Long and Winding

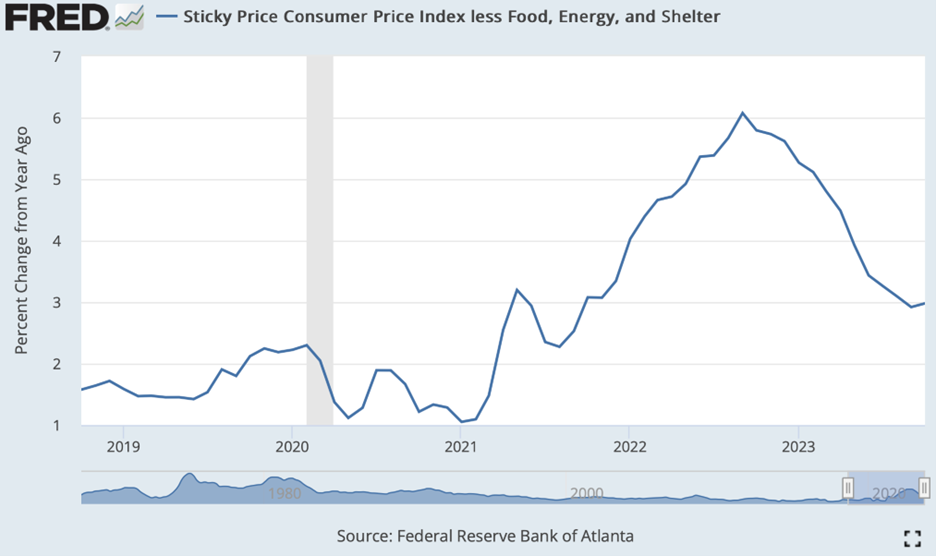

The S&P 500 reached its highest level in more than a year on Friday after Federal Reserve Chair Jerome Powell suggested that interest rates have peaked. “We’re getting what we wanted to get, we now have the ability to move carefully,” which translates from Fedspeak as “mission accomplished.” Given the disruptions to the economy during the last few years of tight monetary policy, one might opine that we got what we needed rather than what we wanted. It has been a long and winding road, but the financial markets have reached the favorable destination of slow and steady economic growth, rising corporate profits, full employment, modest and moderating inflation (see graph below), and declining interest rates. Just this past Thursday, November 30, the Fed’s preferred inflation gauge, Core PCE, for October decelerated for the fourth straight month to 3.5%, confirming the decelerating inflation shown in the below graph, which is from the November 14 Bureau of Labor Statistics C.P.I. report.

There was even a nice uptick in the Consumer Confidence Index last week, with the November reading bouncing back after three straight monthly declines. Small caps, which dramatically underperformed during the lengthy period dominated by the forked-tongued recession Cassandras and the relentless “higher for longer” Fed mantra, remain a prime beneficiary in the current environment. Indeed, the Russell 2000 was the top-performing index for the week, rallying 3%, while the S&P 500 advanced 0.8%, and the Nasdaq inched up 0.4%. The Oil & Gas and Technology sectors both treaded water, while every other sector enjoyed handsome gains.

Bond investors were also rewarded, as the benchmark 10-year Treasury yield, which hit 5% in October, fell 24 basis points this week to end at 4.22%, its lowest yield since early September. The 2-year Treasury rate of 5.1% a month ago settled in at 4.58% on Friday. Gold continued to climb, reaching its highest level on record, while Crude Oil prices softened, and the Dollar was steady at a three-month low.

Holding Steady

The labor market will be in focus, with the jobs report for November being released on Friday. The consensus estimate is for an increase of 175,000 in nonfarm payrolls and the unemployment rate to hold steady at 3.9%.

November Stocks on the Move

+135.1% Rocky Brands Inc (RCKY) announced a positive third-quarter earnings surprise at the beginning of November and continued to rally the entire month. The earnings results benefited from improved retail orders as end-market inventories have essentially normalized.

+48.9% Superior Group of Companies Inc (SGC) released results that showed significant top and bottom-line improvement due to normalized inventory levels in the Healthcare Apparel segment, strong demand in the Branded Products segment, and continued momentum in the Contact Centers segment.

+36.9% KKR & Co (KKR) posted another quarter of AUM growth ($527.7B at 9/30 vs $518.5B at 6/30), strong fee-related earnings, and positive returns across all fund types.

+25.2% Hamilton Beach Brands (HBB)’s third-quarter results marked significantly improved profitability and exciting product innovation in commercial healthcare and home health verticals. Additionally, the Company announced a new $25M stock buyback program.

+23.8% Kulicke & Soffa Industries (KLIC) highlighted core market strength in semiconductor and electronics assembly, as well as ongoing progress in supporting the transition to more advanced display solutions during its third-quarter earnings call. The Company also increased its quarterly dividend to $0.20/share from $0.19/share.

+22.6% Green Brick Partners Inc (GRBK) announced third-quarter earnings that showed continued strength and market share gain in a rather tumultuous macro environment, with net new home orders rising 73% year-over-year.

+21.0% Westwood Holdings Group Inc (WHG) posted third-quarter earnings that showed decent performance across all strategies, improving margins, and a growing pipeline of exciting placement opportunities.

-11.1% Orion Energy Systems Inc (OESX) reported mixed results during its fiscal second quarter 2024 earnings call on November 7th. Lower lighting revenues were offset by higher EV Charging and Maintenance revenue. The Company reiterated its 30% topline growth outlook for FY24 and sees accelerated start-up of project work.

-16.6% Patterson Companies (PDCO) slumped on lowered guidance from its fiscal third quarter 2024 earnings call. The Company’s challenges during the period were lower sales of high-tech equipment, as well as a slowdown in veterinary visits leading to lower pharmaceutical sales orders.

-17.0% V2X Inc (VVX) was lower for the month after reducing its EBITDA and EPS guidance for the full year. Management attributed the cut to strong execution achieved in the prior year, as well as timing of national security support.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.