed officials have been on message about fighting inflation with all their available tools as priority one.

Inflation will dominate the narrative on Wednesday and Thursday with back-to-back PPI and CPI reports. Whereas the year-over-year change grabs the headlines, we would encourage investors to also focus on the month-over-month trends. Very moderate monthly increases are replacing year-ago much higher monthly increases. If that trend continues, the annual inflation rate should be down to under 3% by late spring 2023. If the monthly CPI was flat, it would translate to an encouraging reading under 8%, although the consensus calls for a monthly increase of 0.2% and a year-over-year increase of 8.1%.

The University of Michigan Consumer Sentiment Survey for October on Friday is expected to remain at a very depressed level, slightly lower than the reading from September. Expectations for inflation within that survey are forecasted to decline fractionally.

Retail spending data for September will also be released on Friday. Thanks to a strong labor market and excess savings, consumer spending has remained resilient despite the daily deluge of rampant pessimism about the economy in the media.

Third quarter earnings season will kick off, with the big banks reporting on Friday. S&P 500 earnings are expected to increase 2.4% year-over-year for the quarter, but actual results usually exceed the estimates. Given all the uncertainty in the world, forward guidance is certainly going to be quite constrained.

Stocks on the Move

-12.3% Resources Connection Inc (RGP) is a professional services firm. The Company provides accounting and finance, human resources management, and information technology professionals to clients on a project-by-project basis. Resources assists its clients with discrete projects requiring specialized expertise, compensation program designs, and transitions of management information system. RGP announced fantastic fiscal first quarter earnings per share of $0.60 and revenue of $204M. Gross margin improved 190 basis points to 40.9% and EBITDA margin improved 280 basis points to 15.0%. Resources Connection has a robust pipeline and its strategic digital transformation initiatives continue to drive business. Despite some analysts’ negative sentiment, North Star maintains conviction in RGP given its very solid core project consulting business and it being the first mover in on-demand talent with the steady rollout of the HUGO app.

+13.4% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. EPM rallied last week on news that OPEC was cutting target production by 2 million barrels per day.

+15.5% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

+11.3% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.