Last Week:

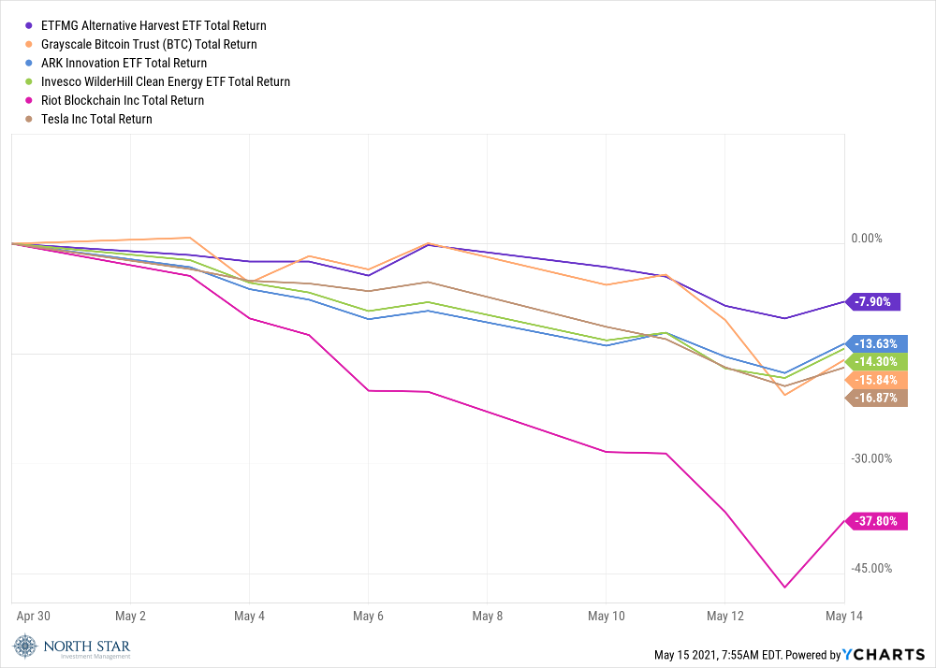

Mr. Market, like Disneyland’s Mr. Toad, had a wild ride. Toad, borrowed from “The Wind in the Willows”, regularly becomes obsessed with current fads, only to abandon them abruptly. That sounds like a reasonably good description of most of the trading community. May has provided a particularly bumpy road for the recently popular SPAC, Electric Vehicles, Clean Energy, and Cannabis sectors.

The most pronounced sharp twists in the road last week came from a cyber-attack, a surge in inflation, soft economic data, and a surprise relaxing of COVID-19 safety protocol from the CDC. Colonial Pipeline Co., the operator of a critical gasoline pipeline to the Eastern U.S., became a DarkSide victim this week and paid close to $5 million to the hackers, according to people familiar with the matter. The company shut down the pipeline the previous Friday, leading to a spike in prices and long lines at the gas stations. The pipeline resumed operations on Wednesday, but that same morning the U.S. Bureau of Labor Statistics reported that over the last 12 months the Consumer Price Index surged 4.2 percent, representing its largest 12-month increase since a 4.9-percent increase for the period ending September 2008. The back half of the week also saw soft economic data from retail sales and an unexpected drop in consumer sentiment. In the midst of the worst market sell-off in 6-months, the Centers for Disease Control and Prevention said on Thursday that fully vaccinated people could start taking off their masks indoors, leading to a “reopening” rally that cut the losses in half. Mega cap tech stocks finished with the worst performance, with the Nasdaq declining 2.34%, small caps lost 2.07%, and the S&P 500 shed 1.39%. The dollar and gold were largely unchanged, while the yield on the Ten-Year Treasury recouped the 5 basis points it lost the previous week to finish at 1.63%.

We prefer less thrilling stock market rides, and as such continue to favor time-tested valuation rationales based on cash flow metrics and stable balance sheets in the North Star Funds – in fact, we LOVE discussing our admittedly nerdy obsession with cash flow-based valuation metrics. That said, we do believe that for risk-tolerant investors with long-term time horizons, the clean energy and cannabis themes are worth consideration for small investment positions. Concerning crypto securities, we continue to prefer gold as a hedge against the debasement of the dollar and other sovereign currencies. If Led Zeppelin alters the lyrics of “Stairway to Heaven” to “all that glitters is Bitcoin” then we might have to reassess our position.

This Week:

It is Tax Day on Monday, and also the deadline for contributions into most retirement plans. Earnings season winds down with the retail sector moving into the spotlight as Walmart, Target, Home Depot, Lowe’s and Macy’s all report quarterly results. The economic calendar is light with updates on the Empire State Index, the NAHB Housing Market Index, housing starts, leading indicators, and PMI all expected to show modest softening from the previous month. The Federal Open Market Committee releases the minutes from its April meeting, and investors will scour the transcript for any cracks in the Fed’s conviction to keep short-term rates near-zero for the foreseeable future.

Stocks on the Move:

Companies with news…

-14.8% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, and licensed brand Michelin. Last week, Rocky Brands declared a $0.14/share quarterly dividend, in line with previous quarters.

RCKY is a 6.0% position in the North Star Dividend Fund and a 4.2% position in the North Star Micro Cap Fund.

Companies without news…

-11.2% Flexsteel Industries Inc (FLXS) manufactures and sells wooden and upholstered furniture for the retail, contract, and recreational vehicle (RV) furniture markets. The Company’s products are sold to furniture dealers, department stores, and RV manufacturers. There was no significant company news last week.

FLXS is a 2.9% position in the North Star Dividend Fund.

+16.1% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. There was no significant company news last week.

BBW is a 1.4% position in the North Star Micro Cap Fund.

+10.6% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels. There was no significant company news last week.

CNTY is a 1.3% position in the North Star Micro Cap Fund.

+11.2% Consolidated Communications Holdings Inc (CNSL) offers telecommunications services. The Company offers local and long-distance telephone, high-speed internet access, and digital television services to individuals and businesses in the States of Illinois, Pennsylvania, and Texas. There was no significant company news last week.

CNSL is a 1.4% position in the North Star Micro Cap Fund.

-11.3% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. There was no significant company news last week.

GRBK is a 1.0% position in the North Star Micro Cap Fund.